Market Briefing For Monday, March 24

Macro paralysis persisted into Quarterly Triple-Witching Expiration Friday, and while that has been frustrating, it's not particularly surprising. How so? I noted that once the 'reciprocal tariffs' were postponed until April 2nd, there would be this period of time to traverse until we see if they are moderated.

On Friday President Trump indicated 'flexibility' on tariffs; and the timing did coincide with S&P coming-off it's earlier lows. However, I had posted on 'X' that 'Expiration' usually ends associated pressures around 1 pm ET; so give the President's remarks credit, or the diminished pressure of Expiration; and while it doesn't matter which (or both) were causal influences; the Street will assume it hinges on tariffs; so fine that contributes as well to reduced angst.

One can argue being prepared for more downside in the big-cap stocks; but it probably relates to 'derating' not Treasuries, but Q1 Earnings Reports with the prospect of mediocre guidance. That would reflect sentiment contraction we'd noted for awhile, but also justifies the lower multiples on big stocks; proving of course that they were overpriced as we contended even before earlier upside.

The upside of market downside and economic sluggishness shy of unraveling would be the so-called Fed Put. Rate cuts become more probable if things are slow; but they wouldn't entirely offset concerns that justified contracting PE's. I can't accept that the Administration 'wants' the U.S. to have a recession; you already see political pushback about the heavy approaches from constituents around the Country. So it's a question of whether this was 'detox' or 'dealing'.

