The FTSE Finish Line - Monday, June 16

Image Source: Unsplash

London's FTSE 100 index bounced back on Monday, driven by increases in Entain following the gaming giant's positive earnings outlook, as investors keep an eye on rising geopolitical tensions in the Middle East. Israel and Iran remain at the forefront of news, as their conflict shows no signs of abating. Early on Monday, Iranian missiles targeted Tel Aviv and the port city of Haifa in the latest round of retaliatory attacks that began last week. The rising tensions contribute to increasing uncertainty around the global economy, with oil prices surging against the backdrop of the Group of Seven meeting taking place on Monday. The G7 discussions are regarded as a crucial opportunity to re-establish a sense of unity among democratic leaders following U.S. President Donald Trump's fluctuating tariff policies that have disrupted global trade. Attention will then turn to the monetary policy meetings of the Bank of England and the U.S. Federal Reserve later this week, which will be closely observed for indications on how the central banks intend to handle the uncertainties caused by U.S. tariffs. The MPC meeting on Thursday is expected to be relatively quiet, with the Bank Rate likely remaining at 4.25%. However, unexpected developments in the vote split have become routine. Before the MPC casts its votes, adjustments from the ONS regarding an overestimated CPI (Wednesday) will need to be considered, alongside recent weaker labour market and GDP reports.

Single Stock Stories & Broker Updates:

-

Shares of Entain increased by 5.3% to 791.4p, making it the top gainer on the FTSE 100 index. The company announced that BetMGM, its U.S. sports-betting partnership with MGM Resorts, has raised its annual revenue and core earnings forecast. BetMGM now anticipates revenue of at least $2.6 billion for fiscal 2025, an increase from previous predictions of between $2.4 billion and $2.5 billion. Additionally, core earnings are expected to reach at least $100 million in fiscal 2025, compared to prior expectations of a positive EBITDA. BetMGM noted that the positive momentum seen in Q1 has continued into Q2 through June 13. The stock has risen approximately 15% year-to-date, including the gains from today's session.

-

Shares of Spectris, a maker of scientific instruments, rose 5.6% to 3,334 pence. The company is among the top gainers on the FTSE mid-cap index, which increased by 0.2%. On Friday, the company turned down a takeover offer from private equity firm KKR, just days after supporting a possible competing $5 billion bid from private equity firm Advent. SXS did not disclose details about KKR's proposal, which was first reported by the Wall Street Journal. As of the last closing, the stock has increased approximately 26% so far this year.

-

Gas producer Energean fell 4.4% to 781.5p. Berenberg downgraded its rating to "hold" from "buy," while keeping the price target at 1,000p. The company was instructed by the Israeli government to suspend production at its Karish offshore gas field, located 90 km from Israel in the Mediterranean Sea. Berenberg noted, "... with energy infrastructure seemingly under threat from both sides in the (Israel-Iran) conflict, we think it's wise to adopt a cautious stance." They also indicated that the Karish gas field is projected to represent 74% of the company's production forecast for 2025. Out of seven analysts, three rate the stock as "buy" or better, while four have a "hold" rating; the median price target is 1,075p, according to data from LSEG. Year-to-date, ENOG has decreased by nearly 25%, factoring in today's decline.

-

Shares of Costain Group rose 8.5% to 139.6p, their highest since March 2020, making it the top gainer on the FTSE small cap index, which is up 0.3%. The company announced a £10 million share buyback program and stated that trading is in line with FY25 expectations. Peel Hunt raised its price target to 150p from 135p and maintained a "Buy" rating, while Panmure Liberum increased its target to 170p from 150p. Peel Hunt noted ongoing operational and strategic progress, contributing to higher earnings quality and visibility. Year-to-date, the stock is up approximately 32%.

