Daily Market Outlook - Thursday, June 19

Image Source: Unsplash

Equities declined as the US considered the possibility of direct conflict with Iran, while Federal Reserve Chair Jerome Powell cautioned about significant inflationary pressures ahead. MSCI’s Asia (Ex Japan) regional index of shares dropped around 1%, with Hong Kong stocks sliding over 2%. US equity futures dipped slightly after the S&P 500 Index ended the previous session nearly unchanged. Meanwhile, the dollar strengthened against most major currencies. Cash trading in Treasuries was paused on Thursday due to a US holiday. Market sentiment grew more cautious following a Bloomberg report indicating that senior US officials are preparing for a potential strike on Iran in the coming days. This added to existing concerns after the Federal Reserve downgraded its growth forecast for this year and projected higher inflation, highlighting how tariff-related uncertainties are complicating the central bank’s efforts to adjust monetary policy. In Japan, bond yields decreased across most maturities after a strong auction outcome and reports suggesting the government plans to reduce super-long bond sales by approximately 10% from initial projections. Oil prices dipped following a turbulent trading week as attention remained on whether President Donald Trump might escalate US involvement in the Israel-Iran conflict.

The Fed's June meeting left the Fed Funds target rate unchanged at 4.25-4.50%. The statement now describes economic uncertainty as "diminished but remains elevated". The new Summary of Economic Projections reflects a GDP forecast for 2025 at 1.4% (down from 1.7%) and PCE inflation at 3.0% (up from 2.7%). The 'dot plot' indicates fewer rate cuts by 2026 and 2027, with rates expected to stay above the 3.0% long-term average. For 2025, the median projection still suggests two 25bp rate cuts, but now eight participants expect no cuts, up from four in March. Powell reiterated the Fed's cautious stance on rate changes, and while the market anticipates a cut by October, the June meeting offered little new information to support this view.

UK labour market news opens the door for MPC to signal August rate cut. Today's focus from the MPC will centre on the vote split and any subtle hints in the language of the minutes. The Bank Rate is expected to remain steady at 4.25% for now. Yesterday’s inflation data, showing 3.4% year-on-year, aligned with the May Monetary Policy Report (MPR), as did the easing of services CPI to 4.7% year-on-year, meaning it likely wasn’t a surprise for the MPC. The key question is how much last week’s weaker labour market report will shape the committee's outlook. Given the recent surge in energy prices driven by conflict in the Middle East, it’s unlikely the minutes will strongly signal an August rate cut. Instead, the familiar “gradual and careful” approach is expected to feature prominently once again. However, the clear deterioration in employment figures should receive some emphasis, lending a dovish tone to the overall message. Such an outcome could lead to dissenters against a May rate cut softening their stance regarding an August adjustment, rather than an increase in moderates voting for an immediate cut this time. The central expectation appears to be a 7-2 vote at the June meeting, with Dhingra and Taylor backing a cut. However, there’s a potential risk of a 6-3 split if someone like Ramsden, for instance, interprets the labour market trends as warranting more decisive action.

Overnight Headlines

- SNB Set To Lower Main Rate To Zero; Negative Territory Ahead

- UK MPC Set To Pause Policy, But Dovish Dissent Grows Louder

- PM Starmer Puts UK Cabinet On Alert For Potential US Attack On Iran

- Fed Keeps Rates Steady But Pencils In Two Cuts For 2025

- Trump Privately Approved Attack Plans For Iran; Withheld Final Order

- US Officials Prepare For Possible Strike On Iran In Coming Days

- Oil Tanker Market Signals More Middle East Energy Disruption Ahead

- Nigeria To Export First Gasoline Cargo To Asia From Dangote Refinery

- Microsoft Prepared To Walk Away From High-Stakes OpenAI Talks

- Morgan Stanley To Shutter Electronic Equity Market-Making Unit

- NatWest Rules Out Bidding For TSB

- UBS And Pictet Report Data Leak After Cyber Attack On Provider

- Australia Unexpectedly Sheds Jobs, Driven By Part-Time Roles

- New Zealand’s Economic Recovery Gathers Pace As Exports Jump

- Brazil Lifts Interest Rate To 15% As Robust Economy Fuels Inflation

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1415-25 (4BLN), 1.1430-35 (1BLN), 1.1450 (891M)

- 1.1475-80 (1.6BLN), 1.1490-1.1500 (2.1BLN), 1.1545-50 (1.7BLN)

