Market Briefing For Thursday, September 10

Institutional biases - contributed to the strength of a projected Wednesday rebound after the 3 day decline. Not to focus solely on our Fed continuing to have the back of this market, there's more. The institutions dominated the 'narrow universe' of gainers for some time and they generally use similar (if not almost identical) algorithms.

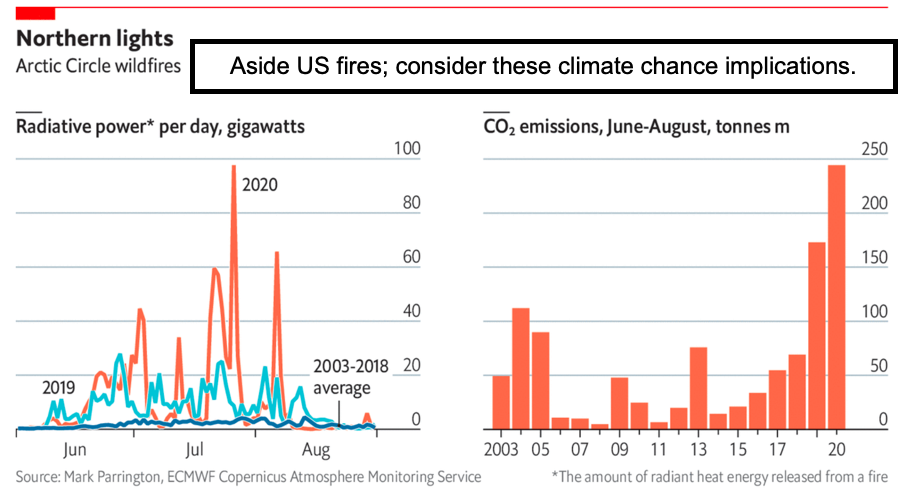

Also they were hurt in the shakeout and presumably loathe to let things melt away. A new member asked why I'm not more assertive about intraday S&P moves. As you'll recall I have a view that there are only a few times a year that dramatic moves will occur in a normal market. And although this is not a normal market, there are forces at-work attempting to limit contractions, broaden participation, and not surrender a key lead of technology altogether. It might be partially political, but it's out there. This tragedy (the fires) matters, and ultimately supports the rebuilding boom for years.

Speaking of politics, it gets heavier now. But in this case The White House 'spin' on a President 'not wanting to cause panic', is only partially acceptable, as begs questions as to why lots of other things transpired (including 'rebelling' against masks or going for a National Emergency sooner) if the President knew how bad COVID-19 was early on. I note this not to express my (slightly conflicted) 'centrist' bias, but suspecting this will be an issue, especially with regard to not issuing early-warning preparation calls.

As or if this comes-out more vividly, it may well show in the polls. Bob Woodward will be interviewed on CBS '60 Minutes' this Sunday (their highest ratings?). I've often been critical of journalists, but whether it was Jeff Goldberg in The Atlantic, or Bob Woodward, I respect their work. As someone recalling attacks on journalists during Nixon-era Watergate and Pentagon Papers scandals or denials, I get this. Today's journalists generally are agenda-driven even with scripted interviews. I get that too. So every now or then worthy journalists rise above shrill politics, meriting attention.

Executive summary:

- Rebound occurred without an initial dip, encouraging me to call for traction to be retained generally through the session, the late-day fade was fairly typical.

- Our S&P pattern idea included suggesting we'd get a rebound and 'revisit' the idea of a new leg lower after we see Thursday, nothing carved in stone here.

- The last 'dramatic low' was our March 23rd on a dime reversal and the last 'sell' (albeit not too much drama) was over a week ago, with multi-week warnings of a market that was exhausted, narrow super-cap leadership and with rising risk.

- S&P overshoot was what elevated our warning that expected a shakeout as the next probable move, yes for some weeks, but we understand the nature of this market so upon the 'overshoot' we were alert to a more imminent decline.

- Furthermore, because (look at the Oscillators) there wasn't abroad overbought market, so probable catastrophe (which some still call for) didn't make sense.

- Most stocks faded from mid-Summer rebounds, so they'd be hard to drive lower, not to mention many such stocks were pondering a post-COVID recovery.

- We are not exactly in a 'raging mania' as Druckenmiller alleges or Gundlach (yet again), these are names I don't mind mentioning (quoted on TV today), for that matter I simply disagree, hard to disagree but we had this year right and they did not, that's no assurance about the future, as the President now gets tossed in the mix too, more so than up to now, whether that matters is also pending.

