Inflation In Hungary Moves Up Yet Again

The January re-pricing was much stronger than expected, translating into a significant acceleration both in headline and core inflation, leading us to revise our outlook.

Headline inflation close to 8%

The community of analysts were hoping for some consolidation in the Hungarian headline inflation reading in January. However, this has become wishful thinking lately as incoming inflation data from other countries were all surprising on the upside. And indeed, Hungary has just joined that group. Headline inflation surprised widely on the upside with a 7.9% year-on-year reading in January. The monthly figure came in at 1.4%, much higher than the usual reading, or what we have seen over the past couple of years (0.9-0.9%). To make things worse, this is quite a broad-based price pressure as 76% of the consumer basket shows an above 3% year-on-year price increase.

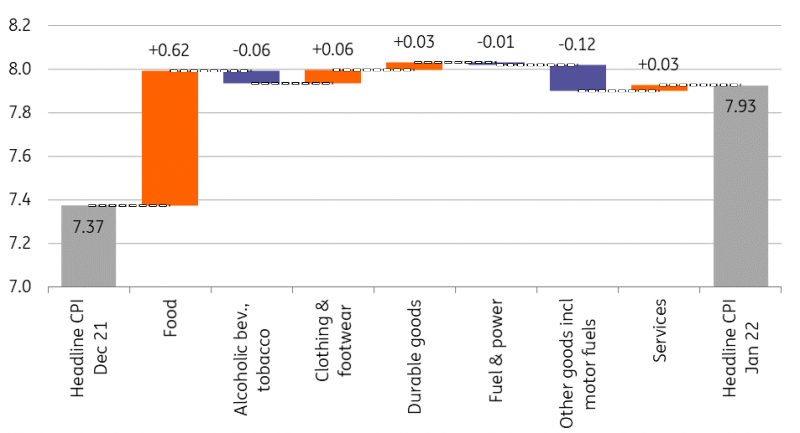

Main drivers of the change in headline CPI (%)

Image Source: HCSO, ING

The details

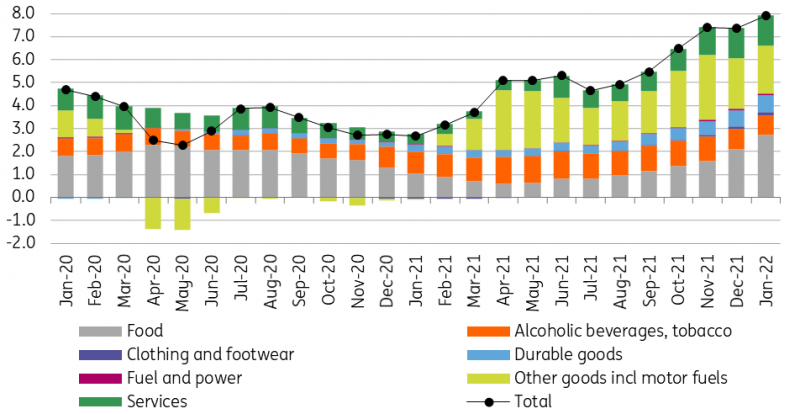

- The acceleration in headline inflation was caused by food prices. Inflation in this category reached 10.1% year-on-year. Out of which – based on the National Bank of Hungary (NBH) calculation – 30% is related to unprocessed food with the remainder coming from processed food. This shows a strengthening spill-over effect from supply shocks and that the more than 27% yearly increase in agricultural producer prices is translating into a strong consumer price pressure. The price cap introduced by the government only came into force in February, thus it hasn’t yet affected the inflation in this product group.

- Inflation in services also accelerated by 0.2ppt to 5.2% YoY in January. It is hard to pinpoint one or two sectors here, as the majority of services were showing a significant pick up in price increases. Transportation, holiday packages, medical services were showing the most significant changes. The 0.7% monthly price increase in services is higher than the historical average, showing a strong re-pricing on all sorts of cost side pressures (e.g. transportation, energy, and labour costs).