- USD/CHF: 0.8100 (300M), 0.8120 (300M), 0.8150 (300M), 0.8265 (650M)

- EUR/NOK: 11.40 (396M)

- EUR/GBP: 0.8475 (303M), 0.8550 (304M), 0.8600 (701M)

- GBP/USD: 1.3290 (526M), 1.3430 (282M), 1.3500 (630M)

- AUD/USD: 0.6425 (571M), 0.6450-60 (1.2BLN), 0.6475 (525M), 0.6525 (427M)

- USD/JPY: 144.00 (324M), 145.00 (624M), 146.00 (550M)

CFTC Positions as of the Week Ending June 13th

- Speculators have reduced their net short position in CBOT US Treasury bonds futures by 22,628 contracts, bringing it down to 79,745.

- They have also decreased their net short position in CBOT US Ultrabond Treasury futures by 24,696 contracts, now totaling 203,747.

- Speculators have increased their net short position in CBOT US 10-year Treasury futures by 18,845 contracts, reaching 724,101.

- Similarly, the net short position in CBOT US 5-year Treasury futures has risen by 74,384 contracts to 2,470,920.

- The net short position in CBOT US 2-year Treasury futures has gone up by 36,591 contracts, now at 1,180,516.

- Equity fund managers have raised their net long position in S&P 500 CME by 10,532 contracts, reaching 825,013.

- Equity fund speculators have increased their net short position in S&P 500 CME by 31,419 contracts, now at 316,744.

- The net long position for the Japanese yen stands at 144,595 contracts.

- The euro's net long position is 93,025 contracts.

- For the British pound, the net long position is 51,634 contracts.

- The Swiss franc shows a net short position of -21,268 contracts.

- Bitcoin has a net short position of -2,009 contract

Technical & Trade Views

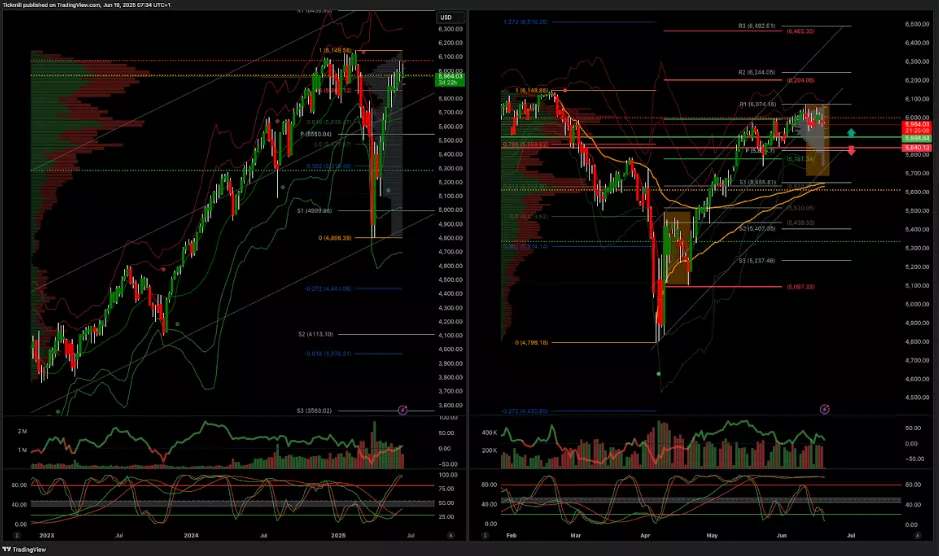

SP500 Pivot 5900

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 5900 target 6100

- Below 5800 target 5700

(Click on image to enlarge)

