ECB Hikes Rates, What’s Next?

The “between a rock and a hard place” metaphors are growing stale at this stage, so here’s the truth served neat: the ECB is in a serious bind. SVB’s collapse, driven in large part by higher rates, has given the world goosebumps about global banking systems’ frailty.

Image via Elite Currensea

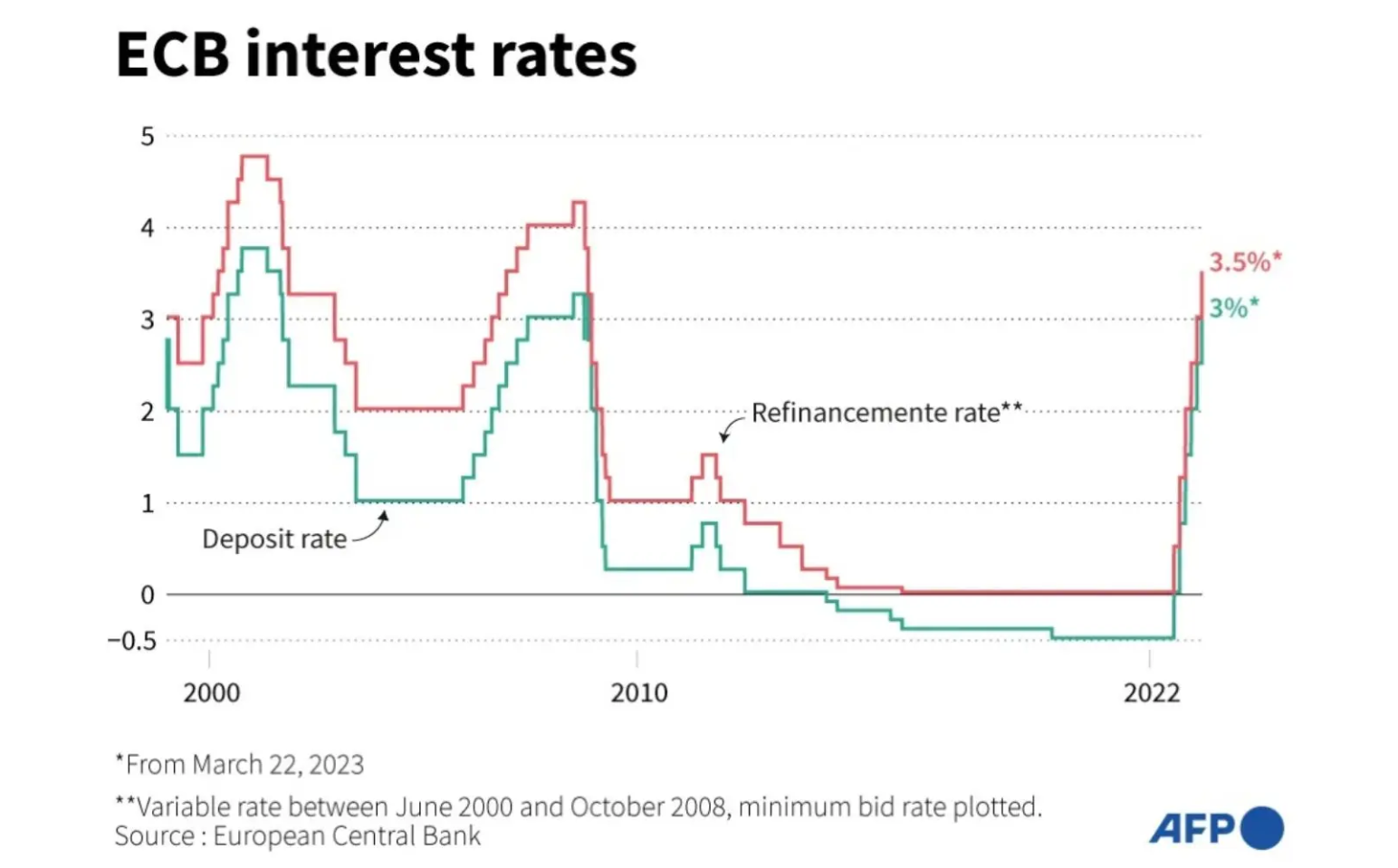

And then there’s the issue of Credit Suisse – already beset by its own laundry list of issues – which was tottering like a man eight drinks deep until Switzerland’s central bank threw it a lifeline. It was only natural, then, that some investors called on the ECB to stop serving round after round of jumbo hikes – but in vain: the central bank dished out another 0.5-percentage-point hike, taking rates to their highest levels since late 2008. There was some evidence of caution, mind you: the ECB broke with tradition and kept mum about its next steps.

