Inflation And Costs, One Year Ahead: What Do Businesses Think?

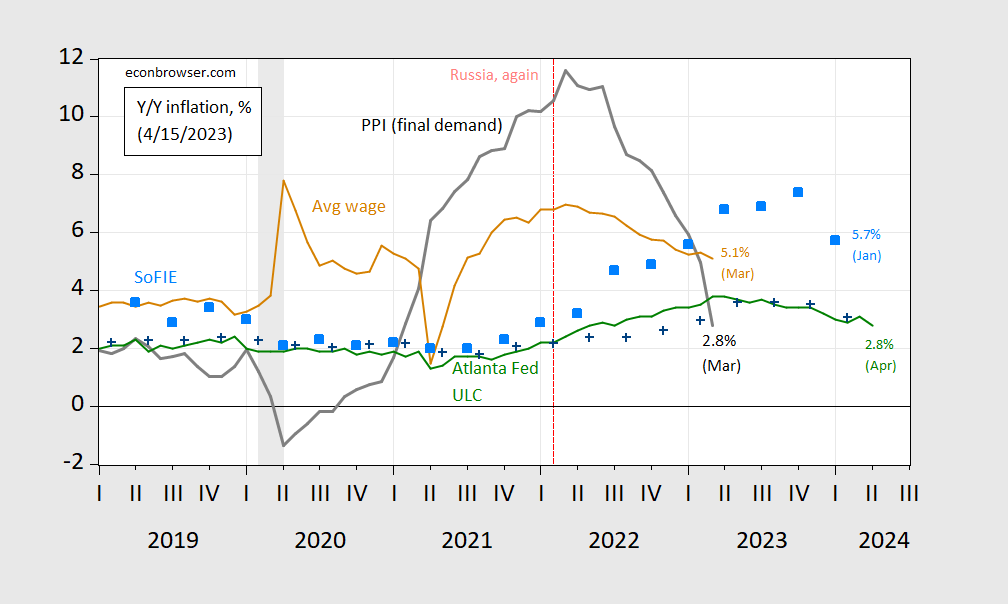

Paul Krugman reminds me why “expected” inflation doesn’t necessarily translate into one-for-one actual inflation, because of nominal rigidities like staggered contracts. He also brings my attention to costs that firms expect (as opposed to prices they expect), as measured by the Atlanta Fed’s “Business Inflation Expectations”. Here’s how those expectations stack up against others, and actual evolution of costs.

(Click on image to enlarge)

Figure 1: Year-on-year PPI for final demand goods and services (black), in average hourly earnings for production workers and nonsupervisory workers (tan), unit labor costs (green), and inflation from Survey of Firms Inflation Expectations (sky blue squares), and Survey of Professional Forecasters median (blue +). NBER defined peak-to-trough recession dates shaded gray. Source: BLS via FRED (FRED series PPIFIS, AHETPI), Atlanta Fed, Coibion-Gorodnichenko SoFIE, Philadelphia Fed,NBER, and author’s calculations.

It’s interesting to me to observe (as anticipated) unit labor costs don’t move one-for-one with expected inflation as measured by the Coibion-Gorodnichenko SoFIE median. One shouldn’t take too much from the gap between the average wage and unit labor costs, given strong compositional effects during the pandemic.

More By This Author:

CPI, PPI, and PCE Instantaneous Inflation

Market Expectations On Fed Funds, Spreads, Inflation Post-CPI Release

Oil Prices, Gasoline Prices