Get Out Of The Shadow Of The Pandemic, Airbnb Records The Strongest Q4 Ever

Online house rental supplier Airbnb (Nasdaq: ABNB) released its Q4 and full-year 2021 performance on February 15th. It showed that Airbnb's revenue and net income of Q4 2021 both exceeded the expectations previously predicted, marking it the best Q4 and year performance in Airbnb's history. What's more, the company's earning guidance of Q1 2022 also exceeded Wall Street's forecasts.

The market is more bullish on Airbnb given its stellar performance in Q3 2021. On Tuesday, Feb 15th, the company's stock closed up to 6% and even rose by more than 8% after the announcement of the Q4 performance, but then dropped back to 3.6%.

Strongest Q4 ever

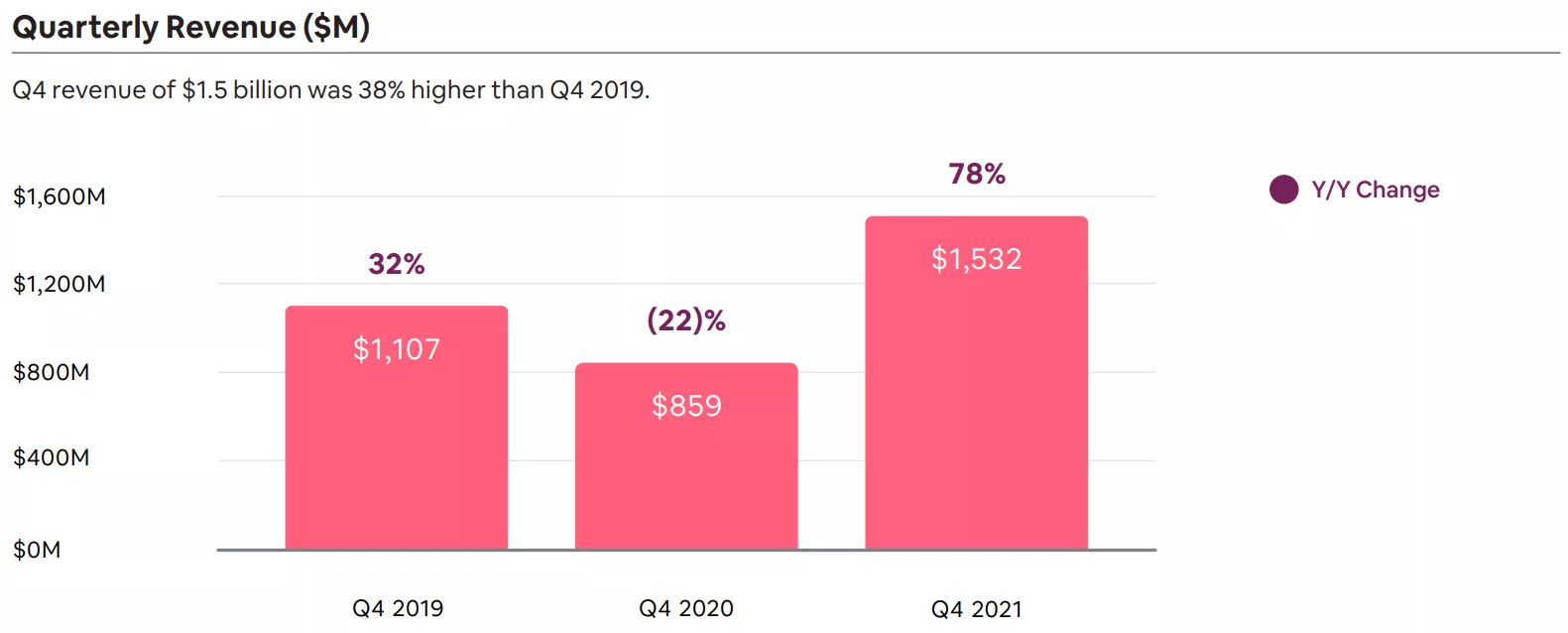

Financials showed that Airbnb's Q4 revenue of US$ 1.53 billion was 78% higher than Q4 2020 and 38% higher than Q4 2019. The bold gains also surpassed the revenue guidance of US$ 1.48 billion given in Q3 2021, showcasing the company's full recovery back on the right track, despite variants and surges of the COVID-19 pandemic. The company elaborated that the striking revenue of Q4 2021 was primarily attributable to the continued growth of booked room nights from the regions like North America, Europe, EMEA, and Latin America.

