Tuesday Talk: Poseur Putin

Putin's sending troops into the Donetsk and Luhansk regions of Ukraine to carry out "peacekeeping" functions has increased concern about impending war and further dampened positive sentiments in the market.

Monday the S&P 500 closed at 4,349, down 31 points, the Dow Jones Industrial Average closed at 34,079, down 233 points, and the Nasdaq Composite closed at 13,548, down 169 points. Top gainers and top losers were across all sectors:

Chart: The New York Times

In early morning trading market futures are trading pointedly downwards. S&P futures are trading down 49 points, Dow futures are trading down 332 points and Nasdaq 100 futures are trading down 260 points.

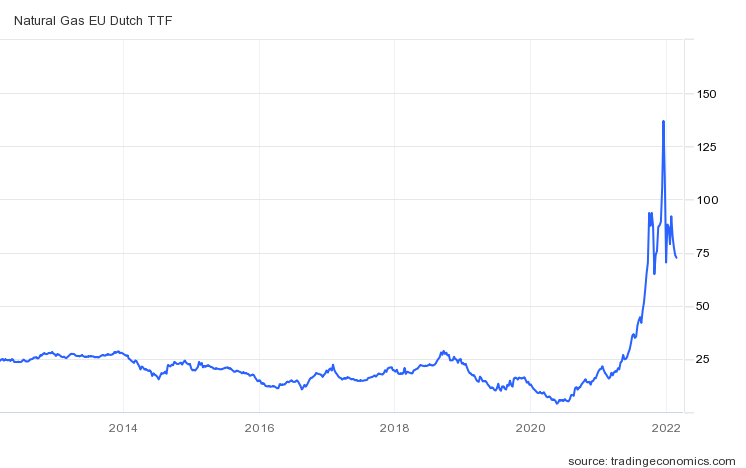

With regard to "talking-heads" who have said the U.S. should have sent more natural gas to Europe to counter the demand for Russian natgas, TM contributor and economist Menzie Chinn in his article Would Pumping More Natural Gas In America Have Countered Russian Pressure? through stats and graphs shows readers that the answer is decisively, no. Below are some of Chinn's notes and charts. See the full article for more detail:

"A first glance at actual data (i.e., linking up with reality) is useful. I plot US natural gas prices (Henry Hub) and TTF Dutch natural gas prices, as of today, for the past 10 years.

I’m hard-pressed to see a high correlation between the two (even if HH is in $, and TTF Dutch is in euros), partly because of the spike in February 2021 prices for the US...I know from my previous work...that the natural gas market has been historically fragmented, and despite the development of LNG transportation, barriers remain.

A recent study confirms my impression...From Loureiro et al. (2022):

…This study conducts growth convergence testing and clustering analysis on a panel comprised of four established gas price benchmarks and two emerging ones that expand up to the pre-Covid-19 period. The most significant finding is that no gas price convergence can be found outside Europe. This is despite the existence of episodes of partial convergence that are identified in the literature, and replicated and explained here. Importantly, the results strongly reject the postulate that increased LNG flows serve as a price-levelling arbitrage mechanism...

Bottom line: stay away from simple-minded nostrums like “if only we’d pumped a lot more natural gas in America, Russia wouldn’t be able to pressure Europe”; more basically, spend 30 seconds doing some research before pontificating."

Contributor Tammy Da Costa in her article BTC/USD Stumbles, Russia-Ukraine Drives Sentiment once again bursts any remaining bubbles that cryptocurrency is on the cusp of replacing Gold as a flight to safety asset.

"Bitcoin prices have fallen back below $40,000 as risk sentiment continues to follow developments in the conflict between Russia and the Ukraine. With investors recently seeking refuge in safe-haven assets, riskier securities and rising volatility has recently weighed on digital assets, preventing BTC/USD to gain traction beyond the $44,000 handle."

"If selling pressure continues to mount, bearish continuation could result in a retest of the January low ($32,932) which paves the way for the 38.2% retracement of the above-mentioned move at around $28,860."

