UK Treasury To Bail-Out Bank Of England's £11 Billion QE Losses

Just when you thought UK PM Liz Truss had her budget under control, it appears another big hole just appeared that needs to be plugged.

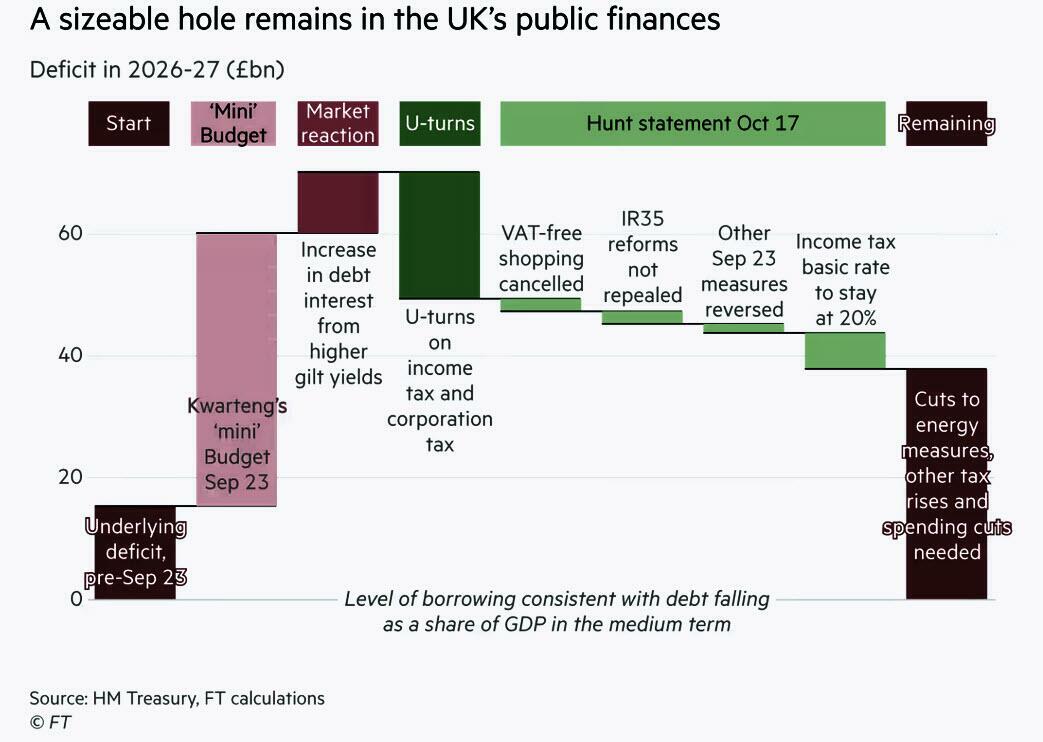

As we recently detailed, new UK chancellor Jeremy Hunt faces the daunting task of closing a £40bn gap in the government’s accounts...

(Click on image to enlarge)

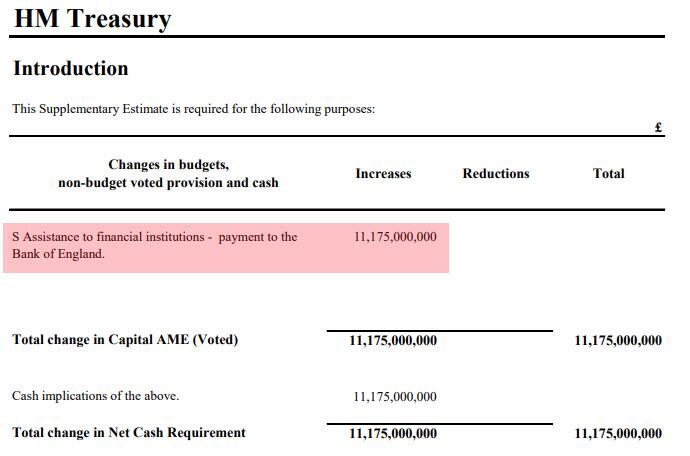

But, as Bloomberg reports, there are more holes for the UK Treasury to find cash for as it is set to transfer more than £11 billion ($12.4 billion) to the Bank of England this fiscal year to cover projected losses in its bond-buying program.