Data source: Shareholder Letter Q4 2021

Airbnb achieved GBV (Gross Booking Value) of US$ 46.9 billion throughout the year 2021. Nearly two years under the pandemic, changes to travel are unfolding in many European and North American countries. Remote work style has set people free from sitting in office every day. As a result, people are spreading out to a wide range of towns and cities and staying longer time. Brian Chesky, the CEO of Airbnb, says that he'll also be living on Airbnb, staying in a different town or city every couple of weeks, just like they are for millions of guests who can now live anywhere.

The average daily rates have already returned to growth since the beginning of Q3 2020. It averaged US$ 154 in Q4 2021, representing a 20% increase year-on-year, and a 36% increase compared to the same period in 2019. Airbnb's share-housing model has a powerful edge over the big chain hotel before they shifted to an asset-based development model.

Data source: Shareholder Letter Q4 2021

Despite the cancellation of flights and holiday plans caused by the sudden emergence of Omicron, Airbnb is barely within the reach of the impact while demonstrating resilience. "The impact of Omicron on bookings and cancellations was lower than we experienced with Delta last summer." said the company's management.

The breakneck growth of GBV turned Airbnb from a net loss in Q4 2020 to a net income of US$ 55 million in Q4 2021, a record high for the fourth quarter. Meanwhile, the company posted Q4 Adjusted EBITDA of US$ 333 million, with a profit margin of 22%, making the quarter most profitable fourth quarter ever. The full-year 2021 Adjusted EBITDA profit margin was 27%.

Notably, nights and experience booked stayed lean, compared to Q4 2019, in the Asia Pacific countries and regions such as China and Japan where used to be a major source of cross-border tourists remained their border closed. However, booking orders increased 22% over Q3 2021 mainly due to the lifting of certain travel restrictions in other countries like Australia. Excluding Asia Pacific, global lodging and experience bookings were 8% higher than 2019 levels in the quarter.

Hold on to the throne

The business model adopted by Airbnb is the recipe for its spectacular trajectory across the year at a time when plenty of travel agencies and hotels are still struggling against the pandemic. As a creation of the shared economy, the business model adopted by Airbnb is built on its internet platform where garners considerable property resources that scatter around the world to meet customers' diverse needs. Generally, individual hosts and guests are directly mutual connected through the platform which can help both sides to make a booking order and offer safety protections. Airbnb, as an intermediary, claims no ownership of the houses but charges commissions from home renters and tenants.

It is this asset-light business model that makes Airbnb more resilient and more flexible in adjusting its business model in the face of the pandemic. "The reason we've been able to respond to this changing world of travel is that our model is inherently adaptable." said the management.

By far, the Airbnb community enjoys a mass scale of hosts and guests worldwide after years of experience in the sector. As of 2021, the community has over 6 million active listings, earning a record US$ 34 billion in 2021. The core competitiveness of Airbnb is exactly the community that builds jointly by its hosts and guests. Its strength would be further cemented by its efforts to constantly raise brand awareness and reputation, as well as pare expense discipline.

In terms of expenses, the company's expense control has been maintained at a high level. For the full year of 2021, the company's total costs and expenses decreased from US$ 6.969 billion to US$ 5.562 billion. As mentioned in the company's report, the company realized 32% of the stock-based compensation and stock settlement obligations compared to 2019, with roughly 3/4 of the profit-driven by optimizing financial and marketing strategies and only 1/4 of it through ADR growth.

Whether Airbnb can hold on to a high market share or not is the main topic for the company in the years to come. But one thing is for sure, Airbnb, as the industry leader, would devour more market share and become more profitable as the penetration rate of global home-sharing rental increases and the impact of the pandemic fades.

We can find confidence from the 2022 guidance given by the company. It expects its revenue to be between US$ 1.41 billion and US$ 1.48 billion in the first quarter of 2022, up 58.96%-66.29% compared to the same period in 2021. The company believes that Q1 2022 would be the strongest quarter even in Airbnb's history as the impact of Omicron has quickly dissipated and guests are confidently booking for the summer travel season early in the year.

Reference:

Disclaimer: This article is prepared by Mentor Finance (the "Company") and by certain qualified investors (such as professional investors). By reading this article, you agree to keep ...

more

No it’s not. $ABNB's revenue was down 30% quarter over quarter.

Why are $ABNB's earnings are so low?.08