What Will It Take To Turnaround The Canadian Housing Market

Image Source: Unsplash

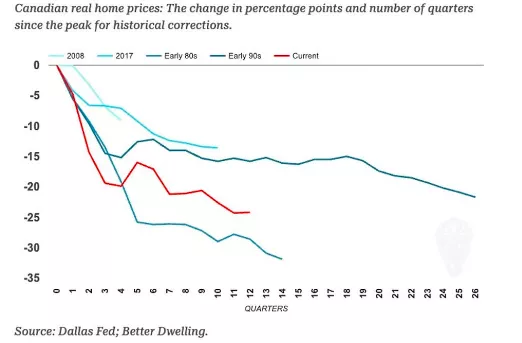

The Canadian housing is clearly out of balance, as prices slump and the condo and rental markets search for customers. Canadians have experienced several housing price declines in the last four decades and the current slump exhibits a familiar historic pattern. Each decline has its own markings, but all share a substantial gestation period needed to reverse course.Chart 1 illustrates that today’s decline in prices is expected to last 10-12 quarters, possibly resulting in bottoming out when prices are 25% lower from their peak. Certainly, by historical results the market has considerable way to adjust downward to a new price equilibrium.

Figure 1.The duration of housing slumps

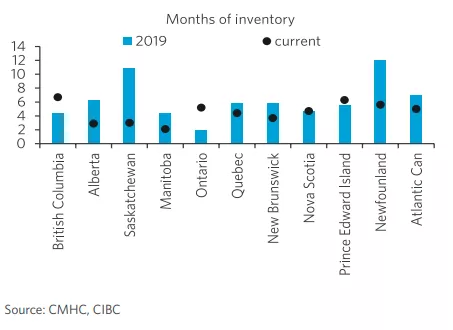

Ben Tal at the CIBC released a comprehensive look at the fundamentals behind the residential market.Overall, most of the Canadian market is in relative balance with no excess supply. However, the two major exceptions are Ontario and British Columbia, the two biggest markets.

Figure 2 Inventories by province

Tal digs into the structure of the housing market and points out:

There is a “deviation in activity between the recessionary condo market and surging purpose-built rentals. Such trajectory was unthinkable only a few years ago, but the combination of increased rental demand, falling land and construction prices, government incentives, and increased interest from institutional investors among other factors is reviving that important segment of the market.”

Already under way is the cancelation of numerous condo projects, other condo projects are switching to rentals, and an overall price adjustment as sales slump and inventory pile up. Hence the significant price discounts in the condo market. Nevertheless, Tal remains optimistic that “It’s only a matter of time before demand shifts towards condos”.

Housing demand is not immune to overall economic conditions. Canada is clearly in a recessionary mode, job losses over the past quarter have totally over 100,000. The uncertainty regarding US tariff policy has simply put all manufacturers into a deep funk. As a consequence, rental prices are on the decline and fallen as much as 10% from their recent high in 2023.No doubt the oversupply in condos for rent is a major factor. Tal concludes that a further 5-7% decline in condo prices is needed to stabilize the market and reverse its current trajectory

.

What about other factors that could boost housing demand? The Bank of Canada does not have much room to cut rates, certainly not to the historic lows prior to the pandemic. Investors do not expect the bank to cut more than 50bps over the next 12 months. Inflation expectations are hovering around the 2% mark, leaving little wiggle room for the Bank drop rates further than expectations. The unsettling nature of the Canada-US trade war will keep the Bank on a cautious footing.Mortgage rates are currently up against the 5% mark, and any relief, say a ¼ would not tip the scales towards boosting demand. Immigration has been a big source of housing growth andfor political reasons the Federal government is rapidly cutting back on letting in permanent and temporary workers from overseas. Finally, we cannot expect any fiscal stimulation from the Federal or provincial governments, as they struggle to keep deficits under control.

More By This Author:

A Great Unease Is Sweeping Through The Government Bond MarketsCanada’s Growth Prospects Hinge On A Trade Deal

Understanding Canada’s Decision To Remove Retaliatory Tariffs On U.S. Imports