U.S. Tariff Hits The Canadian Economy As The Trade Deficit Soars

Image Source: Unsplash

Canadians knew their economy would soon be hit by Trump’s tariffs, yet many observers were not expecting to observe such a dramatic reversal so soon in April. The trade deficit hit a record high in April of C$7.1b, as exports hit the US tariff wall. There was a 16% drop in Canadian exports to the U.S. and only a very small increase of exports elsewhere. There was no time to develop alternative trade arrangements to offset the loss developing in the US markets. The loss of trade will quickly reveal itself in the expected fall off in GDP for the month and the current quarter.

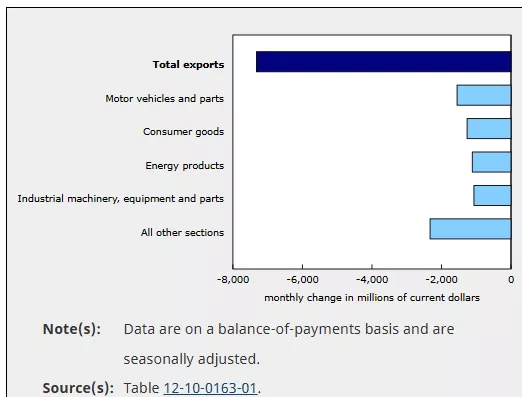

Contribution to the April change in exports by product (StatsCan)

By sector, the hardest hit was the auto manufacturers whose exports fell by 17%, as the US tariff hit passenger cars and light trucks which were put in place early in April. Canadian auto makers announced layoffs and the curtailment of production lines. On the consumer side, a whole raft of food products and pharmaceutical exports fell by 16%. Canadian energy products dropped in value by 8% due to the lower cost of oil. Finally, a host of industrial products, minerals and forestry shipped to the US also declined in the month. In sum, no sector was spared the impact of tariffs as both price and volume sales weakened.

The U.S. was not spared the impact of its tariffs on the two-way North American trade. Auto and auto parts US exports to Canada dropped dramatically by 18% and a host of industrial electrical goods imported dropped by 10%. Bilateral trade was severely hit and more negative results are expected as the both countries face adjustments in cross border trade.

The Carney government has yet to announce its full measure of retaliatory tariffs, in particular just after Trump increased the tariffs on steel and aluminum import from 25% to 50%. The Trump history of over extending and then retreating on tariffs has not resulted in a Canadian response until there is clear evidence that this new level of tariffs will stick. Nonetheless, there is clear evidence that the tariffs are making a major impact on bilateral trade, putting additional pressure on the federal government to respond.

The thorny question in Canada concerns what will the Bank of Canada do in the near-term. Yesterday’s decision to hold the line on its policy rate at 2.75% reflects the quandary the Bank faces. The Bank stresses that the on-again/off-again nature of US tariff policy results in such a high level of uncertainty that central bankers are struggling to find a way forward. TheBank statement is very concerned with the US tariffs’ impact on Canadian exports and the spill-over into business investment, employment and inflation. April’s trade figures offer up a very dim out regarding the impact of tariffs on the Canadian economy.

More By This Author:

Does The Trump Administration Want A Strong Or Weak Dollar?Trump’s Great Walk Back On Tariffs

The Bank Of Canada Calls The Trade War The Greatest Threat To Financial Stability