The Israeli Economy Defies Normative Economics: The Aftermath Of War

Image Source: Pixabay

Investors worldwide gave the Israeli economy a ringing endorsement following the 12-day war with Iran. Multiple economic measures point to a wave of optimism amongst both equity and debt investors regarding the near- and long-term prospects in Israel. What makes this story so unusual is that, normally during a war, the stress of war shows up in various financial markets in in the form of selling waves and falling equity prices and rising interest rates.......not so with Israel.

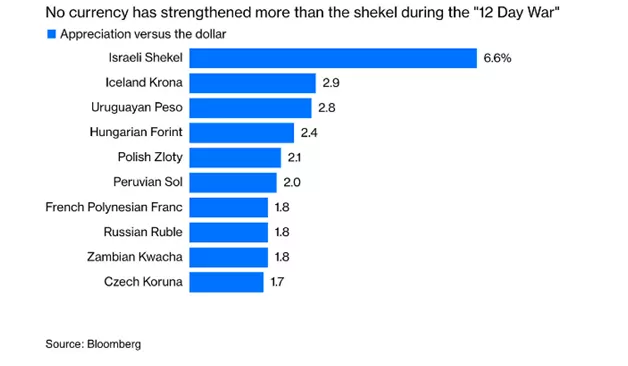

Normally, wars immediately result in the nation’s currency coming under fire from traders, anticipating an outward flow of capital, possibly currency restrictions. During the 12-day Iranian war, the shekel has strengthened by 6.6% against the USD and has gained against more than 100 currencies worldwide. In some measure, the strength of the shekel is a USD story in so far as the USD has lost ground to every major currency. Couple this with a huge influx new foreign investment into the Israeli high-tech sector, the shekel inevitably would appreciate.

Normally, a domestic stock exchange experiences selling pressure during a time of military conflict. However, the Israeli public markets enjoyed a steep surge in foreign investment. Since the Hamas attack of Oct 7,2023, the TA stock index has steadily climbed, especially since January 2025, and has outperformed the MSCI world index and the S&P 500 index.

The private sector 2024received $12 billion in various funding rounds for startups in 2024., Already, in the first half 2025 investors have awarded the sector with an additional $9 billion. Funding for cybersecurity, fintech, health and, of course, defense technologies dominate the funding sources. The technology prowess that Israel displayed in conducting the war has resulted in yet a greater overseas interest in funding the start-up nation. Over 60% of active investors in the tech sector are non-Israelis, a sign of the growing international confidence.

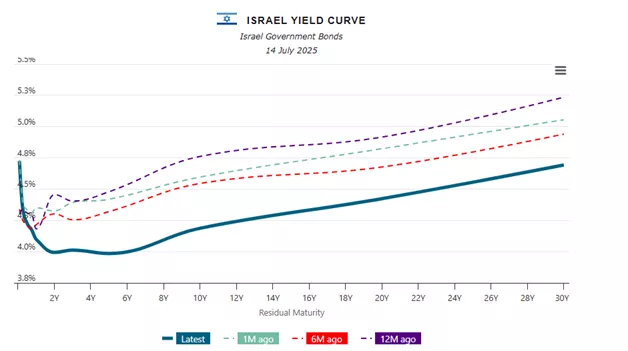

Finally global debt investors similarly showed their confidence in the Israeli economy. Defying normative behaviour, the yield on 10-year Israeli bonds fell more than 50 basis points in over a year as Israel fought wars on multiple fronts. At the same time, most of the world’s sovereign debt yields were steeping as central banks struggled with reaching inflation targets.

.Source: World Government Bonds

Turning to the immediate future, the IMF, Bank of Israel and the OECD anticipate that the Israeli economy will expand on average by 3.5% in 2025 and 4.5% in 2026. These growth rates above those projected for the EU and North American economies. With the war in Gaza not showing any signs of ending any time soon, these projected growth rates continue to support the view that the Israeli economy remains an outlier.

More By This Author:

Canada Is In No Rush To Make A Long-Term Trade Deal With U.S.

The US Government Incompatible Goals: Eliminate Trade Deficits While Running Large Fiscal Deficits

Central Bankers Just Don’t Know Where We Are Headed

Wow, this is incredible!