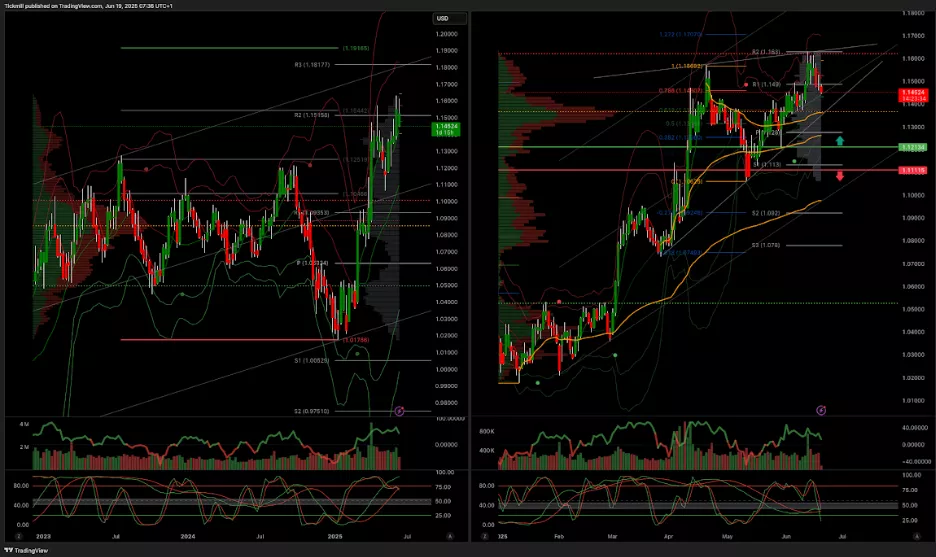

EURUSD Pivot 1.12

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 1.11 target 1.19

- Below 1.11 target 1.0950

(Click on image to enlarge)

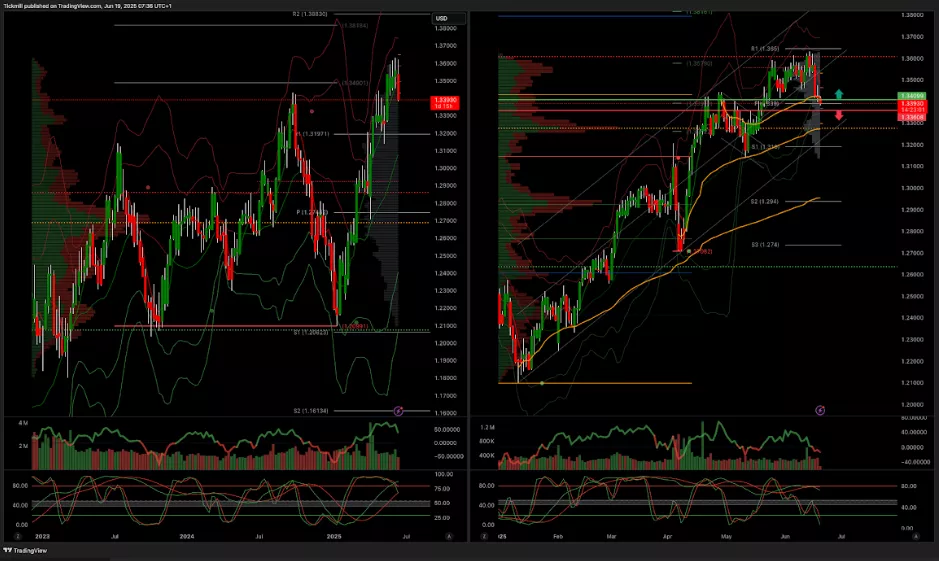

GBPUSD Pivot 1.34

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 1.34 target 1.38

- Below 1.3350 target 1.32

(Click on image to enlarge)

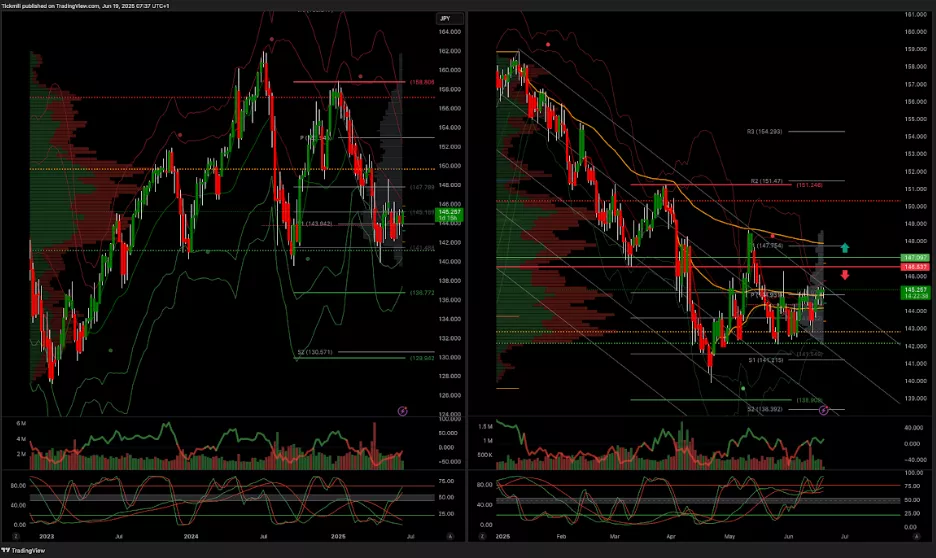

USDJPY Pivot 147

- Daily VWAP bullish

- Weekly VWAP bearish

- Above 147.10 target 148.26

- Below 146.53 target 139

(Click on image to enlarge)

