Daily Market Outlook - Wednesday, June 18

Image Source: Unsplash

Crude oil prices remained close to a five-month peak amid concerns that rising tensions in the Middle East might lead to increased US involvement. In Asia, stocks exhibited mixed performance ahead of a Federal Reserve's monetary policy announcement. Although the widespread sell-off in markets from earlier in the week eased a bit, the general sentiment continued to be gloomy. MSCI's most comprehensive index of Asia-Pacific shares, excluding Japan, dropped by 0.3%. West Texas Intermediate crude increased by as much as 1.1% after reaching its highest point in nearly five months on Tuesday, following President Donald Trump's call for Iran’s unconditional surrender and his warning of potential strikes against Iran's leaders. While Hong Kong shares dipped, those in Japan rose after the S&P 500 fell by 0.8% in New York. Treasuries saw slight declines in Asia but managed to retain most of their gains from Tuesday, which were influenced by geopolitical uncertainties and disappointing US data regarding retail sales, housing, and industrial activity. Bloomberg's dollar index remained stable after experiencing its largest rise in a month during the US trading session, the conflict has shown that the U.S. dollar continues to hold some status as a safe haven in specific circumstances, especially when the conflict is perceived to increase the likelihood of disrupting global oil supply and when it shifts traders' focus away from U.S.-specific risks. Oil has risen by approximately 10% over the past week as reports indicated that Trump met with his national security team in Washington to deliberate on the worsening situation in the Middle East, intensifying speculation that the US might soon engage in Israel's military actions against Iran. US armaments are viewed as vital for more thoroughly incapacitating Iran’s nuclear program than what Israel could achieve on its own.

The Office for National Statistics (ONS) announced this morning that the UK Consumer Price Index (CPI) inflation rate stood at 3.4% year-on-year in May. This reflects a slight decrease of 0.1 percentage points from April, yet it exceeds market expectations by 0.1 percentage points. This figure aligns perfectly with the Bank of England's (BoE) predictions outlined in its May Monetary Policy Report. The critical services sector also mirrored this trend, with its annual rate dropping to 4.7% year-on-year from the previous 5.4% year-on-year. There will undoubtedly be discussion regarding the adjustments to vehicle excise duty and the fluctuations in airfare costs. These elements caused the transport sector to be the largest detractor in the annual rate change between April and May, contributing a negative 35 basis points. However, there were positive contributions from food prices (+11 basis points) and furniture (+7 basis points). The inflation rate for food at 4.2% year-on-year now surpasses the BoE's anticipated rate of 3.5% year-on-year. Nonetheless, the UN World Food Price Index, which often serves as a reliable indicator, points towards a potential reduction ahead. When the Monetary Policy Committee (MPC) convenes today for their June meeting, it is expected to disregard much of the noise surrounding road tax and airfare fluctuations that have attracted market attention. Consequently, if tomorrow's announcement about the voting outcomes or the wording in the minutes exhibits any dovish undertones, it is likely to be supported by last week’s softer-than-anticipated employment data rather than the inflation figures, which the Committee had forecasted.

The FOMC is expected to maintain the Fed Funds rate at 4.5% on Wednesday, but this meeting carries significant importance due to current uncertainties. In the latest update of the Summary of Economic Projections, the median forecast indicated a shift towards anticipating two rate cuts this year instead of one, though it was a narrow margin. This was before Liberation Day when policymakers believed any tariff impacts would be short-lived. Now, the main question is whether the recent increase in tariffs (initially raised, then reduced, but still elevated) necessitates a more cautious approach, or if the previous assumption stands. Trump's recent focus on "deals" may support a more balanced strategy. However, macroeconomic data has also shown a shift. Notably, inflation figures have consistently surprised on the low side, which might not have a significant impact yet since tariff effects have not fully filtered through. Nevertheless, it is advantageous when evaluating the baseline of underlying inflation. Confidence and activity indicators have appeared weak, and crucially, labor market data shows continued signs of a downturn. Typically, lower inflation and weak demand would heighten Powell's concerns, but whether this is enough to sway the entire committee towards a more dovish stance remains uncertain. However, markets could interpret a trend of rising unemployment expectations, slower growth, and stable mid-term inflation as a strong indication of that shift, even if the median forecast remains unchanged.

