Daily Market Outlook - Tuesday, June 17

Image Source: Pixabay

US and European stock futures dropped while oil prices increased after President Donald Trump urged for the evacuation of Tehran, a statement that sharply contrasted with the previous optimism regarding the Israel-Iran conflict not escalating further. Gold prices saw volatility in response to Trump's remarks made during a social media update from the G-7 leaders' summit in Alberta. It was unclear what he was referencing, although he had previously indicated that Iran was interested in negotiating. According to the White House, Trump is cutting short his G-7 trip and heading back to Washington. A separate report from CBS indicated that Trump requested the National Security Council to be ready in the Situation Room. These developments triggered a wave of risk-off moves in S&P 500 futures. Markets are wary of potential U.S. military action in Iran, leading to increased risk aversion due to added uncertainty.

The Bank of Japan maintained its key interest rate and announced a plan to reduce its bond market withdrawal gradually starting next year, signalling caution amid rising market volatility. During a two-day meeting, the BOJ board, headed by Governor Kazuo Ueda, decided to keep the benchmark policy rate steady at 0.5%, as stated in a Tuesday announcement. The central bank intends to slow the pace of its monthly bond purchases from the current ¥400 billion to quarterly reductions of ¥200 billion ($1.34 billion) beginning next fiscal year. In his press conference, BOJ Gov Ueda emphasises the need for flexibility in policy despite bond-buying plans. The BOJ may speed up tapering this year but will adjust based on the situation. The economy is recovering, with inflation expected to hit the 2% target. Uncertainties include tariffs and geopolitical developments, as the BOJ remains hawkish and seeks optimal timing for future rate hikes.

The MSCI Asia index experienced a slight rise, with gains in Japanese and Taiwanese markets, while Hong Kong and China saw declines. Stocks related to semiconductors saw an uptick as interest in artificial intelligence trades gained momentum. Risk appetite returned to Wall Street on Monday, lifting the S&P 500 by approximately 1% to over 6,000 once again. Investors displayed mixed signals about their confidence in the US economy, as long-term Treasury bonds continued to underperform the market, despite a $13 billion auction of 20-year bonds yielding expected levels—showing significant improvement compared to last month’s disappointing auction that triggered a widespread selloff.

Domestically, in the UK the latest labour market updates suggest an increasing likelihood of a cut in August, following the MPC's decision to maintain the Bank Rate at 4.25% at Thursday's meeting. While the -0.3% m/m GDP decline reported for April may be considered temporary trade-related volatility, employment trends are becoming clearer and are expected to influence the June MPC minutes, indicating that a majority might favour an August rate cut. The decline in employment appears to align with a more dovish scenario of sustained demand weakness outlined in the May MPR. Additionally, the voting patterns of individual members will be scrutinised. The two members who opposed the May rate cut referenced a surprisingly robust labour market; if recent data alters their perspectives, it could lead to a more unified vote for an August reduction. However, the May CPI figures are due for release tomorrow. A consensus inflation rate of 3.3% y/y would effectively negate last month's 3.5% y/y, likely due to an ONS miscalculation regarding vehicle excise duty inflation, resulting in an average rate of 3.4% y/y, consistent with BoE staff projections.

Today’s macro slate includes German ZEW, US retail sales, trade prices, industrial production, and the NAHB housing index.

Overnight Headlines

- EU Shuns Economic Dialogue With China Over Deepening Trade Rift

- BoJ Holds Rates, Slows Bond Taper Amid Market Volatility

- Trump Signs Executive Order To Implement US–UK Trade Deal

- Trump Leaves G7 Early, Resists Joint Statement On Israel-Iran

- Israel Strikes Iran State Media Buildings In Escalating Conflict

- Iran Ties Talks To End Of Israeli Bombing, Diplomats Say

- Goldman: China Housing Demand To Stay 75% Below Peak

- ‘SALT’ Deduction In Limbo As Senate Republicans Unveil Tax Plan

- OpenAI Wins $200M US Defense Contract As Microsoft Tensions Rise

- Eli Lilly In Talks To Acquire Verve Therapeutics For Up To $1.3B

- AMD Surges 9% On Analyst Optimism For AI Chip Recovery

- SoftBank Plans $4.9B T-Mobile Share Sale To Raise Capital

- SK Hynix Rallies On AI Data Centre Plans By Parent Group

- Oil Rises, Gold Gains On Trump’s Tehran Warning

- KKR Buys Zenith Energy In Bet On Off-Grid Power Growth

- US Approves $2B Military Hardware Sale To Australia

FX Options Expiris For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1495-1.1500 (494M), 1.1520-30 (426M), 1.1545-50 (320M)

