Precious Metals Speculator Bets Lower As Silver Bets Go Bearish For 1st Time Since 2019

Image Source: Pixabay

Here are the latest charts and statistics for the Commitment of Traders (COT) data published by the Commodities Futures Trading Commission (CFTC). The latest COT data is updated through Tuesday, July 26, and it shows a quick view of how large traders (for-profit speculators and commercial entities) were positioned in the futures markets.

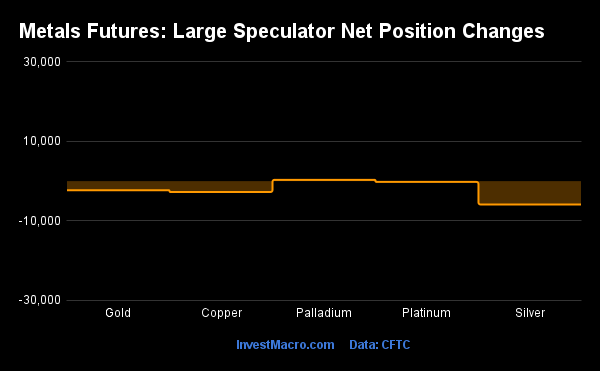

Weekly Speculator Changes: Week 30

COT precious metals speculator bets were lower again this week, as just one out of the five metals markets we cover had higher positioning this week while the other four markets had lower contracts. The only precious metals market to see higher speculator bets this week was palladium with a gain of 343 contracts.

The metals leading the declines in speculator bets this week were silver (-5,860 contracts) and copper (-2,726 contracts), with gold (-2,265 contracts) and platinum (-186 contracts) also showing lower bets on the week.

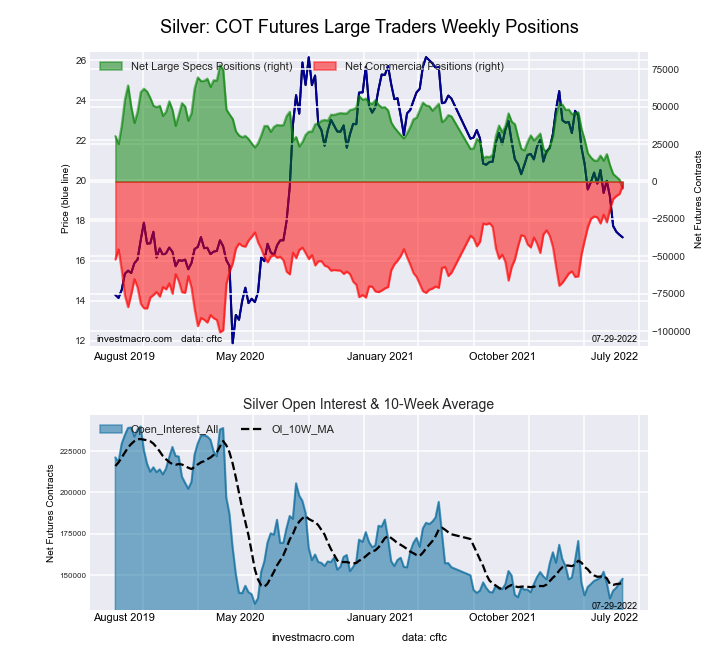

Highlighting the metals COT data this week was the continued drop in speculator bets for the silver contracts. Silver speculative bets have now fallen for seven consecutive weeks (a total decline of -21,904 contracts over that period) and for a whopping thirteen out of the past fourteen weeks (a total decline of -50,929 contracts over 14 weeks).

This speculator sentiment weakness has now brought the overall net position into bearish territory (-4,500 contracts this week) for the first time since June 4 of 2019, a span of 164 weeks. The silver position has only seen approximately 30 weeks in bearish territory over the past ten years, with a seventeen-week streak of bearish positions in 2018 dominating this data.

These negative net positions for silver are rare and usually only persist for a short time, so it will be interesting to see if this is some type of bottom for silver speculators or if this will continue. The silver futures price did get a boost this week and rose back over the $20 level ($18.54 weekly open vs $20.19 close) after hitting two-year lows recently just above the $18.00 price level.