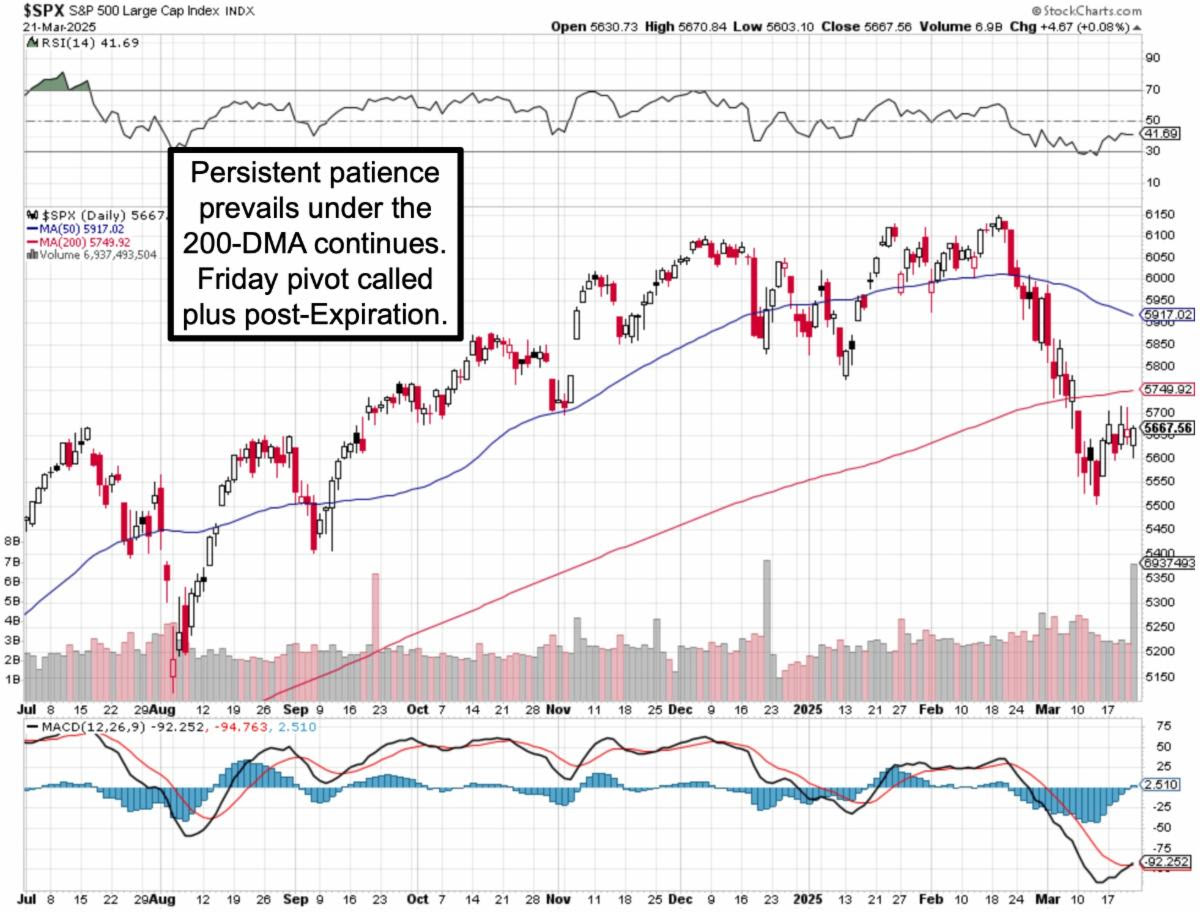

Market X-ray: we've had half a dozen or so negative weeks for S&P and now the frustration becomes more palpable; this was post-honeymoon sobering of the start of Trump 2.0 .. and it might surprise with a snappy Spring rebound.

But we're not at April 2 yet; there is end of-Quarter re-balancing to contend of course with; and the geopolitical climate is absolutely mixed; plus discussions of tariffs with President Xi of China could absolutely impact the overall tone.

I think everyone knows the flux everything is experiencing; and our ideal Call for post-Expiration 'relief', whether it backs-off a bit first, or not (probably will).

This market was expected to be heavy in February; looked-for but didn't get much of a revival in March; and we're still on-hold ahead of April 'tariff day'.

We do have the somewhat boring Nvidia panel on Quantum; however there was at least a realization by Jensen that maybe it's not way-distant before we see 'products'. Of course we have to parse his words because self-serving is evident given what Nvidia relies on now and in the near-future for 'revenue'. It is also the case that Nvidia processors can't prevent certain computer hacks; but apparently Quantum computers can deflect nefarious hacks, for-instance.

I think these sectors can be complimentary; I think Jensen knows that; and as this fatiguing segment requires, swings in both directions are part of the deal. We have that coming up again in a week, with D-Wave's own gathering at the Phoenician in Scottsdale, and Jensen won't be there to behave as a spoiler or a curmudgeon (which is what his attempt to recast Quantum as 'instruments, rather than computers', which attempted to label them as solely investigative not as tools; and that's the case generally, but not when it comes to QBTS). I posted a summary on 'X' of the D-Wave computer sale Google funded; and it makes a point that up and down share moves don't always reflect progress.

We're following (and/or 'in') these stocks for almost pennies late last Summer and early Fall; and like so many semiconductor or computer stocks 'always' in the past, there are wide swings often (not always) on the way to achievement. For sure these are not stocks for 'other than gamblers'; as noted at the start. I do find these and AI generally an effort to sidestep the multiple revisions that a lot of big-cap stocks are subject too; and in fact these techs aren't impacted by macro economics, but the backdrop psychology has proven to matter a bit.

Incidentally . . Boeing won the contract for the 'next generation' jet-fighter as Lockheed was the competitor. We aren't enthusiastic about either; but note the Pentagon plans to operate the new Fighter Jet with 'drones as wingmen', and that's what's interesting. Even if Anduril makes the drones (not public yet) that's fine; it all has to be managed; that's where both AI; eventually Quantum, can play roles.

Also given such new tactical plans, one presumes fewer units (aircraft) will be ordered as part of prioritizing DoD spending, to contend not only with Budgets but the reality of dealing with adversarial drone-swarms that require a different approach to intercepting without incredible costs of spending half a million on an interceptor to knock-down a 50k (or more) drone (but you see my point... and overall the Budget for Ai airspace management is going to increase, not decrease, as it makes sense given changing missions).

Bottom line: major Averages turned higher Friday afternoon; whether you believe it was just passing an Expiration inflection point intraday or Trump's 'tariff flexibility' comment .. or both. The big Boeing win knocks Lockheed, but Boeing has been refurbishing the old McDonald-Douglas F18 facility in St. Louis; so I think BA expected to win the competition. The engine competition between GE and RTX continues; as do drone builders (and possibly software management of everything).

No escape velocity for the recovery; all this is beneath S&P 200-DMA; leaving things pending; so it's why getting a rebound next week would be useful, from a technical chart perspective; but generally market remains on-hold pre-April.

More By This Author:

Market Briefing For Monday, March 17

Market Briefing For Monday, March 10

Market Briefing For Monday, March 3