For markets: A problem shared.

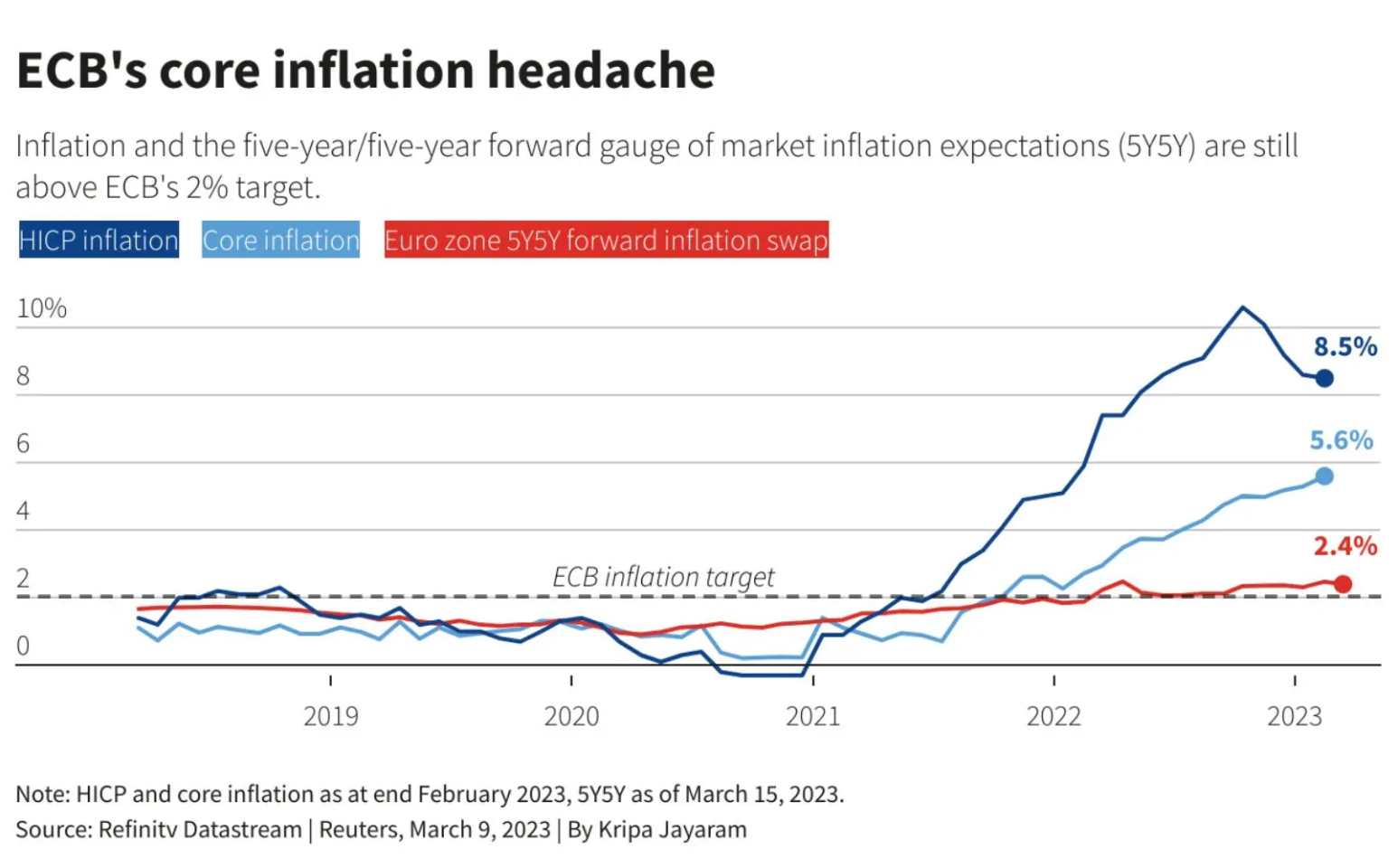

The world’s going to have to wait and see how the flailing banking system affects the ECB’s ability to tackle rising prices. After all, inflation’s still closer to double digits than it is to the central bank’s 2% target. But hey, at least misery has company: the US and UK have to answer their own “to hike or not to hike?” dilemmas next week – and there are no easy options on the table. The ECB’s backing itself, though, reassuring investors that it’ll be able to support the bloc’s financial system if it needs to.