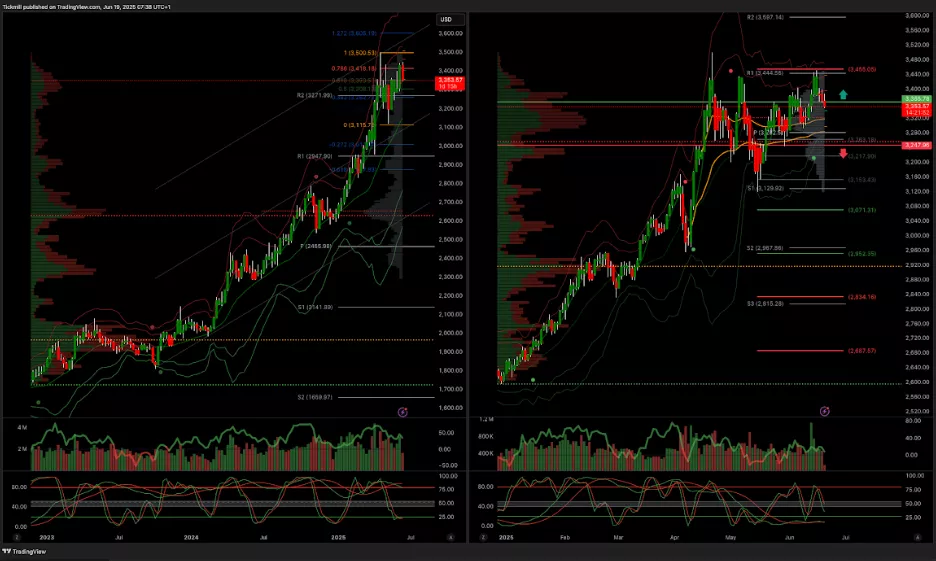

XAUUSD Pivot 3365

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 3410 target 3600

- Below 3240 target 3000

(Click on image to enlarge)

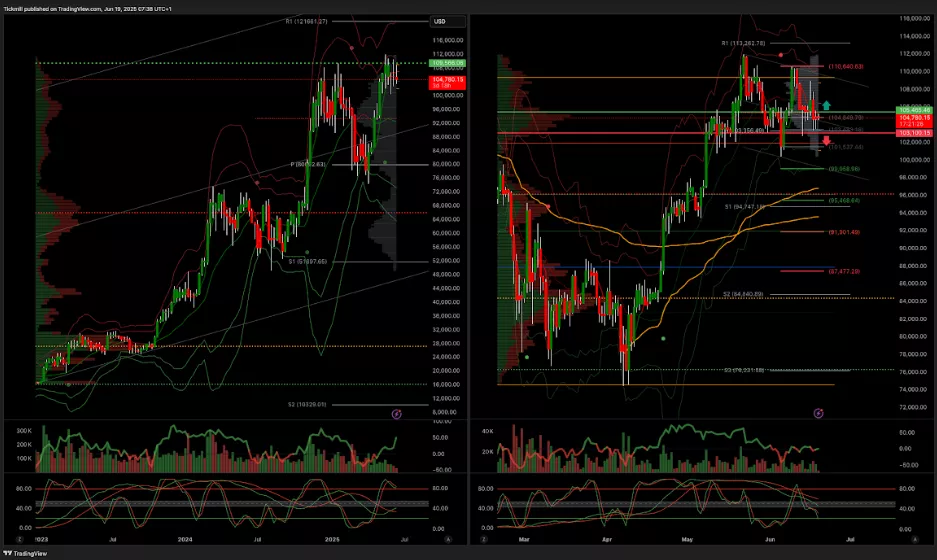

BTCUSD Pivot 105k

- Daily VWAP bearish

- Weekly VWAP bearish

- Above 105k target 118k

- Below 103k target 100k

(Click on image to enlarge)

More By This Author:

The FTSE Finish Line - Wednesday, June 18

Daily Market Outlook - Wednesday, June 18

The FTSE Finish Line - Tuesday, June 17