Elliott Wave Forecast: Northern Star Resources Ltd

Image Source: Unsplash

NORTHERN STAR RESOURCES LTD – NST

Stock Analysis & Elliott Wave Technical Forecast

Greetings! Today’s Elliott Wave update focuses on the Australian Stock Exchange (ASX) ticker NST (Northern Star Resources Ltd). Our analysis suggests that ASX:NST is entering a bearish phase in the short term, with a projected drop toward around 16.86. There is no bullish bias at this time, and our wave count supports that outlook.

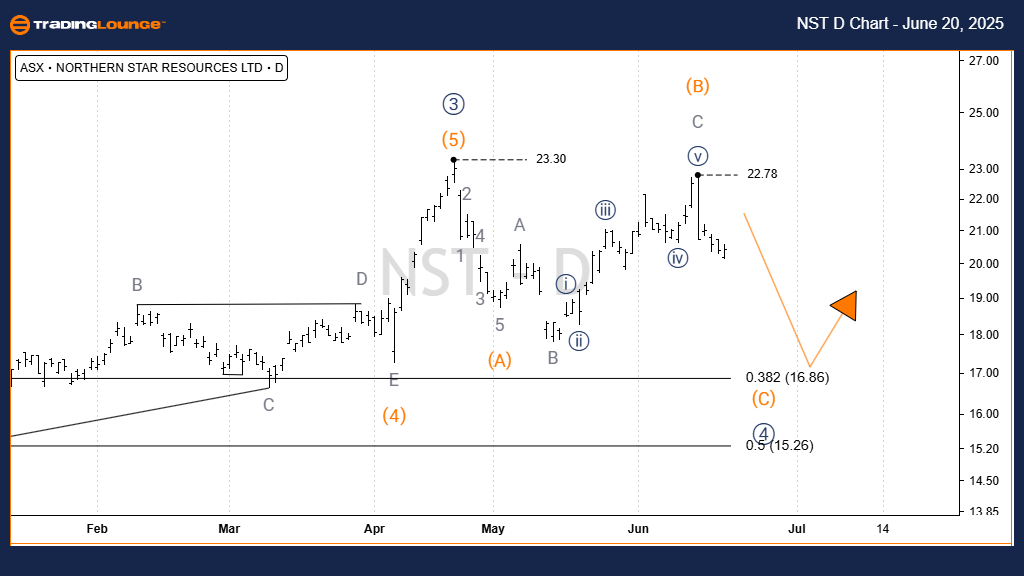

Daily (1D) Chart Analysis

- Function: Major trend (Minor degree, grey)

- Mode: Motive

- Structure: Impulse

- Position: Wave C)‑orange of Wave 4))‑navy

- Details:

-

- Wave 4))‑navy is unfolding lower as an ABC‑orange zigzag.

- Waves A)B)‑orange have completed, and Wave C)‑orange is now heading downward toward a target of 16.86.

- Invalidation point: 23.78

- Conclusion: No signs of bullish reversal—trend remains bearish.

(Click on image to enlarge)

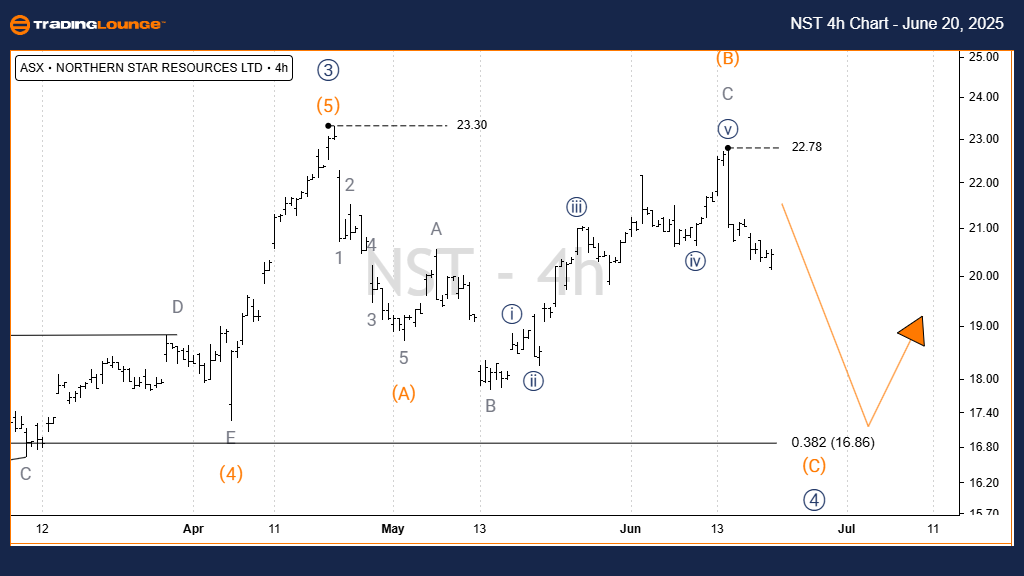

4‑Hour Chart Analysis

- Function: Major trend (Minor degree, grey)

- Mode: Motive

- Structure: Impulse

- Position: Wave C)‑orange of Wave 4))‑navy

- Details:

-

- As seen on the 1D chart, Wave C)‑orange is unfolding downward post the high at 22.78.

- Target remains near 16.86.

- Invalidation point: 22.78

(Click on image to enlarge)

Conclusion

Our structured forecast, based on Elliott Wave principles, outlines a clear short‑term bearish trajectory for ASX:NST. Key levels—16.86 as the target and 23.78 as the invalidation point—offer precise validation or invalidation markers. This enhances confidence and clarity in our outlook. The goal: providing readers with an objective, professional perspective on current market trends and actionable price signals.

Technical Analyst:

Hua (Shane) Cuong, Certified Elliott Wave Analyst – Master Level (CEWA‑M)

More By This Author:

Elliott Wave Technical Forecast: Newmont Corporation - Thursday, June 19

Elliott Wave Technical Analysis: IBEX 35 - Thursday, June 19

Elliott Wave Technical Analysis: Euro/U.S. Dollar - Thursday, June 19

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more