Data Snapshot of Commodity Market Traders | Columns Legend

| WTI Crude | 1,597,451 | 2 | 259,260 | 0 | -283,489 | 100 | 24,229 | 49 |

| Corn | 1,320,768 | 2 | 186,528 | 54 | -138,899 | 52 | -47,629 | 16 |

| Natural Gas | 976,126 | 4 | -118,290 | 43 | 83,028 | 57 | 35,262 | 64 |

| Sugar | 722,469 | 4 | 64,103 | 50 | -65,756 | 56 | 1,653 | 10 |

| Soybeans | 583,850 | 0 | 85,241 | 40 | -57,573 | 66 | -27,668 | 24 |

| Gold | 487,515 | 10 | 92,690 | 0 | -108,422 | 100 | 15,732 | 0 |

| Wheat | 301,674 | 6 | 25 | 19 | 8,068 | 71 | -8,093 | 68 |

| Heating Oil | 269,127 | 23 | 18,684 | 70 | -33,531 | 36 | 14,847 | 50 |

| Coffee | 199,536 | 5 | 28,641 | 64 | -28,867 | 43 | 226 | 2 |

| Copper | 183,958 | 15 | -26,562 | 23 | 26,839 | 78 | -277 | 24 |

| Brent | 177,837 | 22 | -41,482 | 42 | 40,557 | 61 | 925 | 22 |

| Silver | 147,784 | 14 | -4,500 | 0 | -2,653 | 100 | 7,153 | 4 |

| Platinum | 73,423 | 45 | -4,468 | 2 | -171 | 98 | 4,639 | 27 |

| Palladium | 7,124 | 4 | -3,408 | 4 | 3,894 | 97 | -486 | 16 |

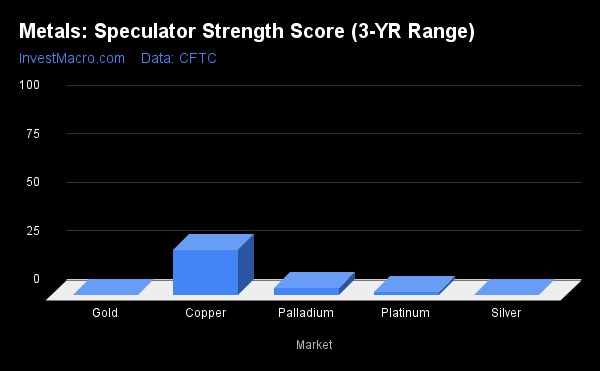

Strength Scores

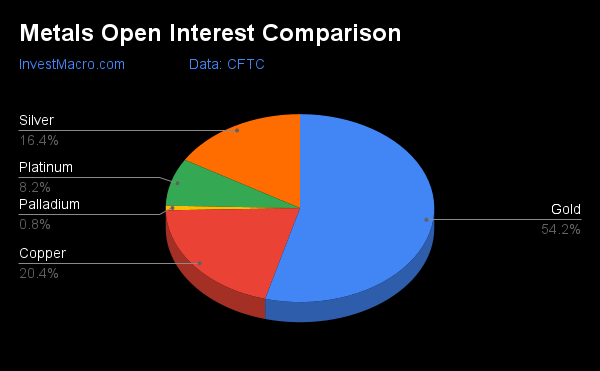

Strength scores (a measure of the three-year range of speculator positions, from 0 to 100 where above 80 is extreme bullish and below 20 is extreme bearish) continue to illustrate how out of favor the metals markets have been and continue to be for speculators.

Copper (23.2%) leads the metals market in strength scores and is just out of a bearish extreme reading (below 20%), and it fell a few points from last week. On the downside, gold (0.0%) and silver (0.0%) continue to make new three-year low levels, and are followed by platinum (2.0%) and palladium (3.7%). All four of these markets are in bearish extreme positions (below 20%) and have been for multiple weeks.

Strength Statistics

- Gold (0.0%) vs. gold the previous week (0.9%).

- Silver (0.0%) vs. silver the previous week (7.1%).

- Copper (23.2%) vs. copper the previous week (25.2%).

- Platinum (2.0%) vs. platinum the previous week (2.2%).

- Palladium (3.7%) vs. palladium the previous week (1.7%).