Da Costa's article includes charts and stats discussing Bitcoin's MACD (moving average convergence/divergence) and MA (moving average).

Contributor Mish Shedlock tracks CPI increases in major economies around the world in Global CPI Surge Comparison By Country In The Covid-19 Recovery.

Shedlock also notes that the IMF has collected data on stimulus programs and includes a comparison of U.S. and Canadian programs.

"Fiscal Stimulus is far more difficult because there are multiple forms. Putting money directly into people's pockets is vastly different than spending money on shots and medical supplies. The IMF has Fiscal Stimulus Data for every country but comparisons are not easy."

Shedlock includes the below chart of stimulus as a percent of GDP by country, which is interesting in of it self.

A quick look at both charts shows that the lowest increase in the CPI is in Japan despite having provided the highest amount of stimulus as a percent of GDP.

TalkMarkets contributor Taki Tsaklanos writes, Nasdaq Selling About To Accelerate. What’s Next: Exhaustion Selling Or A Real Crash?

"The Nasdaq volatility index is getting scarier than ever. Its aggressive profile is confirming what we are saying for a long period now: a bigger sell-off is underway. Is a buy opportunity underway or is this the start of a mega crash?...The downtrend that started in the first week of January is pretty clear, and it might be that the Nasdaq will drop to 12950 points. It might be in a flash crash type fashion, presumably it will be a buy the dip opportunity but who knows maybe it will induce more selling. As long as 12464 is respected we believe we remain in a long term uptrend. Don’t forget, the ongoing volatility can be part of the long term uptrend."

See the article for charts and additional technical analysis.

In the "Where to Invest" Department both Airbnb and First Citizens BancShares cross contributors' radar.

