The FTSE Finish Line - Thursday, June 19

Image Source: Pexels

London shares fell on Thursday as escalating tensions in the Middle East rattled investors. Ongoing aerial assaults between Israel and Iran fuelled uncertainty, compounded by U.S. President Donald Trump's ambiguous stance on whether the United States would join Israel in airstrikes against Tehran. Trump hinted that Iranian officials were open to meeting in Washington, while European Union ministers are set to discuss the crisis with Iran on Friday, raising hopes in the markets for a potential de-escalation. The conflict has also impacted oil prices, which rose today, boosting the energy sector by 1.2%. Gains in major companies like Shell and BP helped offset losses in the commodity-heavy FTSE 100 index.

Meanwhile, as anticipated, the Bank of England's Monetary Policy Committee (MPC) maintained the Bank Rate at 4.25% during its June meeting. After rate cuts in August, November, February, and May, and holding steady in September, December, March, and now June, the decision reinforces expectations that the MPC will continue its strategy of adjusting rates only quarterly. This outcome was widely expected, aligning with recent communications. Both our forecasts and those of all economists surveyed by Bloomberg predicted this decision, with markets assigning just a ~2% probability to a rate cut in June.

Single Stock Stories & Broker Updates:

-

Shares of Whitbread, the owner of Premier Inn, declined by 1.4% to 2,752 pence. The company's total accommodation sales in the UK fell by 2% year-on-year for the quarter ending May 29, indicating weak demand in its primary UK market and limited future prospects. Total sales for the first quarter also decreased by 4% compared to the previous year. Nevertheless, WTB reports that forward bookings in the UK are currently ahead of last year, and they anticipate that their German hotels will start generating profits in fiscal 2026. Analysts from Peel Hunt express confidence in the long-term outperformance potential of WTB, stating it is a highly efficient market leader. The stock has declined by 6.5% year-to-date.

-

Shares in recruitment companies in Europe slid on Thursday. British recruiter Hays forecasted a more than 57% drop in annual operating profit to £45 million ($60.36 million), which fell short of the market expectation of £56.4 million. As a result, Hays' shares fell about 13% at 0716 GMT. The company reported broad weakness in permanent hiring. Jefferies analysts noted that the weaker-than-expected performance is particularly negative for rival Page Group, as permanent activity constitutes about 72% of its group fees. Consequently, Page Group's shares fell approximately 6.5% to April lows, while Randstad and Adecco both declined by around 3.5%.

Technical & Trade View

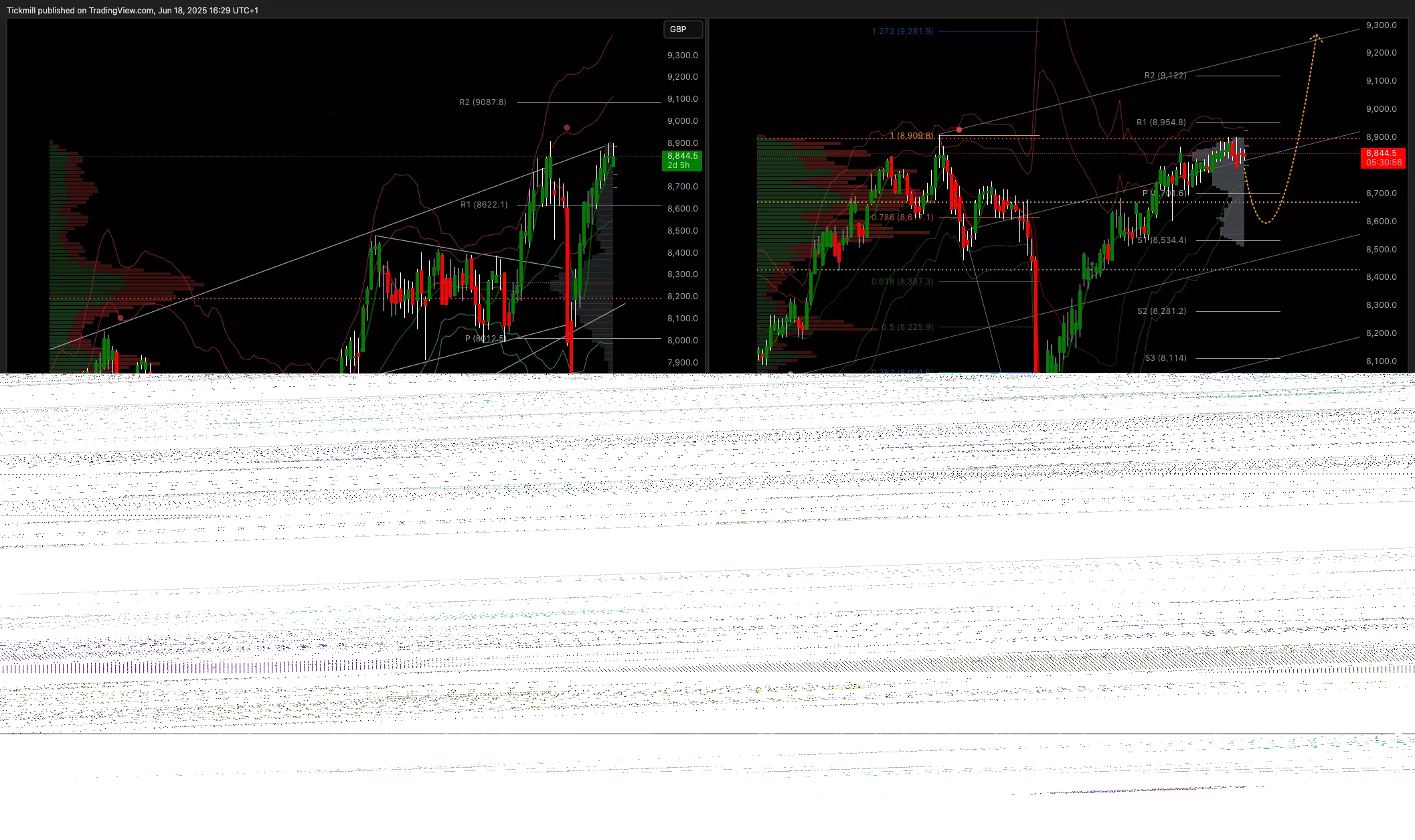

FTSE Bias: Bullish Above Bearish below 8700

- Primary support 8600

- Below 8500 opens 8400

- Primary objective 9200

- Daily VWAP Bearish

- Weekly VWAP Bullish

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Thursday, June 19

The FTSE Finish Line - Wednesday, June 18

Daily Market Outlook - Wednesday, June 18