US Wheat Crop/Stocks Update

Market Analysis

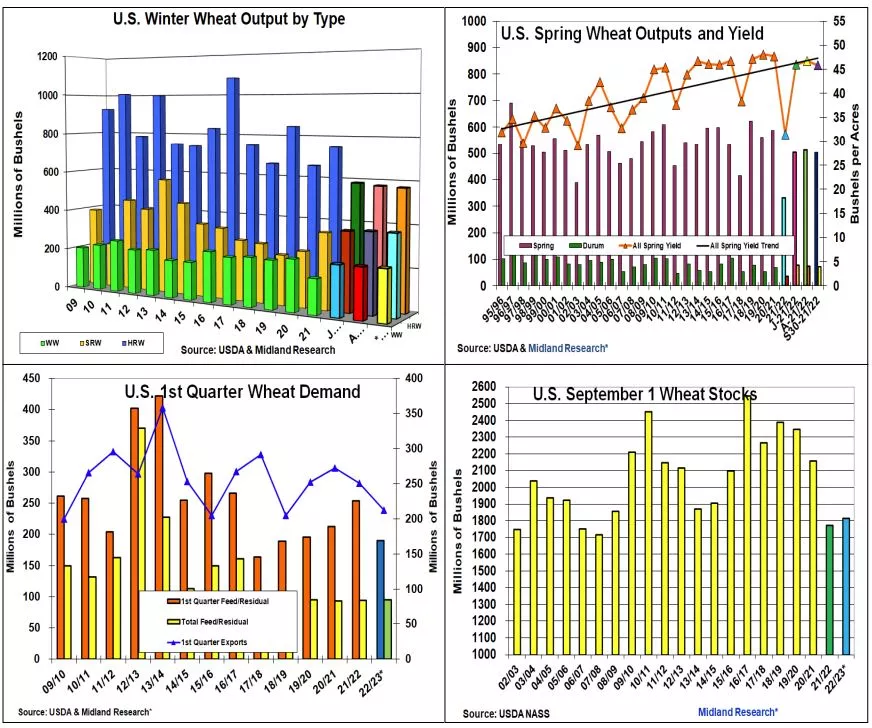

Over the years, the USDA’s September 30 Small Grains report can be a non-event. Very modest changes in US barley, oats and total wheat crops have occurred over the years. This could be the case within the various 2022 varieties of US winter wheat crop on the upcoming report. However, the past dryness over the past 60 days in the N Plains spring wheat and durum areas suggests these varieties might have had some slippage in their earlier yield prospects.

Despite August’s 3 million bu decrease in the US winter wheat output because of a further 8 million drop in the S Plains’ hard red output, the eastern US soft red crop rose by 5 million. Hard red could slip a bit further, but possible soft red and PNW white wheat increases with likely keep 2022’s winter wheat crop only 1 million lower at 1.197 billion bu. After a wet spring in the N Plains delayed the region’s wheat seedings until late May and early June, the past 60 days of below normal rainfall has prompted some concerns about lower spring wheat test weights. This was behind our 9 million smaller spring and 2 million bu lower durum crops for the upcoming Small Grain update on Friday. Overall, 2022’s US wheat production could be down 12 million bu from August to 1.771 billion bu, but 125 million bu larger than last year.

This year’s strong US currency has reduce this past summer’s overseas shipments by 35 million bu. However, the largest reduction in wheat’s demand was in the US cattle yards. After a dramatic jump last year because of wheat’s favorable price, Russia’s invasion of Ukraine & this year’s reduced hard red supplies, this US feed demand could be down 65 million bu from 2021’s usage. Even with a 55 million lower total US supply because of a smaller carryover, wheat’s Sept 1 US quarterly stocks could be up 42 million to 1.816 billion bu later this week.

Despite this past quarter’s possible higher ending stocks, US wheat supplies will remain the smallest since 2013/14 US crop season. Despite indications that Russia’s wheat crop could be historically large (95 mmt or more), financial and transportation sanctions have curtailed their shipments.

What’s Ahead:

The Black Sea conflict remains wheat’s main price factor. The increasing possibility of Ukraine’s food corridor being closed because of Russian war setbacks remains. However, Canada and Australia’s crop prospects appear strong while US & Argentine dryness curtail their 2023 crops.

Up 2022 Chi & KC sales to 45% in the $8.90 & $9.75 areas & begin MN sales to 25% in the $9.75-85 area.

More By This Author:

Pre-Sept 30 Corn & Bean Stocks: Be Alert For Stronger Corn Feeding & A Smaller US Bean Crop

September US Crop/S&D Reports - Lower Midwest Yields Pulled US Crop Outputs Down

Western Midwest Heat/Dryness Vs. The ECB Moderation - The Big Question

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more