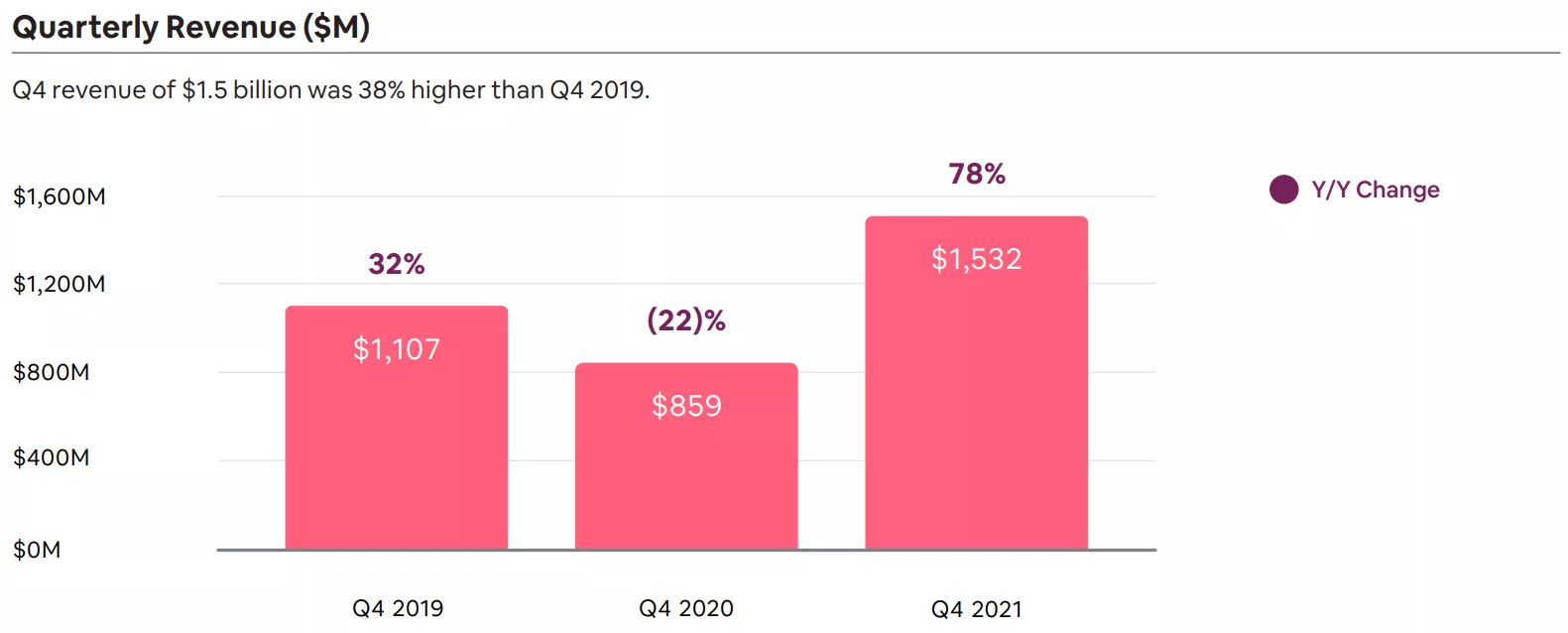

In a TalkMarkets exclusive the Staff at Mentor Finance note that Airbnb Records The Strongest Q4 Ever.

"Financials showed that Airbnb's (ABNB) Q4 revenue of US$ 1.53 billion was 78% higher than Q4 2020 and 38% higher than Q4 2019. The bold gains also surpassed the revenue guidance of US$ 1.48 billion given in Q3 2021, showcasing the company's full recovery back on the right track, despite variants and surges of the COVID-19 pandemic. The company elaborated that the striking revenue of Q4 2021 was primarily attributable to the continued growth of booked room nights from the regions like North America, Europe, EMEA, and Latin America.

Data source: Shareholder Letter Q4 2021

Airbnb achieved GBV (Gross Booking Value) of US$ 46.9 billion throughout the year 2021. Nearly two years under the pandemic, changes to travel are unfolding in many European and North American countries. Remote work style has set people free from sitting in office every day. As a result, people are spreading out to a wide range of towns and cities and staying longer time...We can find confidence from the 2022 guidance given by the company. It expects its revenue to be between US$ 1.41 billion and US$ 1.48 billion in the first quarter of 2022, up 58.96%-66.29% compared to the same period in 2021. The company believes that Q1 2022 would be the strongest quarter even in Airbnb's history as the impact of Omicron has quickly dissipated and guests are confidently booking for the summer travel season early in the year."

Contributor Thompson Clark writes that First Citizens BancShares is The Only U.S. Bank Stock I'm Buying.

Image: First Citizens Bank

"With $100 billion in assets, First Citizens (FCNCA) is one of the top 20 banks in the US. It’s headquartered in Raleigh, North Carolina (where I’m based). And the stock has a lot going for it. First, it has strong insider ownership—something we’re always looking for. CEO and Chairman Frank Holding, Jr. and his family own over 20% of shares...The stock is trading around $792, or about 1.2X book. To put that in perspective, peers like M&T Bank (MTB) and Fifth Third Bank (FITB) have similar return-on-equity levels. But they trade for 1.45X and 1.7X book, respectively. So, we’re looking at a 15% to 40% upside if First Citizens starts trading near its peers. That’s nothing to sneeze at."

Read Clark's article for more details.

Caveat Emptor.

As events in Ukraine continue to unfold, I draw your attention to these remarks Vladimir Putin made yesterday:

"As a result of Bolshevik policy, Soviet Ukraine arose, which even today can with good reason be called 'Vladimir Ilyich Lenin's Ukraine'. He is its author and architect. This is fully confirmed by archive documents...And now grateful descendants have demolished monuments to Lenin in Ukraine. This is what they call decommunization. Do you want decommunization? Well, that suits us just fine. But it is unnecessary, as they say, to stop halfway. We are ready to show you what real decommunization means for Ukraine."

Chilling.

Show kindness to those around you. We are all in this together.

I'll be back on Thursday. Have a good week.