- 1.1600 (670M), 1.1625 (1.7BLN)

- USD/CHF: 0.8100 (200M), 0.8135 (378M)

- GBP/USD: 1.3400-15 (780M)

- USD/CAD: 1.3600 (760M), 1.3620 (350M)

- USD/JPY: 143.50-55 (400M), 146.00 (508M), 146.25 (475M)

CFTC Positions as of the Week Ending June 13th

- Speculators have reduced their net short position in CBOT US Treasury bonds futures by 22,628 contracts, bringing it down to 79,745.

- They have also decreased their net short position in CBOT US Ultrabond Treasury futures by 24,696 contracts, now totaling 203,747.

- Speculators have increased their net short position in CBOT US 10-year Treasury futures by 18,845 contracts, reaching 724,101.

- Similarly, the net short position in CBOT US 5-year Treasury futures has risen by 74,384 contracts to 2,470,920.

- The net short position in CBOT US 2-year Treasury futures has gone up by 36,591 contracts, now at 1,180,516.

- Equity fund managers have raised their net long position in S&P 500 CME by 10,532 contracts, reaching 825,013.

- Equity fund speculators have increased their net short position in S&P 500 CME by 31,419 contracts, now at 316,744.

- The net long position for the Japanese yen stands at 144,595 contracts.

- The euro's net long position is 93,025 contracts.

- For the British pound, the net long position is 51,634 contracts.

- The Swiss franc shows a net short position of -21,268 contracts.

- Bitcoin has a net short position of -2,009 contract

Technical & Trade Views

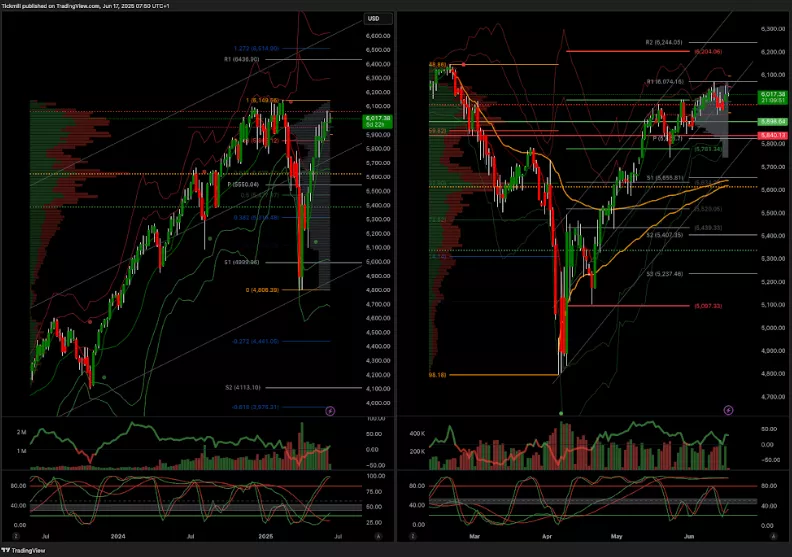

SP500 Pivot 5900

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 5900 target 6100

- Below 5800 target 5650

(Click on image to enlarge)