The capital transfer was detailed in an update to the “Central Government Supply Estimates” published on Tuesday by the Treasury.

The new £11.175 billion injection is listed under “assistance to financial institutions - payment to the Bank of England”.

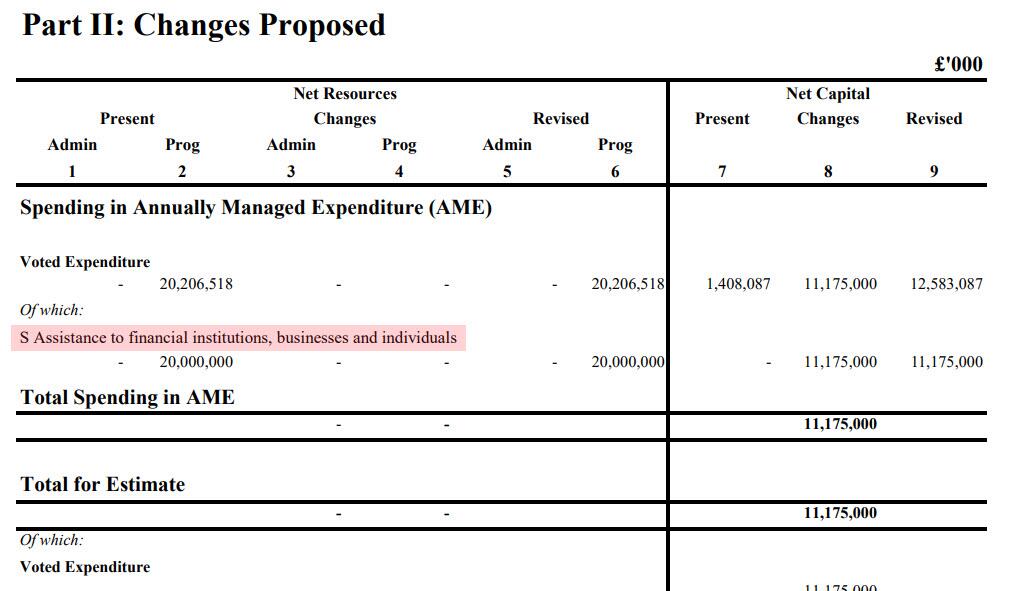

Notably, this payment is also described as "assistance to financial institutions, businesses and individuals" under proposed new changes...

(Click on image to enlarge)

Much more palatable for UK taxpayers?

Bloomberg calculations suggest the BOE’s annual loss could top £20 billion as soon as next year.

Bloomberg reports that a spokesman for the Treasury said “the new Chancellor remains very committed to Bank independence and has full confidence in it.”

Notably, we wonder how much worse this hole will get now that the Bank of England is set to start its QT (bond-selling) program once again.

The situation in the UK is apparently different to that in the US as while The Fed typically remits its operating profits (on interest income from the bonds on its balance sheet and from fees for services provided) to the US Treasury (under Federal law). That money becomes part of the federal government’s operating budget. In other words, the central bank serves as a revenue source for Uncle Sam.

As we noted previously, in 2021, The Fed reported a net income of $107.8 billion and sent $107.4 billion to the US Treasury.

But it is possible for the Fed to lose money. In fact, it will likely do so in 2023. If so, it would be the first operating loss since 1915.

However, unlike in the UK, while the US government will see a reduction in revenue which will increase the federal budget deficit, we live in a world where the Fed gets to make its own accounting rules. And according to its own accounting rules, any net loss magically turns into a “deferred asset.”

Maybe the BoE and UK Treasury need to take some notes...

More By This Author:

European Auto Stocks Rally After Sales Rise For Second Month In A Row

Netflix Soars After Q3 Results, Subscriber Growth And Forecast All Tops Forecasts

Market Tumbles On Report Apple Cutting Iphone 14 Plus Production

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more

Why does it matter if the BoE takes a loss from bond trading? There are no shareholders holding equity in the bank,