Canada’s Growth Prospects Hinge On A Trade Deal

Image Source: Pexels

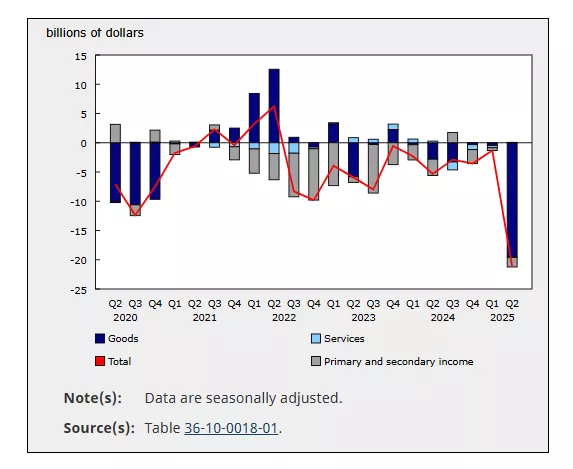

Canadian GDP declined thisrecent quarter, a warning sign of how important it is that PM Carney conclude a trade deal with the U.S. without delay. The 1.6% annualized decline in GDP last quarter featured a jaw-dropped decline of 27% in exports, and an overall minus 8% contribution from the net trade toGDP.

Canadian retaliatory tariffs were lifted earlier this month.Canadian exports were already given free trade status for goods covered by CUSMA. That duty - free arrangement covers nearly 85% of all bilateral trade. Canada is just “matching” those U.S. exemptions for Canadian exports already in place. Wisely, PM Carney is no longer seeking a totally free-trade deal, especially as he has emphasized that, in the aggregate, the U.S. posts a 6% tariff on Canadian exports, the lowest tariff level of any U.S. trading partner. Nevertheless, this is cold comfort to Canadian workers in the auto, steel, aluminum and softwood lumber industries, all of whom encounter very high tariffs barriers. The auto plants are very reliant on light-truck exports to the U.S.That same sector is greatly impacted by higher steel and aluminum prices. And, Canadians are a major source of U.S. imported lumber. Last, but not least, CUSMA is a up for renewal in 2026, making corporate investment decisions ever harder each day.

Canada’s Current Account Balance (Statistics Canada)

Where might the tariffs on Canadian exports finally get settled out? There is a widespread consensus among international economists, that the world could withstand overall tariffs in the 10-15% range, before creating a worldwide recession. With the U.S. applying tariffs of 25% on Canadian steel and aluminum exports, there is room to negotiate cuts in line this guideline. The road ahead will be difficult. Lumber has long been a real sticky wicket as the U.S. continues to claim Canada unfairly subsides the production costs of softwood sold to U.S. homebuilders. Finally, the automotive tariffs are a dog’s breakfast in which parts continuously cross the border and the industrystruggles with identifying what parts are duty-free .

Some relief on tariffs might just originate south of border in the industries most impacted. Canada supplies over 50% of the aluminum consumed in the U.S., leaving very little room for the U.S. industry to replace that large amount with increased domestic output. Moreover, Canada holds a large competitive advantage in the cost of electricity, the primary source of energy used by the industry. Similarly, Canada is largest source of steel imports into the U.S. The ability for Canada to leverage its trading position is complicated by a global overcapacity in both steel and aluminum.

Matters get more complex in determining the trade outcomes. U.S. tariffs have yet to work themselves through the economy, leaving the industries somewhat in the dark as setting domestic prices. Meanwhile, Canadian exporters are having to navigate U.S. tariffs and assess the prospects of selling into a protected market that itself is trying to sort out where its competitive advantages reside. Tariff policy is as much a reflection of domestic capacity considerations as perhaps any other single factor.

So, while we await the outcome of bilateral negotiations, the Canadian economy continues to soften. Looking towards some relief from rate cuts by the Bank of Canada, while welcome, cannot effectively generate growth in an environment as protectionist as exists south of the border.

More By This Author:

Understanding Canada’s Decision To Remove Retaliatory Tariffs On U.S. Imports

Trump’s Shakedown Tactics Don’t Faze Canadians

The Israeli Economy Defies Normative Economics: The Aftermath Of War