Why It Is So Difficult To Forecast Today

Image Source: Pexels

Economists often evoke Yogi Berra’s famous quip that “it is tough to make predictions, especially about the future”. Joking aside, this aphorism permeates the investment and business world, forcing economists to forecast often in the hope of getting it right at some point in the near future. Too often, policy shifts or exogenous developments catches everyone off guard, and sends economists back to their computers to input new assumptions governing their models.

The two most important forecasting arenas are the worlds of policy making by central banks and the pricing of equity and debt markets.We have the major equity indices reaching all-time highs, signally that the economies are robust and investors need only to continue riding the wave. Yet, the major central banks continue to follow a very cautious route, trimming their policy rates ever so carefully in the face of so much uncertainty.

US trade policy is desperate to reduce US trade deficits, yet it has been unable to conclude any comprehensive agreements with Canada, China, or Mexico, its three largest trading partners. For those countries, this state of uncertainty adds considerable unease in their home markets.US fiscal policy has introduced considerable anxiety within the US debt market, as investors constantly assess the risks to the US dollar and US sovereign debt. Congress is willingly to run up continuously greater deficits in favour of tax cuts.Contrary to these concerns, is the rather cavalier attitude of the US financial markets. Price/earning ratios are well into the mid-20s and corporate debt spreads remain tight.Wall St. is expecting continued equity prices to remain strong, inflation to be subdued, tariffs to be absorbed without too much loss of purchasing power. What, me worry?

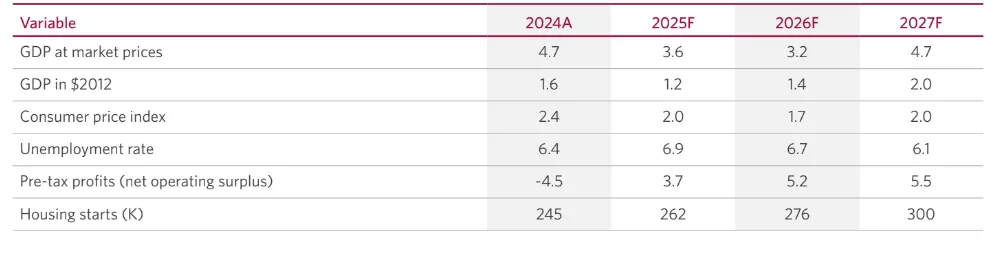

Canada serves an excellent example why forecasters are forever revising the outlook. The CIBC latest forecasts (below) expect Canadian economy to remain sluggish, growing barely above 1%, unemployment to be sticky near 7% and consumer prices to remain atthe 2% market.

(Click on image to enlarge)

Source: CIBC

The weakness in Canada’s expected performance can be traced to several factors, some known, but some unknown. The Federal government’s shift in immigration policies, affecting both permanent and temporary workers, will slow down population growth. Much of the recent economic growth in Canada emanated from a rapid increase in immigration, while overall productivity growth was barely positive.

The over-riding concern is the inconclusive nature of the Canada- US trade relations. The most recent quarter revealed that Canadian exports to the US fell by 27%, a severe blow to an economy that is so widely open. While over 85% of all bilateral trade is covered by the Canada-US-Mexico free trade agreements, many of those industries not subject to tariffs clearly are reluctant to add more investment. CIBC economists continue to expect considerable slack to remain.

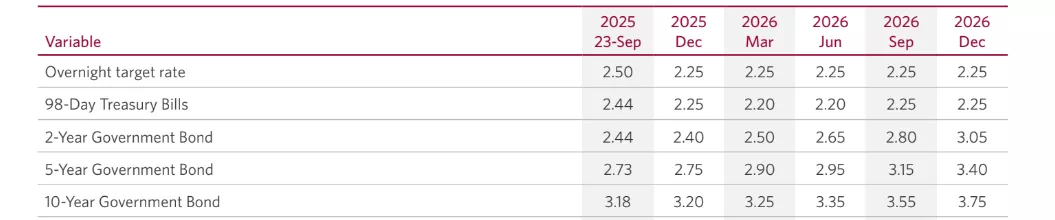

(Click on image to enlarge)

Source: CIBC

Unknown is the Federal budget due in November, although early hints by Prime Minister Carney that we can expect a significant degree of belt-tightening and a considerable widening of the deficit. From the monetary side, the Bank of Canada remains rather mute regarding the timing of further rate cuts, although private sector economists expect just one additional ¼ pt cut later this year and the Bank will be done. More importantly, interest rate forecasters expect a steepening of the yield curve as the 5yr and 10yr bond yields move up, largely in response to the deteriorating US debt markets. Those who are looking for relief from current mortgage rates will not find any comfort in these forecasts. As for the overnight bank rate, the Bank of Canada has no room left to get to a rate to 2% or even lower. That would reduce real rates to zero, something the Bank of Canada will not likely accept, after having experienced the bubble consequences earlier this past decade when real rates went negative.

More By This Author:

What Will It Take To Turnaround The Canadian Housing Market

A Great Unease Is Sweeping Through The Government Bond Markets

Canada’s Growth Prospects Hinge On A Trade Deal