- We also need to talk about durables, where inflation moved up to 7.9% YoY after another 1% monthly price increase. But this should hardly come as a surprise with inflation rising steadily across the board as manufactured goods producers face increasing cost pressures in a shortage economy. Moreover, the January strengthening of the Hungarian forint (HUF) couldn’t limit these pressures.

- What was, however, a major limiting factor in inflation is the fuel price cap. This has become effective again as oil prices moved up close to US$90/barrel during January. According to our calculation, instead of the 1.1% monthly increase (limited by the price cap), the price change could have topped 5%, moving the headline inflation reading well above 8%.

The impact of price caps

The fuel price cap which limits the retail prices of the non-premium petrol and diesel fuel at HUF480 is going to expire on 15 February. According to our estimation, without the price cap, the petrol price would be around HUF510 and diesel around HUF530/litre. On average this could mean an additional 0.5-0.6ppt inflation pressure, although it would spread over two months due to statistical recording reasons. In this respect, we see the government extending the fuel price cap for another three months.

Regarding the price caps which affect the price of some basic foods from 1 February, this will impact only the February inflation reading. As prices reverted to levels seen in October according to the regulation, we calculate a roughly 0.5ppt downward impact going forward. So, the monthly headline inflation will be dragged down by this amount, all other things being equal.

The composition of headline inflation (ppt)

Image Source: HCSO, ING

Underlying price pressure breaks multi-decade record

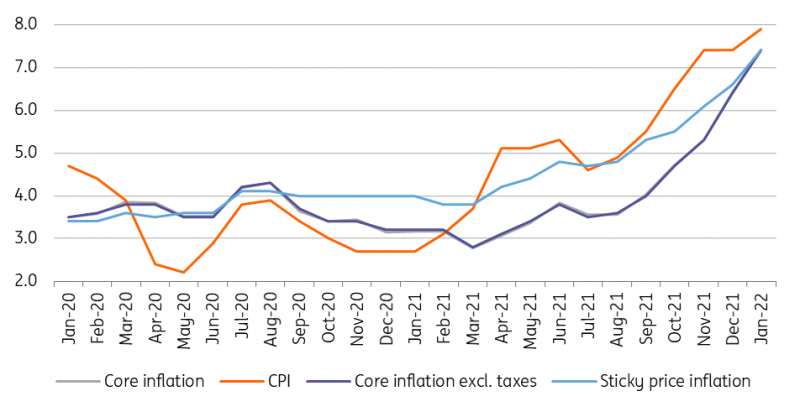

All in all, there is widespread inflation pressure in both core and non-core parts of the consumer basket showing a significant spillover effect from supply-related price shocks and the second-round effects of wage growth. Core inflation rose by 1.4% month-on-month translating into a 7.4% year-on-year figure in January, a level not seen since the end of 2001. The so-called sticky price inflation (which shows the prices of components of the consumer price index which are slow to change, and therefore are good predictors of medium-term developments in headline inflation) spiked to 7.4% YoY as well, posting a new record.

Headline and core inflation measures (% YoY)

Image Source: HCSO, NBH, ING

Inflation outlook moves up, warranting the need for tightening

Taking into account a possible lengthening of the fuel price cap and the incoming impact of food price caps, we see February inflation showing a decrease although it will remain above 7% YoY in our view. Considering the upside surprise in all the various inflation readings and seeing the rising price expectations of both households and corporates, we revise our previous 5.7-5.8% inflation forecast to 6.0-6.1% in 2022. Risks stemming from economic developments remain on the upside.

In light of today's data, we expect the National Bank of Hungary's tightening cycle to continue in the coming months. We see the effective interest rate rising to at least 5.50% in the first half of this year. As the January inflation figures are well above the base case forecasts of the central bank, we also do not rule out the possibility that a higher terminal rate is needed to reach the 3% inflation target in 2023.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more