Overnight Headlines

- Fed To Hold As Growth Slows And Inflation Lingers

- US To Ease Capital Rule Limiting Bank Treasury Trading

- Airbus-Dassault Dispute Threatens European Fighter Jet Project

- Rolls-Royce Urges UK Backing For New Jet Engine

- Amazon Says AI Will Lead To Fewer Corporate Roles

- McKinsey: Global Clients Rethinking US Exposure

- Sam Altman: Meta Offered $100M Bonuses To OpenAI Staff

- G7 Leaders Struggle For Unity Amid Trump’s Abrupt Exit

- Trump Demands Iran’s ‘Unconditional Surrender’

- US Embassy In Jerusalem Closes For 3 Days Amid Conflict

- Italy’s Meloni Urges Gaza Ceasefire At G7 Summit

- Oil Rally Builds On Israel–Iran Conflict Escalation

- China Slams US Plan To Replace Huawei Towers In Panama

- Japan Exports Fall 1.7% Y/Y, Worst Drop In 8 Months

- Senate Passes GENIUS Act Despite Crypto Corruption Concerns

FX Options Expiris For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1400 (660M), 1.1450-60 (2.4BLN), 1.1500 (4BLN), 1.1525 (1BLN)

- 1.1600-05 (1.6BLN), 1.1645-50 (1.4BLN)

- USD/CHF: 0.8100 (400M), 0.8165-70 (522M), 0.8200 (375M)

- EUR/GBP: 0.8575 (534M)

- EUR/SEK: 10.7950 (440M), 11.15 (408M). EUR/NOK: 11.60 (362M)

- GBP/USD: 1.3400 (180M), 1.3500 (231M), 1.3550 (582M), 1.3575 (357M)

- AUD/USD: 0.6450 (210M), 0.6470 (273M), 0.6550 (240M)

- AUD/NZD: 1.0780 (200M), 1.0800 (200M), 1.0835 (340M)

- USD/CAD: 1.3600 (1.8BLN), 1.3700 (532M)

- USD/JPY: 143.00 (692M), 144.00 (844M), 145.00 (397M)

- 145.50 (391M), 145.90-146.00 (753M)

- EUR/JPY: 166.70 (225M), 167.00 (445M)

CFTC Positions as of the Week Ending June 13th

- Speculators have reduced their net short position in CBOT US Treasury bonds futures by 22,628 contracts, bringing it down to 79,745.

- They have also decreased their net short position in CBOT US Ultrabond Treasury futures by 24,696 contracts, now totaling 203,747.

- Speculators have increased their net short position in CBOT US 10-year Treasury futures by 18,845 contracts, reaching 724,101.

- Similarly, the net short position in CBOT US 5-year Treasury futures has risen by 74,384 contracts to 2,470,920.

- The net short position in CBOT US 2-year Treasury futures has gone up by 36,591 contracts, now at 1,180,516.

- Equity fund managers have raised their net long position in S&P 500 CME by 10,532 contracts, reaching 825,013.

- Equity fund speculators have increased their net short position in S&P 500 CME by 31,419 contracts, now at 316,744.

- The net long position for the Japanese yen stands at 144,595 contracts.

- The euro's net long position is 93,025 contracts.

- For the British pound, the net long position is 51,634 contracts.

- The Swiss franc shows a net short position of -21,268 contracts.

- Bitcoin has a net short position of -2,009 contract

Technical & Trade Views

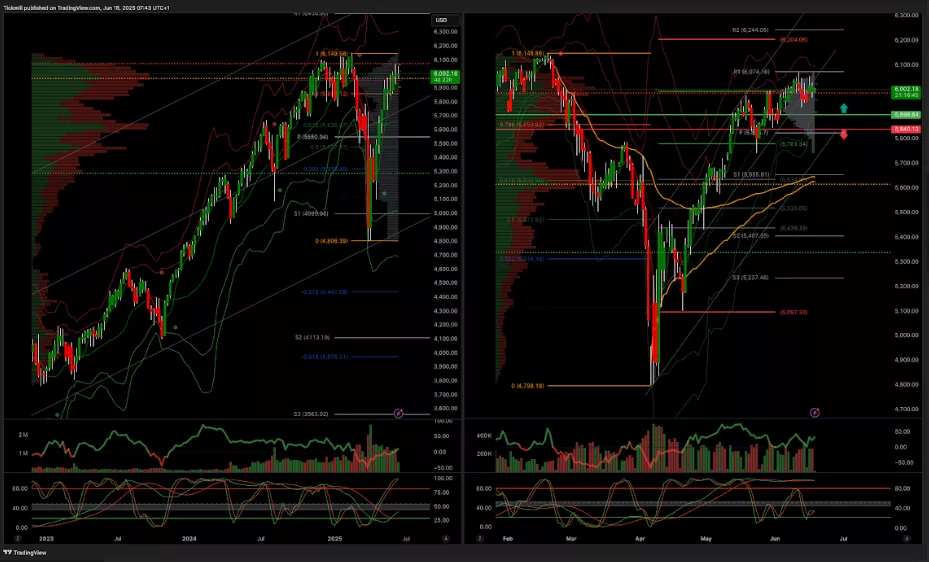

SP500 Pivot 5900

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 5900 target 6100

- Below 5800 target 5650

(Click on image to enlarge)

