Stagnating Eurozone GDP Is Worse Than It Seems

GDP growth in the eurozone was revised down from 0.1% to 0% in the fourth quarter. Poor household consumption and investment data show that underlying developments are weaker than expected, adding concern about eurozone economic performance

Sentiment about the eurozone economy has been more upbeat of late as many bad economic scenarios have been avoided. However, as more data comes in it is clear that the eurozone economy is struggling, with GDP growth revised down to 0.0% in the fourth quarter.

This in itself is concerning, but when we look deeper into the GDP release a bleaker picture is revealed. As expected, growth was revised down thanks to weaker than initially released German and Irish data, but even stagnation seems to overstate the real performance of the eurozone economy in the fourth quarter.

Household consumption contracts

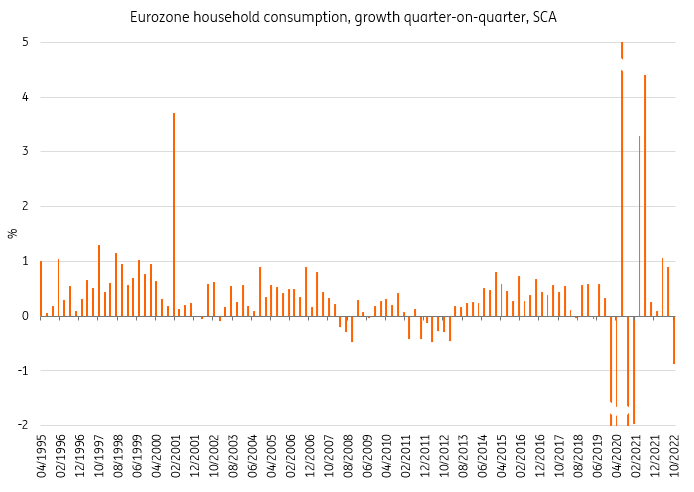

Household consumption in the fourth quarter of 2022 saw the largest decline since the start of the eurozone in 1999, with the exception of during the Covid-19 pandemic. The decline was not the same across countries; the Netherlands and Belgium, for example, saw healthy growth, but France, Germany and Italy all saw declines of around -1%, while Spain experienced a drop of -2.4%.

Household consumption saw the largest decline, with the exception of the Covid-19 pandemic

(Click on image to enlarge)

Eurostat, ING Research

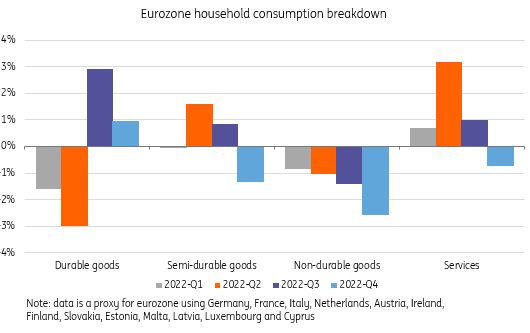

When looking at a breakdown of consumer categories to see what caused this drop, we see that a large decline in non-durable goods consumption led the way. This is likely due to a large adjustment in energy consumption, which is a positive development. The declines in services and semi-durable goods consumption are more worrying though. Durable goods consumption did continue to grow, likely mainly due to older orders being fulfilled now that supply chain problems and input shortages have faded.

Most consumption categories showed declines in 4Q

(Click on image to enlarge)

Eurostat, ING Research calculations

Weak investment reflects economic concerns and higher rates

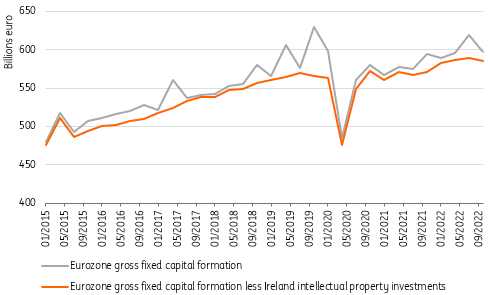

Investment dropped sharply as well in the fourth quarter, by 3.5% quarter-on-quarter. It's important to note, however, that Irish intellectual property investments, related in large part to multinational accounting activity, had a big negative impact on this figure. Stripping this out, we still note a decline of -0.7%. This is the first decline since the third quarter of 2021.

Germany, Spain and Belgium saw declines in investment, France and the Netherlands were roughly stable, and Italy and Greece saw increases – the latter in part due to EU recovery fund support. Overall, the lower investment appetite from firms is likely related to concerns about economic growth and uncertain prospects for the months ahead, while higher interest rates are also starting to bite.

Investment has also dropped, but less markedly

(Click on image to enlarge)

Eurostat, ING Research calculations

Government and weak imports pushed the GDP growth figure up to 0%

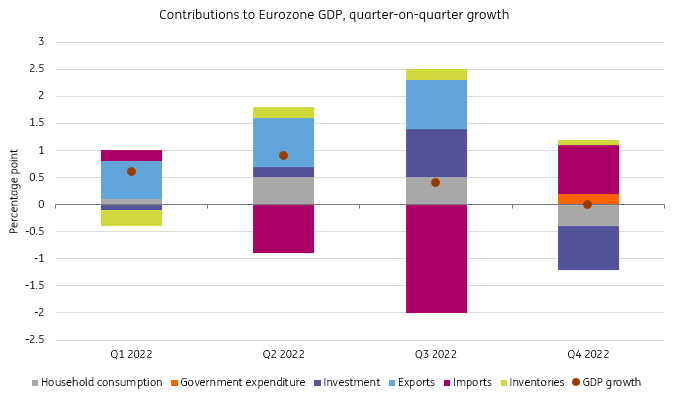

With household consumption and investment down so sharply and together contributing -1.2 percentage points to the GDP growth figure, it’s important to look at offsetting factors. Government consumption is a key one, contributing 0.2 ppt positively, while inventories still added 0.1 ppt to the GDP figure. The main contribution came from net exports though as imports declined sharply in the fourth quarter while exports growth slowed markedly to 0.1%. In total, that resulted in a 0.9 ppt positive contribution from net exports. This means that the main positive contributor to GDP in the fourth quarter was the sharp decline in imports – this is hardly a sign of strength.

Weaker imports contributed positively to GDP, masking very weak domestic demand

(Click on image to enlarge)

Eurostat, ING Research

For the ECB, the release of the underlying components of GDP actually provides a dovish signal. Stagnation in GDP at face value is not a sign that demand is cooling rapidly, but the underlying components show that economic conditions did deteriorate more markedly than initially expected. It’s hard to read where economic activity is headed in the short term, with both positive and negative news coming in about the first quarter of this year. On the back of that, we expect another quarter of stagnating GDP.

More By This Author:

Bank Of Canada Bets On Disinflationary PathRates Spark: Upping The Ante On Policy Rates

The Commodities Feed: Testimony Weighs On The Complex

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more