The FTSE Finish Line - Wednesday, June 18

Image Source: Pexels

On Wednesday, Britain's FTSE 100 initially rose as investors assessed positive inflation data ahead of key central bank meetings in the U.S. and the UK. However, tensions in the Middle East dampened market enthusiasm, causing the benchmark to return to the flatline as the session neared its close. The conflict between Iran and Israel has entered its sixth day, with increasing concerns about potential U.S. military involvement following President Donald Trump's call for Iran's "unconditional surrender."

The UK's CPI inflation rate fell to 3.4% year-on-year in May, slightly below market expectations of 3.3%, but aligning with our forecast. This decrease from April's 14-month high of 3.5% was mainly due to the reversal of factors that had previously driven inflation up. Notably, the Easter-related surge in airfares partially subsided, and the ONS corrected an error that had exaggerated the impact of increased vehicle excise duty rates in April. These adjustments largely explain the significant drop in services inflation (from 5.4% to 4.7%), bringing both the services inflation rate and the headline CPI inflation rate back in line with the Bank of England's projections. Consequently, the latest figures are unlikely to deter the Monetary Policy Committee from its gradual rate-cutting path, with the Bank Rate expected to remain unchanged at 4.25% tomorrow, before a probable quarter-point reduction at the August meeting.

Single Stock Stories & Broker Updates:

-

Shares of British pharmaceutical companies AstraZeneca and GSK declined following U.S. President Donald Trump's warning about impending tariffs on the pharmaceutical industry. AstraZeneca fell 1.5% to 10,500p, while GSK decreased by 1.3% to 1,461.5p, both ranking among the biggest losers on the FTSE 100 index, which has risen by 0.15%. On Tuesday, Trump stated that tariffs affecting the pharmaceutical sector are "coming very soon." Michael Field, chief equity strategist at Morningstar, mentioned that investors are reacting negatively due to Trump's warning regarding tariffs on pharmaceuticals. "There have been significant questions about the constitutionality of these tariffs and their implementation, but in the meantime, the market is taking a cautious approach and reducing the valuations of pharmaceutical stocks." After factoring in the day's losses, AstraZeneca and GSK have increased by 0.5% and 8.6%, respectively, this year to date.

-

Shares of Ocado rose 4.3% to 255.1p, making it a top gainer on the FTSE mid-cap index, which is up 0.06%. The company is expanding its partnership with Spanish supermarket BonPreu to build a robotic warehouse near Barcelona. However, the stock is down about 19% this year.

-

Shares of Speedy Hire drop 6.1% to 25.07p, making it one of the top losers on the FTSE small-cap index. The company reported FY adjusted PBT of £8.7 million, down from £14.7 million a year ago, but remains confident in meeting full-year expectations. Analysts at Peel Hunt note that current challenges are market-driven, while future earnings will rely on operational and strategic actions. The brokerage believes the company is well-positioned for market recovery. Year-to-date, SDY is down approximately 11%.

-

Shares of Oxford Metrics fell 6.9% to 54p after reporting a H1FY25 pretax loss of £0.7 million versus a profit of £3.7 million last year. Headline group revenue declined 14% to £20.1 million. Delays and cancellations in pipeline opportunities due to U.S. policy changes and reduced funding were noted. The board expects FY adj. EBIT to meet expectations and approved a £4 million extension to the £10 million share buyback program. Year-to-date, the stock is down approximately 2.26%.

-

Tullow Oil's shares fell 22% to 16.7p, making it the biggest loser on the FTSE small-cap index, which is down 0.07%. Merger talks with Canadian peer Meren Energy have collapsed, according to Sky News, with no reason provided. Reuters could not confirm the news, and Tullow did not respond immediately. Including today's losses, Tullow is down 15.1% this year.