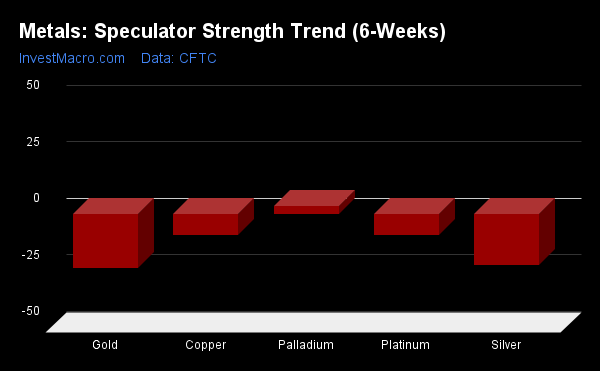

Strength Trends

The strength score trends (or move index, which calculates the six-week changes in strength scores) showed that palladium (3.7%) had the only positive six-week trends for metals this week. Gold (-23.7%) leads the downside trend scores followed by silver (-22.5%), with copper (-9.2%) and platinum (-9.1%) coming in next with lower trend scores.

Move Statistics

- Gold (-23.7%) vs. gold the previous week (-30.8%).

- Silver (-22.5%) vs. silver the previous week (-19.5%).

- Copper (-9.2%) vs. copper the previous week (-14.5%).

- Platinum (-9.1%) vs. platinum the previous week (-13.9%).

- Palladium (3.7%) vs. palladium the previous week (-1.6%).

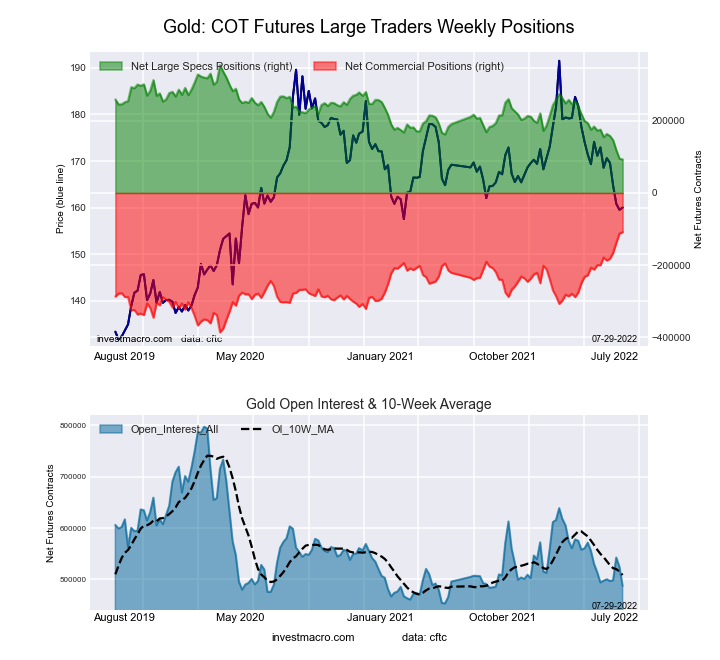

Individual Markets - Gold Comex Futures

The gold Comex futures large speculator standing this week equaled a net position of 92,690 contracts in the data reported through Tuesday. This was a weekly lowering of -2,265 contracts from the previous week, which had a total of 94,955 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish-Extreme with a score of 0.0%. The commercials are Bullish-Extreme with a score of 100.0%, and the small traders (not shown in chart) are Bearish-Extreme with a score of 0.0%.

| Gold Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| –% of Open Interest Longs: | 49.6 | 29.1 | 8.8 |

| –% of Open Interest Shorts: | 30.6 | 51.4 | 5.6 |

| – Net Position: | 92,690 | -108,422 | 15,732 |

| – Gross Longs: | 241,661 | 142,007 | 42,821 |

| – Gross Shorts: | 148,971 | 250,429 | 27,089 |

| – Long to Short Ratio: | 1.6 to 1 | 0.6 to 1 | 1.6 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 0.0 | 100.0 | 0.0 |

| – Strength Index Reading (3 Year Range): | Bearish-Extreme | Bullish-Extreme | Bearish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -23.7 | 25.3 | -25.7 |

Silver Comex Futures

The silver Comex futures large speculator standing this week equaled a net position of -4,500 contracts in the data reported through Tuesday. This was a weekly reduction of -5,860 contracts from the previous week, which had a total of 1,360 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish-Extreme with a score of 0.0%. The commercials are Bullish-Extreme with a score of 100.0%, and the small traders (not shown in chart) are Bearish-Extreme with a score of 3.6%.

| Silver Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| –% of Open Interest Longs: | 37.0 | 42.0 | 15.1 |

| –% of Open Interest Shorts: | 40.0 | 43.8 | 10.3 |

| – Net Position: | -4,500 | -2,653 | 7,153 |

| – Gross Longs: | 54,671 | 62,080 | 22,309 |

| – Gross Shorts: | 59,171 | 64,733 | 15,156 |

| – Long to Short Ratio: | 0.9 to 1 | 1.0 to 1 | 1.5 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 0.0 | 100.0 | 3.6 |

| – Strength Index Reading (3 Year Range): | Bearish-Extreme | Bullish-Extreme | Bearish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -22.5 | 19.8 | -4.3 |