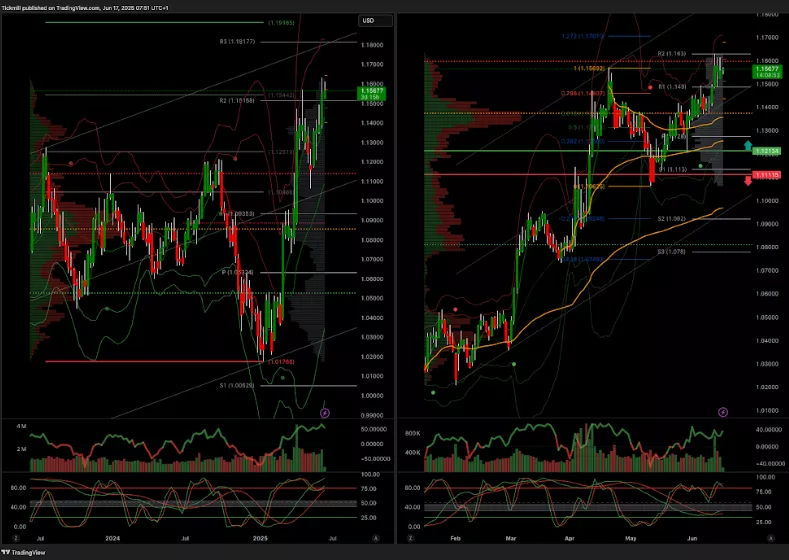

EURUSD Pivot 1.12

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 1.11 target 1.19

- Below 1.11 target 1.0950

(Click on image to enlarge)

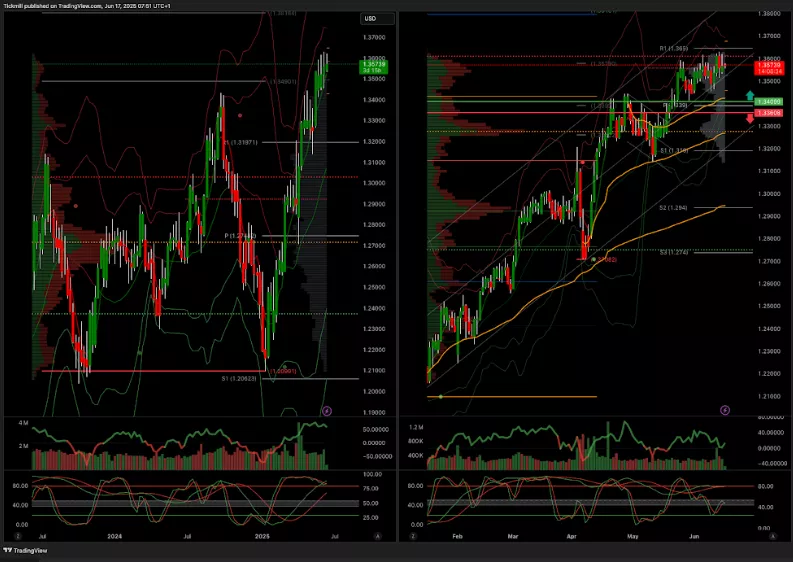

GBPUSD Pivot 1.34

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 1.34 target 1.38

- Below 1.3350 target 1.32

(Click on image to enlarge)