Technical & Trade View

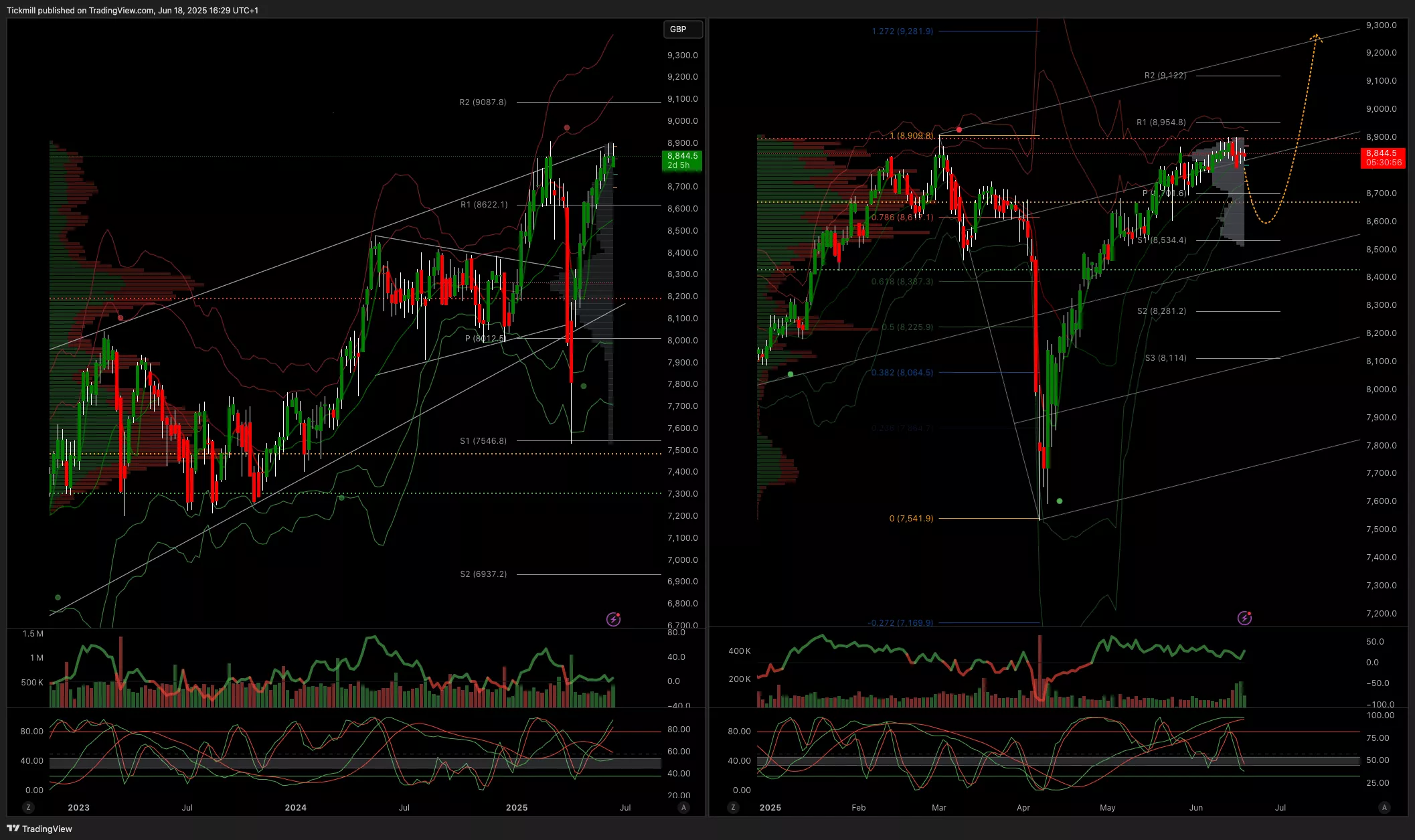

FTSE Bias: Bullish Above Bearish below 8700

- Primary support 8600

- Below 8500 opens 8400

- Primary objective 9200

- Daily VWAP Bullish

- Weekly VWAP Bullish

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Wednesday, June 18The FTSE Finish Line - Tuesday, June 17

Daily Market Outlook - Tuesday, June 17