Poland’s Bank Governor Optimistic On Inflation Outlook, No End To Tightening Cycle

Image Source: Pexels

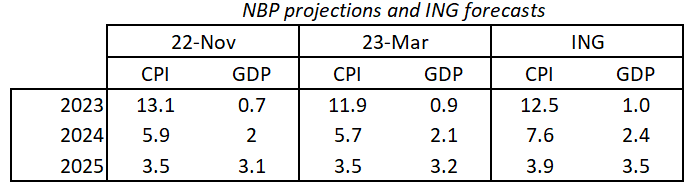

Like the National Bank of Poland, we expect a big drop in CPI inflation by the end of 2023 (see table), but we see a lot of risks hindering inflation from reaching the target in subsequent years. In such an environment, we see no room for interest rate cuts this year.

Inflation processes

NBP president Adam Glapiński announced the end of the inflation plateau and a rapid descent of inflation towards the target. After the expected CPI peak in February (around 18.5% year-on-year), the central bank expects a sharp decline in the following months by around 10 percentage points by the end of this year. According to Professor Glapiński, inflation should fall to single-digit levels in late August / early September. According to the NBP's latest projection, inflation is expected to slightly exceed 7% YoY by the end of 2023.

In addition, the NBP president sees no danger of higher core inflation persisting. According to the NBP, it will follow a downward CPI inflation trend with some delay.

Monetary policy outlook

Despite Glapiński's sizable optimism about the inflation outlook, the Monetary Policy Council has not decided to formally end the interest rate hike cycle, as there are still risks to CPI, and the Council is not unequivocally convinced that a sharp disinflation will materialize. President Glapiński announced that the MPC will not tolerate disruption of the disinflation process and does not rule out interest rate hikes should the need arise. At the same time, it should be noted that, given the length of the pause (rates have remained unchanged for six months), it might be appropriate to treat any upward movement as part of a new cycle.

President Glapiński stated that the Council was not discussing the beginning of interest rate cuts. This may be related to the recent tightening of rhetoric from major central banks, which are concerned about the perpetuation of elevated inflation. The NBP president stressed that the MPC will start easing monetary policy when it is convinced that inflation will fall rapidly toward the target. At the moment, it is not clear whether this will be in 2023 or 2024.

President Glapiński did not hide his contentment with the expected fall in inflation to 7% by the end of the year. It is noteworthy that the European Central Bank and the Fed regarding 5-7% inflation as a big problem, while the NBP chair sees this as a success and estimates that inflation of 5% will not be noticed by the public.

Summary

The course of the press conference did not bring any surprises. The NBP president presented great optimism about the short-term inflation outlook, but he was quite cautious with regard to future policy decisions: he refrained from declaring the end of the tightening cycle and admitted the possibility of cuts at the end of 2023, but at the same time said that the MPC is not discussing this topic for now.

Like the NBP, we expect a big drop in CPI inflation by the end of 2023 (see table), but we see a lot of risks hindering inflation from reaching the target in subsequent years. (1) We believe that inflation also has internal sources. (2) We assess that the reversal of external supply shocks is now underway, which should cause goods inflation to fall. However, we have concerns about service price inflation, which is linked to the pace of wages and the condition of the labor market. The current economic slowdown in Poland and the major economies are taking an unusual course, i.e., the labor market is still very strong, as a result, negotiated hikes of wage in euroland are high and in Poland, their dynamics are hindering a rapid decline in inflation. This is one reason why the Fed and ECB are much more cautious in declaring success in the fight against inflation. (3) Unlike the NBP, we are concerned about the persistence of high core inflation.

In such an environment, we see no room for interest rate cuts this year. However, all indications are that the next move by the MPC will be a rate cut, but the start of the monetary easing cycle will not begin earlier than in the second half of 2024 in our view due to persistently high inflation risks.

We also note that the ECB and the Fed view 5-7% inflation as a big problem, while the NBP governor has assessed the drop in inflation to that level as a big success and the public will not notice such inflation.

In our view, the new CPI projections indicate the persistence and longevity of the inflation shock, while the NBP is very satisfied with this profile.

Image Source: GUS, ING

More By This Author:

The Commodities Feed: First US Crude Draw This Year

Indonesia: Looking To Consumption To Carry The Load

Stagnating Eurozone GDP Is Worse Than It Seems

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more