Technical & Trade View

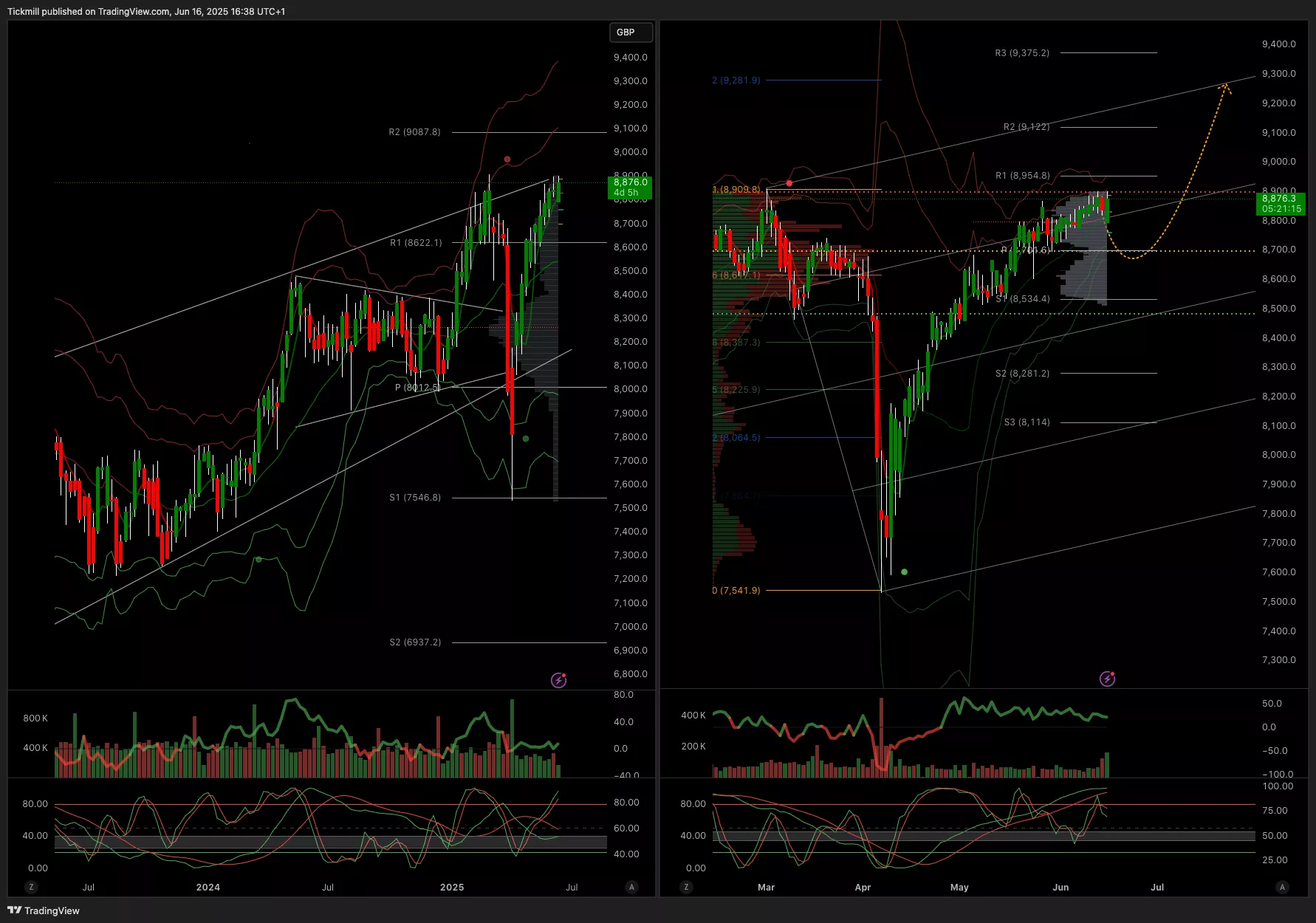

FTSE Bias: Bullish Above Bearish below 8700

- Primary support 8500

- Below 8500 opens 8250

- Primary objective 8900

- Daily VWAP Bullish

- Weekly VWAP Bullish

(Click on image to enlarge)

More By This Author:

S&P 500 Weekly Action Areas & Price Targets - Monday, June 16Daily Market Outlook - Monday, June 16

The FTSE Finish Line - Friday, June 13