Elliott Wave Analysis: Bovespa Index

Image Source: Pexels

Bovespa Index Elliott Wave Analysis | Trading Lounge Day Chart

Bovespa Index Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Orange wave 3

POSITION: Navy blue wave 1

DIRECTION NEXT LOWER DEGREES: Orange wave 4

DETAILS: Orange wave 2 appears complete; orange wave 3 is now unfolding.

Wave Cancel Invalidation Level: 122486

The Bovespa Index daily chart indicates a bullish trend. The price action is moving in impulsive mode, suggesting strong upward momentum. The current structure reflects orange wave 3, which fits into the broader navy blue wave 1 sequence. This implies that the index is in an early advancing stage within a longer bullish cycle.

Orange wave 2 has likely completed its correction phase, leading into orange wave 3. Historically, wave 3 in Elliott Wave theory is often the strongest and can produce large price advances. The next expected move will be a pullback in orange wave 4 once wave 3 completes.

A key technical level to monitor is 122486. If prices fall below this, the wave structure would be invalid, requiring a reevaluation of the bullish scenario. Until then, the current pattern supports ongoing upward movement.

The technical analysis suggests the Bovespa Index is well-positioned for sustained upward movement, driven by the impulsive characteristics of orange wave 3.

(Click on image to enlarge)

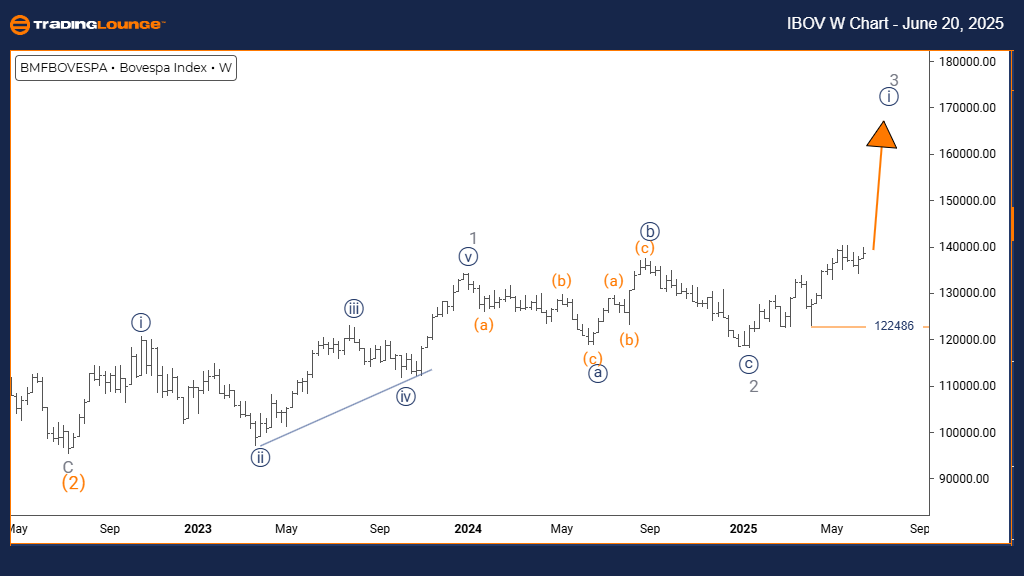

Bovespa Index Elliott Wave Analysis | Trading Lounge Weekly Chart

Bovespa Index Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Navy blue wave 1

POSITION: Gray wave 3

DIRECTION NEXT LOWER DEGREES: Navy blue wave 2

DETAILS: Gray wave 2 appears complete; navy blue wave 1 is now active.

Wave Cancel Invalidation Level: 122486

The Bovespa Index weekly chart confirms a strong bullish trend. The index remains in impulsive mode with upward price momentum. The current wave structure is navy blue wave 1, part of the larger gray wave 3 formation. This signals an early-stage movement in a more extensive bullish cycle.

With gray wave 2 likely complete, the transition into navy blue wave 1 has begun. This typically marks a significant growth phase, with wave 2 expected as a corrective pullback once wave 1 finalizes.

A critical invalidation level is 122486. Dropping below this level would invalidate the wave structure and call for a new analysis. As long as this threshold holds, the bullish outlook continues.

The setup implies robust institutional interest, with navy blue wave 1 now active and potential for continued growth in the upcoming weeks as it develops within gray wave 3.

(Click on image to enlarge)

More By This Author:

Indian Stock Elliott Wave Technical Analysis: Kotak Mahindra Bank

Elliott Wave Forecast: Northern Star Resources Ltd

Elliott Wave Technical Analysis: Vechain Crypto Price News For Friday, June 20

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more