Nvidia Spikes On The Back Of Earnings Report, What’s Next?

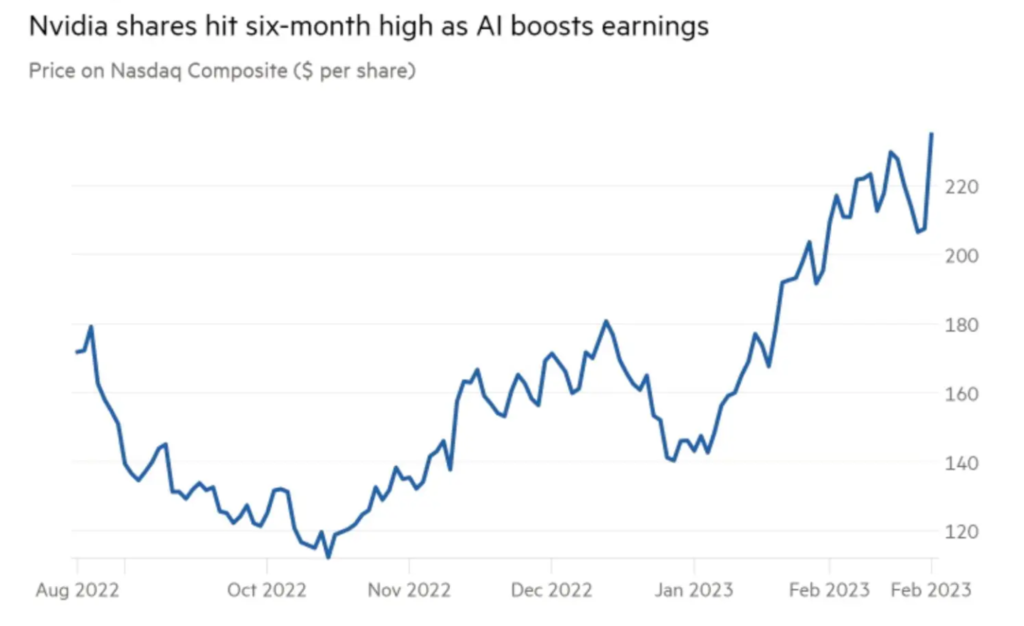

Recently, Nvidia pleasantly surprised investors with some AI-powered quarterly results and more positive profit guidance.

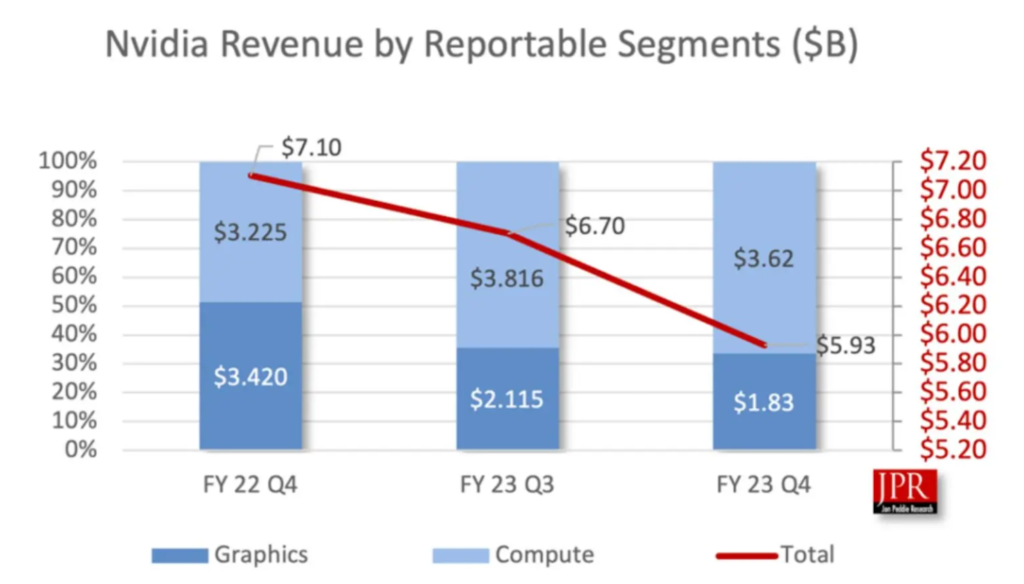

Nvidia is a chipmaker whose gaming business has slowed down recently due to the pandemic and declining PC sales.

However, Nvidia’s AI and data center segments have continued growing, helping the company’s revenue and earnings beat analysts’ expectations. Nvidia’s chips are ideal for running AI services, and tech companies are investing heavily in AI.

As a result, the company dominates the AI chip market, providing about 80% of the processors used for AI. Analysts estimate AI could add $14 billion to Nvidia’s revenue by 2027, suggesting the company is poised to benefit from increasing AI adoption.

What’s Next for Nvidia?

Nvidia is positioning itself to benefit from growth in AI, which is one of the few areas where big tech companies continue to spend money. Nvidia just launched a new cloud service allowing companies to access its AI chips without building their own infrastructure.

This could accelerate AI development and become a significant revenue source for Nvidia.

It’s stock has risen 65% this year, making it the most valuable chipmaker again. Its latest earnings further confirmed that Nvidia may be the best way for investors to gain exposure to AI growth.

Final Thoughts

Since the stock has surged on its AI potential, the company just launched a new cloud service to make its AI chips more accessible.

Nvidia seems poised to benefit as tech companies continue investing in AI and if you are looking for more exposure to the sector, even after the recent rally, we still think it’s a good entry point.

More By This Author:

Deciphering February CPI DataCan Chat GPT Perform Valid Technical, Fundamental Or Wave Analysis?

How To Analyze A Stock Using ChatGPT

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. On average around 80% of retail investor accounts loose money when trading with high ...

more