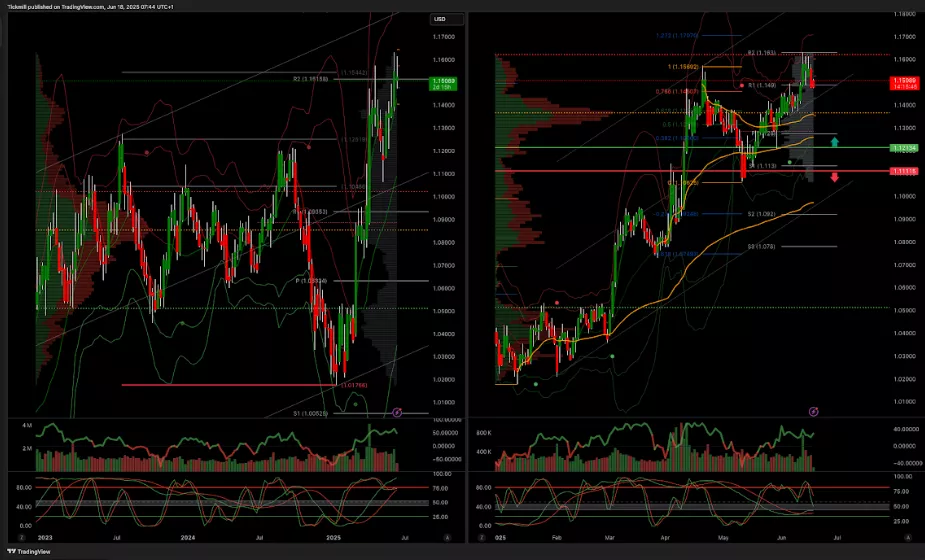

EURUSD Pivot 1.12

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 1.11 target 1.19

- Below 1.11 target 1.0950

(Click on image to enlarge)

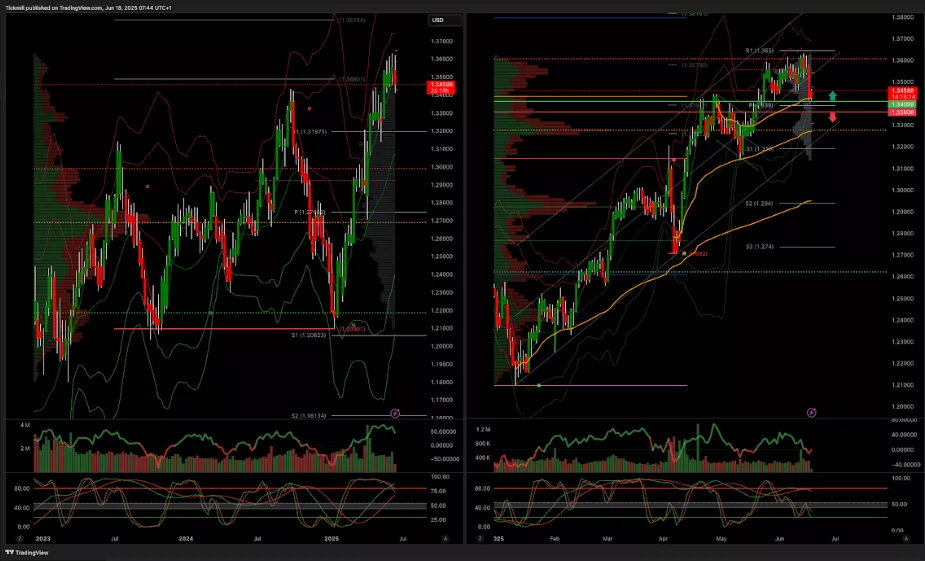

GBPUSD Pivot 1.34

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 1.34 target 1.38

- Below 1.3350 target 1.32

(Click on image to enlarge)