The bigger picture: Dimming hopes.

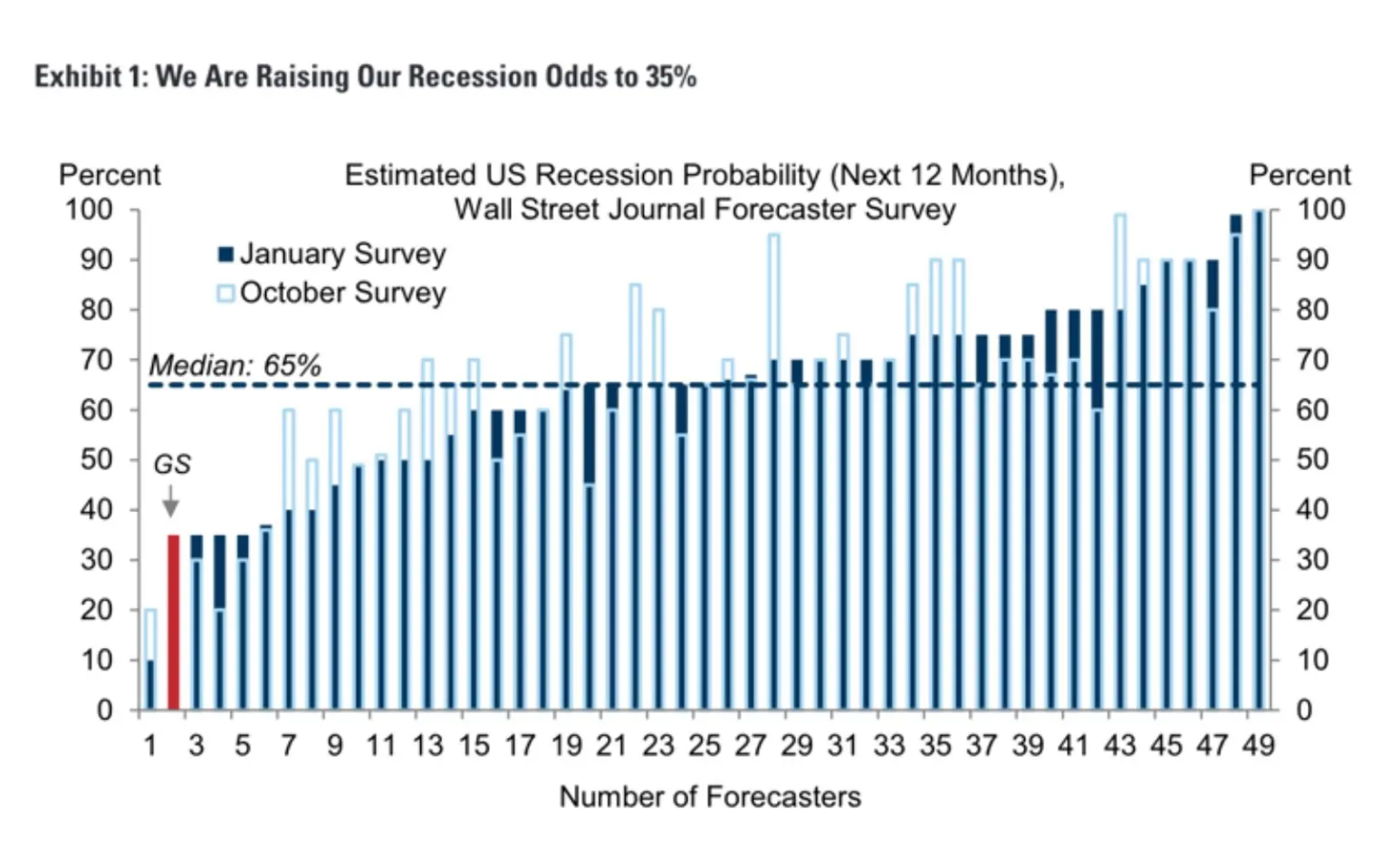

Whichever poison the Federal Reserve picks, the banking debacle has already darkened the US economic outlook. On Thursday Goldman Sachs upped the odds of a recession hitting in the next year to 35%. Still, compared to the average economist, who says it’s more like 60%, Goldman seems like an optimist.

More By This Author:

Five Reasons Stocks May Go Under In March

Nvidia Spikes On The Back Of Earnings Report, What’s Next?

Deciphering February CPI Data

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. On average around 80% of retail investor accounts loose money when trading with high ...

more