Ark Invest Adds More Nano Dimension

Image via Nano Dimensions, Ltd.

Cathie Wood Still Likes Nano Dimension

As we noted in our previous post (Tesla Crashes In Fiery Wreck), there's been some overlap between stocks our system ranks highly and those purchased by Ark Investment Management founder Cathie Wood's ETFs. Tesla (TSLA) is one example of that. Nano Dimension (NNDM) was another. It was one of our top ten names on December 11th, as we noted in a post published a couple of weeks later (Big Gains From Small Names). By the end of last year, Ark Investment Management was the largest institutional holder of Nano Dimension.

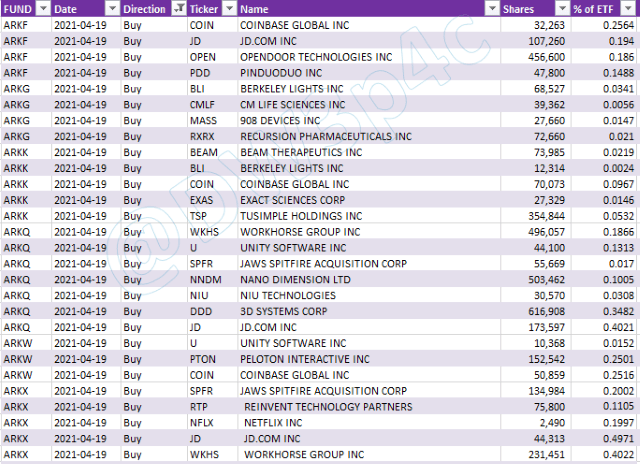

On Monday, the Ark Autonomous Technology & Robotics ETF (ARKQ) purchased another half-million shares of Nano Dimension.

Trade data via Ark Invest.

Ark Of A Diver

As of Monday's close, Nano Dimension was up about 8% since it hit our top names in December, but it's had quite an arc - at one point it was up more than 171%.

Since it had rocketed so high by January, we posted an updated hedge for it.

What If You Owned NNDM Near Its Peak?

In January, we presented a way Nano Dimension shareholders could protect themselves in case their shares collapsed. Since then, shares of NNDM were down nearly 42% as of Monday's close.

Let's look at how the hedges ameliorated that drop and briefly discuss courses of action for hedged Nano Dimension longs now.

The January Optimal Collar Hedge

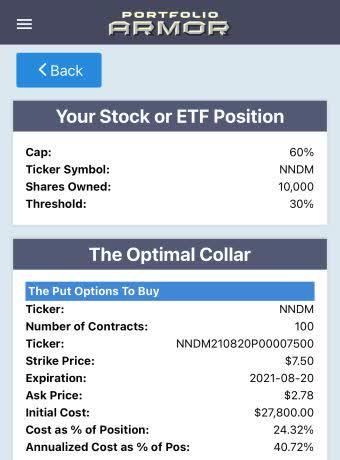

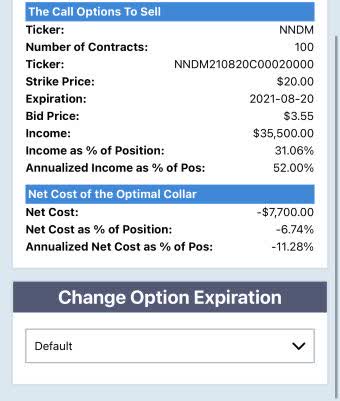

If you were looking to hedge Nano Dimension against a greater-than-30% decline over the next several months in January, it was too expensive to do so with put options. It was cost-effective to do so with an optimal collar though.

On January 13th, this was the optimal collar to hedge 10,000 shares of NNDM against a >30% decline by late August if you were willing to cap your possible upside at 60% over the same time frame.

Screen captures via the Portfolio Armor app on January 13th.

Here, the cost was negative, meaning you would have collected a net credit of $7,700, or 6.74% of position value when opening this hedge. That's assuming, to be conservative, that you placed both trades at the worst ends of their respective spreads (buying the puts at the ask and selling the calls at the bid).

How That Optimal Collar Hedge Has Reacted

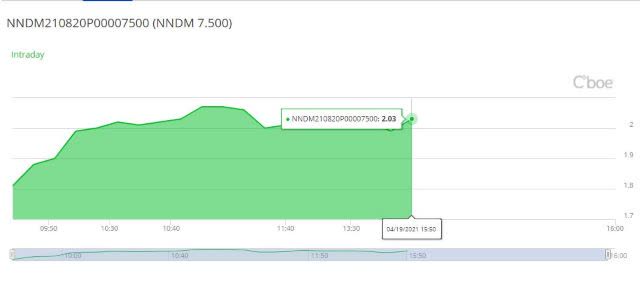

Below is an updated quote on the put leg of the collar, via the CBOE:

And here's an updated quote on the call leg:

How That Hedge Ameliorated The Drop

NNDM closed at $11.43 on January 13th. A shareholder who owned 10,000 shares of it and hedged with the collar above then had $114,300 in NNDM shares, $27,800 in puts, and if the investor wanted to buy-to-close the short call position, it would have cost him $35,500. So, the net position value on Jan 13th was ($114,300 + $27,800) - $35,000 = $107,100.

Since NNDM closed at $6.64 on Monday, the investor's shares were worth $66,400, the put options were worth $20,300, and it would have cost $1,600 to buy-to-close his calls, using the last price in both cases (since both options traded yesterday). So: ($66,400 + $20,300) - $1,600 = $85,100. $85,100 represents a 20.5% drop from $107,100.

More Protection Than Promised

Although Nano Dimension had dropped by about 42% from Jan 13th to April 19th and the hedge was designed to protect against a >30% drop, the optimal collar hedged position was down 20.5%. The time value of the put options gave a bit more protection than promised since the hedges were structured to protect based on intrinsic value alone.

What Now?

That's up to you, and it will probably depend on whether you agree with Cathie Wood's current bullishness on Nano Dimension (our system isn't currently bullish on the stock, but that might change going forward). The nice thing about being hedged though is that it gives you options (no pun intended). A hedged shareholder doesn't have to worry so much about how much further Nano Dimension might drop because his downside is strictly limited. You can exit now, for a smaller loss; you can buy-to-close the call leg of your collar to remove your upside cap if you're bullish; and if you're even more bullish, you can sell your appreciated puts and buy more Nano Dimension shares. In any case, you have breathing room to let the dust settle and decide on your best course of action, without the anxiety of an unhedged investor.

Disclaimer: The Portfolio Armor system is a potentially useful tool but like all tools, it is not designed to replace the services of a licensed financial advisor or your own independent ...

more