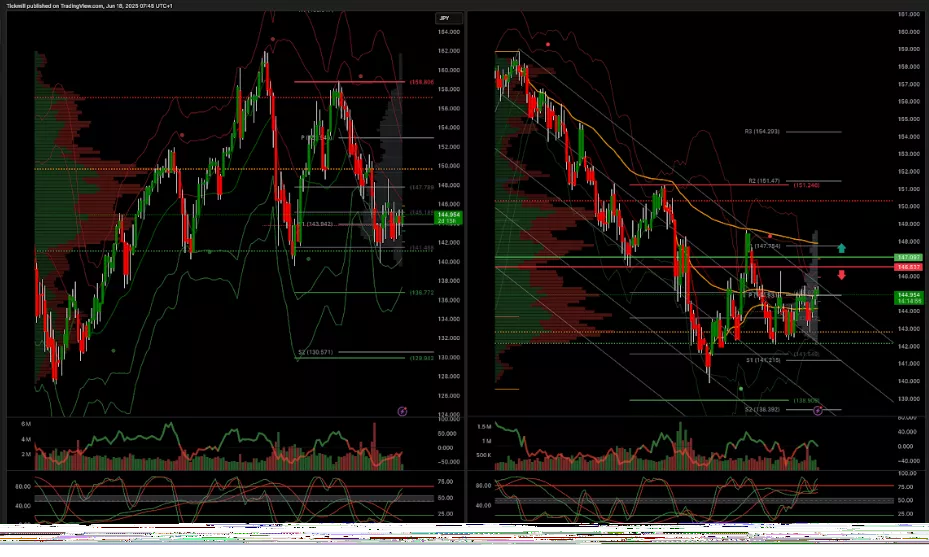

USDJPY Pivot 147

- Daily VWAP bullish

- Weekly VWAP bearish

- Above 147.10 target 148.26

- Below 146.53 target 139

(Click on image to enlarge)

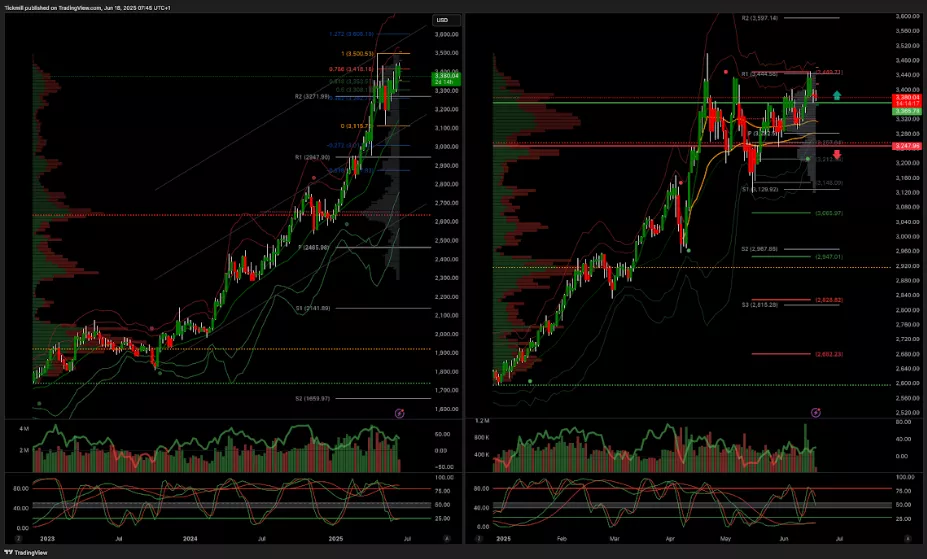

XAUUSD Pivot 3365

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 3410 target 3600

- Below 3240 target 3000

(Click on image to enlarge)

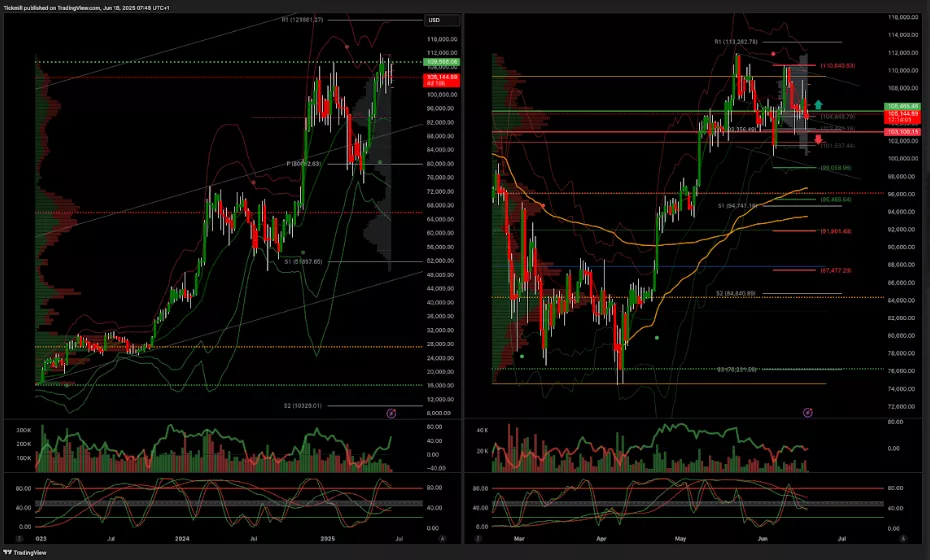

BTCUSD Pivot 105k

- Daily VWAP bearish

- Weekly VWAP bearish

- Above 105k target 118k

- Below 103k target 100k

(Click on image to enlarge)

More By This Author:

The FTSE Finish Line - Tuesday, June 17

Daily Market Outlook - Tuesday, June 17

The FTSE Finish Line - Monday, June 16