The US Government Incompatible Goals: Eliminate Trade Deficits While Running Large Fiscal Deficits

Image Source: Pixabay

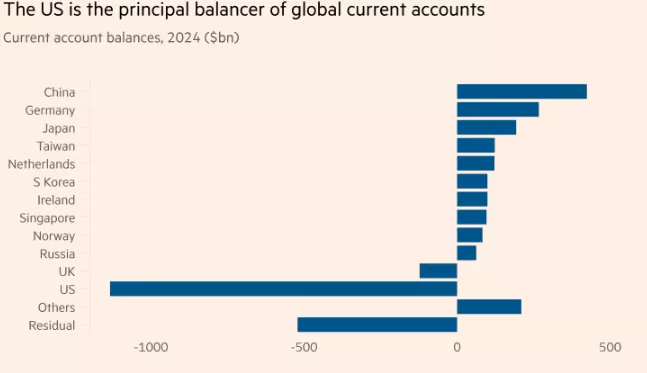

As the US government deals with the complexities of its next budget cycle, it will become more apparent that it will be caught up in a dilemma between trade policy and domestic finances. We have been subject to many explanations for Trump’s war on the international trade regime established a lifetime ago. At the heart of Trump’s grievances is the large, expanding US trade deficit with over 100 different trading partners. Last year, the US current account worldwide deficit exceeded the $ 1.0 trillion mark.

Source: FT.com

In and of itself, there is nothing inherently “bad” about running trade deficits. After all, the US consumer continues to enjoy an enormously wide range of products, produced relatively cheaply. Furthermore, as long as its trading partners are satisfied with receiving payment in USD, these international flows can continue indefinitely. In fact, this high degree of satisfaction has been the hallmark of the international community since the end of the WW2.

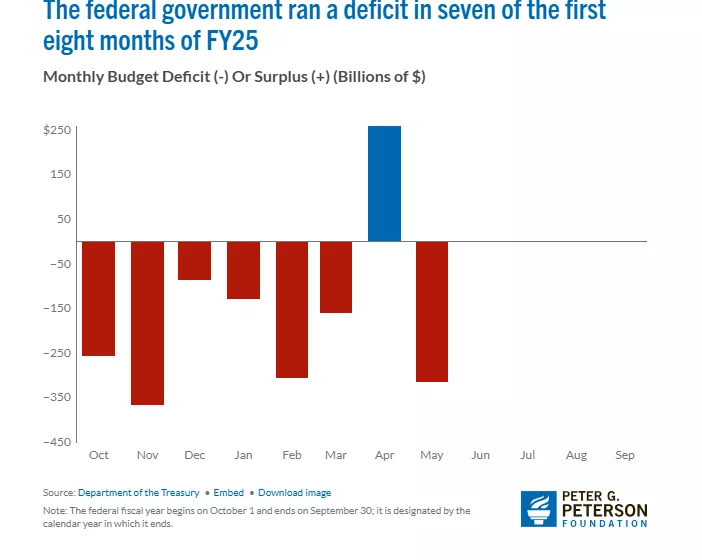

However, trade deficits are no longer viewed independently of US fiscal policy. The Congressional Budget Office projects a federal budget deficit in 2025 of $1.9 trillion, and a projected deficit of $2.7 trillion a decade later.

Here is where trade policy and fiscal policy collide. US domestic taxpayers are not prepared to finance these annual shortfalls at the federal level. The presence of twin deficits means the U.S. needs to issue a record number of Treasury debt instruments. While this is not a novel or new development, it has taken on greater significance, pushing U.S. outstanding debt to an estimated $37 trillion.

Investor reaction to so much debt coming on stream has been very swift. China, once held $1.5 trillion in US Treasuries, has steadily sold off itd holdings which now sit at $750 billion, of half of its prior holdings. Earlier this spring, US Treasuries sold off and the long end of the market jumped as much as 70 bps. The credit worthiness of the US government was challenged in the marketplace and both yields and term premium rose dramatically. This signified real concern about the supply coming on stream. Adding an additional $2.7 trillion in new debt will be taken up, albeit at higher yields. Remember the US budget is already loaded with interest payments from existing debt, so the budget deficit going forward will be re-loaded with new interest payments.

So, what can be done to ease these credit demands? The US tariff policy will do very little in reducing its external trade imbalances. At the moment, the introduction of new tariffs has increased the average US tariff rate from 3%, in 2024 to 18% under the Trump regime, not nearly enough to contribute measurably to a reversal in trade patterns with Asia and the EU. On the domestic fiscal front, the political tug-of-war will continue, although it clearly expected that the end result will be a deficit close to that projected. The U.S. is no near dealing with its twin deficits.

More By This Author:

Central Bankers Just Don’t Know Where We Are Headed

The Falling U.S. Dollar Signals The Decline In American Exceptionalism

U.S. Tariff Hits The Canadian Economy As The Trade Deficit Soars