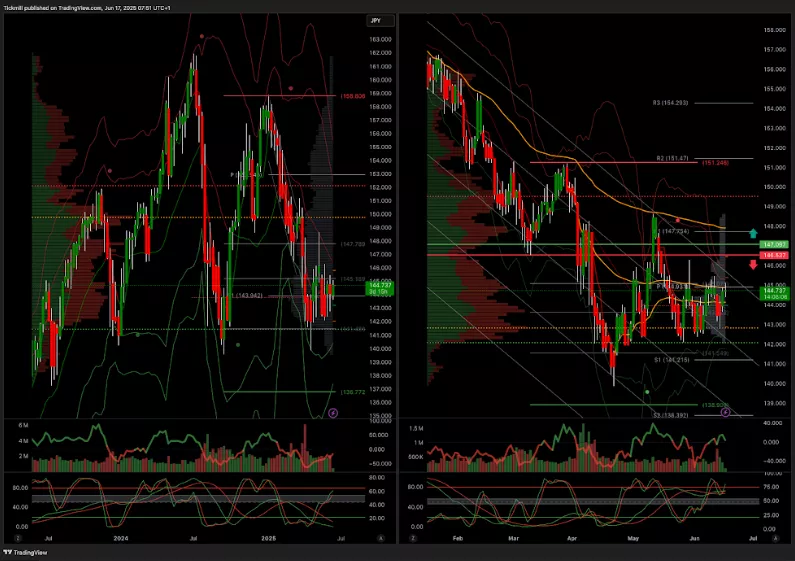

USDJPY Pivot 147

- Daily VWAP bullish

- Weekly VWAP bearish

- Above 147.10 target 148.26

- Below 146.53 target 139

(Click on image to enlarge)

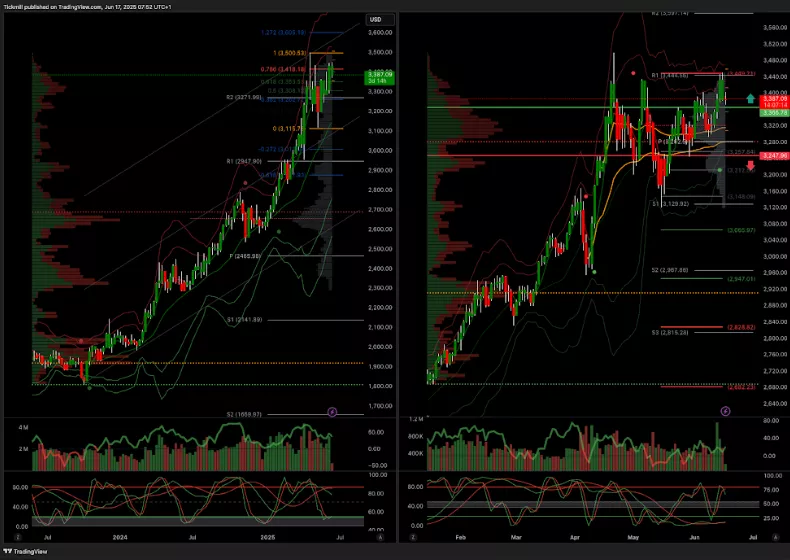

XAUUSD Pivot 3365

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 3410 target 3600

- Below 3240 target 3000

(Click on image to enlarge)

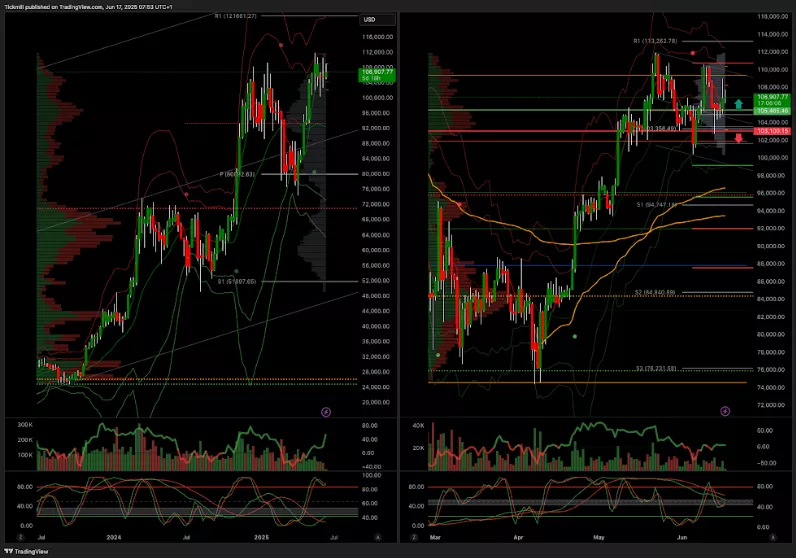

BTCUSD Pivot 105k

- Daily VWAP bullish

- Weekly VWAP bearish

- Above 105k target 118k

- Below 103k target 100k

(Click on image to enlarge)

More By This Author:

The FTSE Finish Line - Monday, June 16

S&P 500 Weekly Action Areas & Price Targets - Monday, June 16

Daily Market Outlook - Monday, June 16