Is NEM A Future Bitcoin Challenger?

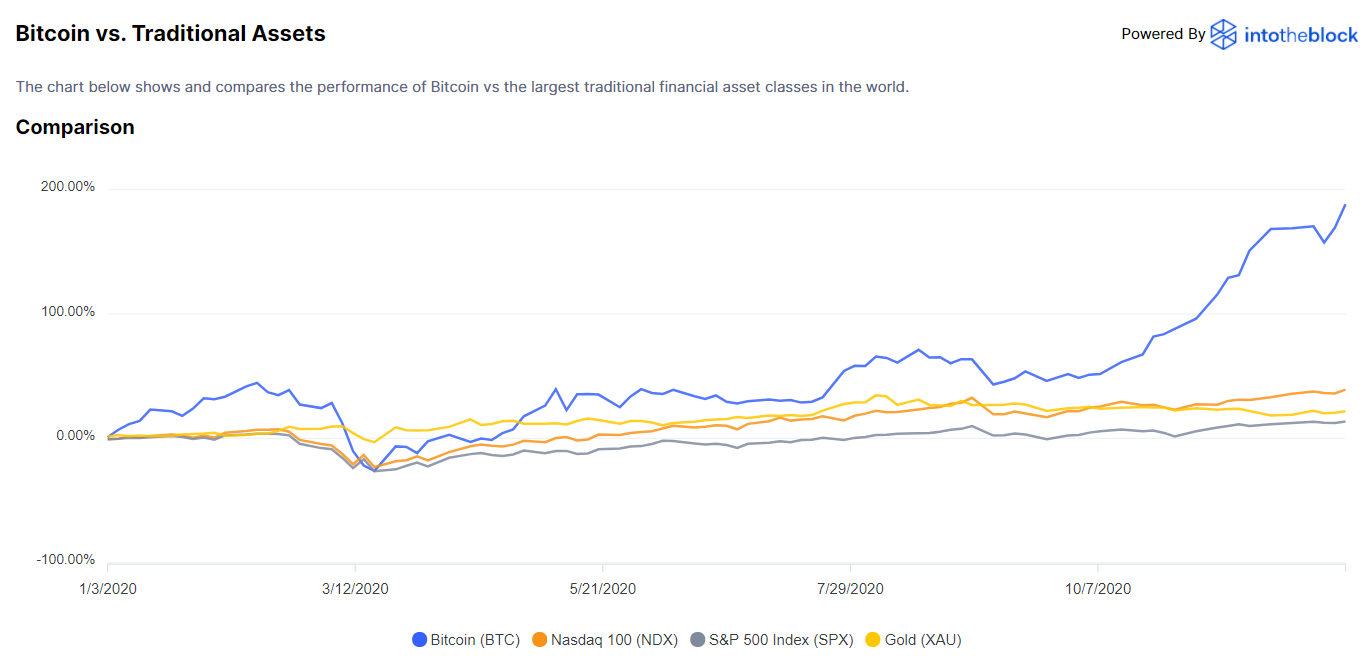

Bitcoin (BITCOMP) is by far the most popular and valuable cryptocurrency judging by its market capitalization of $442 billion. It is also more valuable than several of the S&P 500 stocks. It is tipped to cross the $1 trillion mark in 2022, which suggests that it could easily be in the top 5 of the biggest tradable assets in the world. Bitcoin has outperformed every major asset on offer this year, bar a few stocks.

However, beneath bitcoin, there are several other cryptocurrencies that continue to outperform under the radar of cryptocurrency investors. While the likes of Ethereum and Ripple carry most of the plaudits for alternatives to bitcoin, NEM's XEM Coin could be the best alternative and perhaps a potential challenger for future market dominance.

XEM, the native crypto of NEM’s NIS1 blockchain ecosystem operates the same way as bitcoin’s BTC, It went live five years ago, and has since grown to amass a market cap of more than $2.5 billion.

Its similarities to bitcoin are why many see NEM as potentially being the closest rival to the pioneer cryptocurrency. However, bitcoin is well established and has gained a massive following over the years. It is highly unlikely that a cryptocurrency so similar to it could dethrone it any time soon.

Nonetheless, NEM’s evolution is what could give it the edge in the coming years. One of its latest creations is Symbol (XYM), a NEM-based blockchain ecosystem build with the business-to-business marketplace in mind. It will be launching on January 14, 2021, which means that crypto traders will be able to buy Symbol in a few weeks’ time.

Symbol’s hybrid blockchain ecosystem helps organizations to create new business models and innovative solutions by using both the private and public blockchains. This concept is seen as a key step in the evolution of enterprise blockchains, especially when it comes to using them in smart contracts.

Symbol utilizes the Proof-of-Stake concept for consensus, which when you add to the features already present in NEM’s first iteration crypto, the NIS1 makes it ideal for adoption by organizations as they embrace the evolution of blockchain technology.

Several businesses are already embracing the use of cryptocurrencies, which means that as time goes, even the smaller enterprises will adopt various crypto platforms to perform transactions. Bitcoin is widely described as a capital asset, rather than a currency. However, its functions are mainly those of a digital currency rather than an infrastructure that supports the creations of blockchain projects.

This has been one of its biggest advantages over other cryptocurrencies. However, while it still looks well-positioned to dominate the market for several years to come, a shift towards enterprise ecosystems that support different blockchain projects could see the likes of NEM’s Symbol shake up the market.

Conclusion

In summary, bitcoin is still the real force in the cryptocurrency industry. However, enterprise blockchains are quickly growing in popularity and NEM appears to be positioning itself well with the launch of Symbol.

Given NEM NIS1, the first iteration of the NEM blockchain’s uncanny similarities to bitcoin, the second iteration, Symbol, could prove disruptive enough to make NEM overall a potential challenger to bitcoin.

Disclosure: The material appearing on this article is based on data and information from sources I believe to be accurate and reliable. However, the material is not guaranteed as to accuracy nor does ...

more

Another digital currency, also using Blockchain, which is a security scheme not a currency or even an asset. But where is the actual wealth that is supposed to be represented by the currency? That is the part that is confusing. Or does it only have value because some folks SAY it has value? That is the part that bothers me.

I've always found this aspect confusing myself. And yet I'm shocked that Bitcoin has surpassed $20k. It's main appeal seems to be for criminals. But it's buzziness is causing many investors to buy and horde the "currency." People who will never actually spend those coins to buy anything.

My explanation for what you describe is tha some things are emotion driven, not logic driven. And my opinion is that certainly there is a time and place for emotions and stock trading is neither of those. Oh Well.

Interesting!