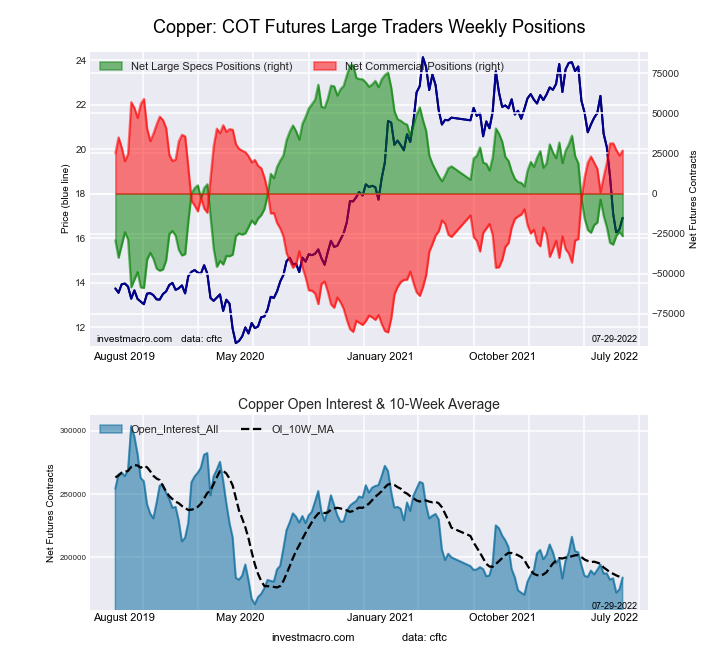

Copper Grade #1 Futures

The copper Grade #1 futures large speculator standing this week equaled a net position of -26,562 contracts in the data reported through Tuesday. This was a weekly reduction of -2,726 contracts from the previous week, which had a total of -23,836 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 23.2%. The commercials are Bullish with a score of 77.9%, and the small traders (not shown in chart) are Bearish with a score of 23.7%.

| Copper Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| –% of Open Interest Longs: | 28.5 | 47.4 | 7.7 |

| –% of Open Interest Shorts: | 42.9 | 32.8 | 7.9 |

| – Net Position: | -26,562 | 26,839 | -277 |

| – Gross Longs: | 52,377 | 87,146 | 14,193 |

| – Gross Shorts: | 78,939 | 60,307 | 14,470 |

| – Long to Short Ratio: | 0.7 to 1 | 1.4 to 1 | 1.0 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 23.2 | 77.9 | 23.7 |

| – Strength Index Reading (3 Year Range): | Bearish | Bullish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -9.2 | 11.4 | -21.9 |

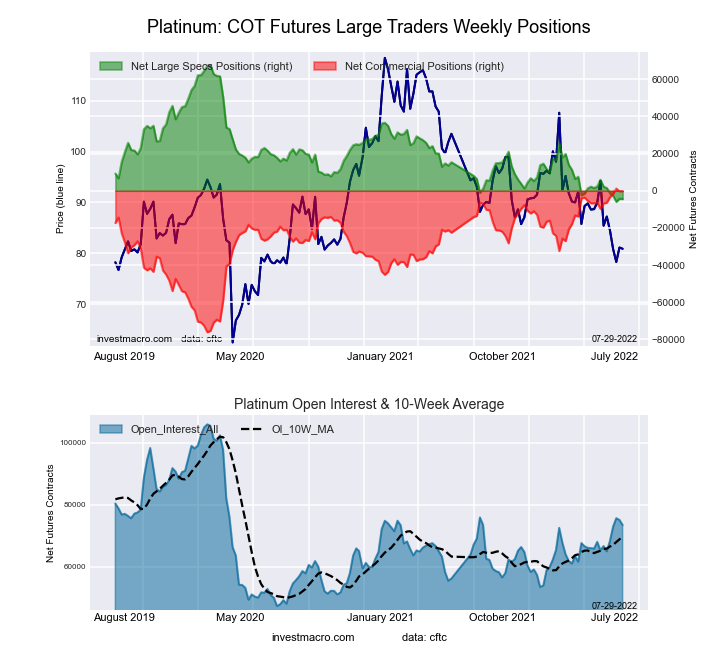

Platinum Futures

The platinum futures large speculator standing this week equaled a net position of -4,468 contracts in the data reported through Tuesday. This was a weekly lowering of -186 contracts from the previous week, which had a total of -4,282 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish-Extreme with a score of 2.0%. The commercials are Bullish-Extreme with a score of 98.2%, and the small traders (not shown in chart) are Bearish with a score of 26.7%.