- CNN is making a huge deal about Bob Woodward's interview with the President, where Trump acknowledged how deadly COVID-19 is... weeks before he publicly acknowledged that, this should have more ramifications than seen so far and in some global circles has people upset believing the US could have helped more.

- It's obvious data was known (we talked about 'WuFlu' starting in January), and as everyone knows the timeline I doubt they will get the political mileage they anticipate to milk, even though Woodward likely has it right.

- Thursday is little LightPath's Q2 Conference Call, with hopefully better visibility on the current Quarter, as far as business pushed forward, and customer stance since that was a factor minimizing Q2 preliminary numbers, guidance is key (LPTH).

- LightPath has been boring to say the least since it's run to nearly 5 and retreat, but it seems like anything that triggers interest would again be picked-up by this era's so-called online trading crowds (maybe more institutions), given that it has a bright growth future, just looking (metaphorically) thru visible lens, add infrared, and participation in autonomous driving, Lidar, AI and AR loom as well.

- The market's upside 'roar' of a rebound is interesting and more than a mere S&P bounce, while AstraZeneca's CEO reassuring investors might have helped too, although the ethics of that discussion being private and JP Morgan's refusal to initially release a transcript to the Press, is somewhat lamentable. (AZN, JPM)

Meanwhile . .the S&P is a high-wire act with regard to 'some' technology stocks, but not all. We have been cautious and now that the biotechs broke heavily we're watching those more closely again for signs of life in those that might benefit.. especially from a realization of what I've suggested all year: the need for therapeutics over vaccines.

Now, the Vaccine trial halt. Digging into it this morning I noted that the actual illness or condition the trial participant contracted was 'transverse myelitis'. Media later is describing the problem as 'neurological'. That's a significant understatement as they don't want to panic people (there's that word again) given all the 'trials' ahead.

Transverse myelitis- is an inflammation of the spinal cord, and it historically appears to have been seen in other vaccine trials (can't affirm it). Now, AstraZeneca did not comment on this (outside of the JPM private interview.. insider information released one might speculate?). There's no evidence given patients with transverse myelitis include the patient who triggered the study discontinuation. The report was careful to note that time of diagnosis, and whether it was directly related to the AstraZeneca / Oxford vaccine, was still unknown.

Just for background, Tranverse Myelitis is really serious, and could cause permanent paralysis. Please note trials by other manufacturers were also halted for investigation (not just AZN). What this proves, or at least shows, is that vaccines could produce some "unwanted" antibodies which can result in serious reactions. Not the first time.

This may have been viewed as bad news for mass vaccinations (at the moment but of course that will change). Great news for stocks like Sorrento (SRNE), which rallied from the start, but more so when the complexity of the 'others' issues was better circulated (I got the story early from a French news source, hence we talked about it early-on), as the day wore-on everyone found out the details to varying degrees.

As for Sorrento: very speculative stock but with a varied portfolio of approaches and a controversial CEO. However their key therapeutic (STI-1499) only produce specific antibody/antibodies, and they used super-computers to sort-out which they believe is best. That may be part of it. Also they own 25% of Cellularity (private) in New Jersey, and they just inoculated their first patients at Univ. of California Irvine. So if that's a success it's very relevant as well. Both Cellularity and Sorrento have close relations and cooperate more broadly than recognized by the bears constant pounding.

Currently every mainstream vaccine candidate works similarly by triggering immune systems to generate antibodies (it doesn't matter which platform or which vaccine maker), and they had a common thread: keep it simple and expedite the vaccine. A common weakness emanates from this approach: that is they all generate something called binding antibodies (useless or even harmful- apparently shown on Oxford's vaccine now), with only very small portion of neutralizing antibodies (those are truly useful according to infectious disease specialists).

Of course, it is a dream for every vaccine maker to have a vaccine that only makes neutralizing antibodies - far more effective with less side effects. Not to excessively focus on speculative Sorrento, but their Covi-XP purports to do just that: generate neutralizing antibodies. Their problem: a dearth of approved trials or even tests, so if they produce finally it could actually replicate their earlier romp or more. If they do.

In-sum: got the bounce and we have the latest Presidential conundrum to ponder. As to the big vaccine trial halt, I learned (cannot provide a source) that there was a similar spinal inflammation case in July, that was not specifically diagnosed as this condition, with responses similar to multiple sclerosis. Maybe this AstraZeneca trial was halted without that knowledge. If so the July case may be considered unrelated. If that case would be re-investigated and treated as initial, then this new case would be the 2nd case.

Comments on the major vaccine producers are very useful; thank for the information on $SRNE, $AZN.

What's your take on the latest news on $AZN?