| Platinum Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| –% of Open Interest Longs: | 42.3 | 38.4 | 11.4 |

| –% of Open Interest Shorts: | 48.3 | 38.7 | 5.1 |

| – Net Position: | -4,468 | -171 | 4,639 |

| – Gross Longs: | 31,027 | 28,217 | 8,349 |

| – Gross Shorts: | 35,495 | 28,388 | 3,710 |

| – Long to Short Ratio: | 0.9 to 1 | 1.0 to 1 | 2.3 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 2.0 | 98.2 | 26.7 |

| – Strength Index Reading (3 Year Range): | Bearish-Extreme | Bullish-Extreme | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -9.1 | 8.6 | 0.8 |

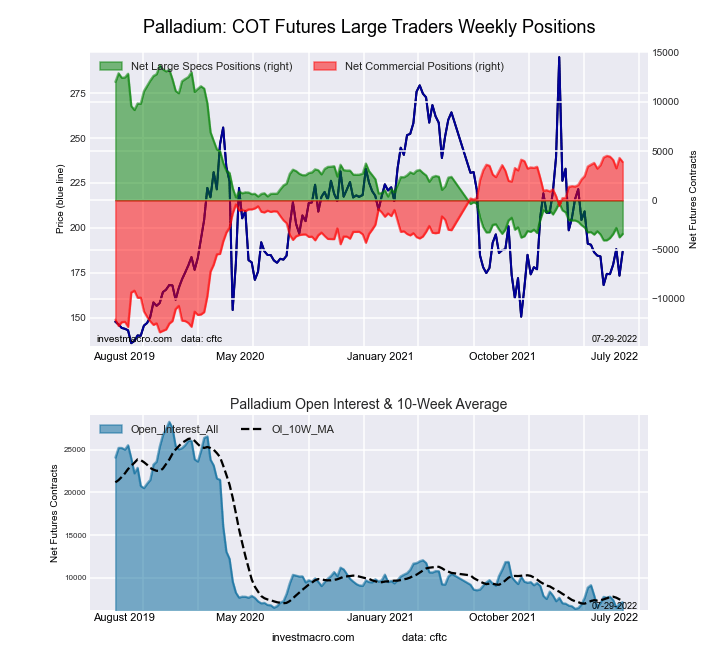

Palladium Futures

The palladium futures large speculator standing this week equaled a net position of -3,408 contracts in the data reported through Tuesday. This was a weekly increase of 343 contracts from the previous week, which had a total of -3,751 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish-Extreme with a score of 3.7%. The commercials are Bullish-Extreme with a score of 96.6%, and the small traders (not shown in chart) are Bearish-Extreme with a score of 15.7%.

| Palladium Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| –% of Open Interest Longs: | 10.2 | 70.4 | 12.6 |

| –% of Open Interest Shorts: | 58.0 | 15.7 | 19.4 |

| – Net Position: | -3,408 | 3,894 | -486 |

| – Gross Longs: | 724 | 5,012 | 898 |

| – Gross Shorts: | 4,132 | 1,118 | 1,384 |

| – Long to Short Ratio: | 0.2 to 1 | 4.5 to 1 | 0.6 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 3.7 | 96.6 | 15.7 |

| – Strength Index Reading (3 Year Range): | Bearish-Extreme | Bullish-Extreme | Bearish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 3.7 | -2.6 | -10.9 |

Article By InvestMacro – Receive our weekly COT Reports by Email

COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is three days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits), and nonreportable traders (usually small traders/speculators) as well as their open interest (contracts open in the market at time of reporting). See CFTC criteria here.

More By This Author:

Energy Speculator Bets Go Higher Led By Natural Gas & Gasoline

Soft Commodities Speculator Bets Slightly Higher Led By Sugar, Lean Hogs & Cocoa

Stock Market Speculator Bets Mostly Higher Led By Russell 2000 & Nasdaq

Disclosure: Foreign Currency trading and trading on margin carries a high level of risk and can result in loss of part or all of your investment.Due to the level of risk and market volatility, ...

more