Five Reasons Stocks May Go Under In March

When investing in stocks, many factors influence the market and determine its direction. The Federal Reserve (Fed) and its monetary policy are often considered the most significant factors.

The S&P 500 saw strong gains in January, increasing over 6%, as it seemed the Fed had inflation under control and could slow down interest rate hikes.

However, recent economic data suggests the Fed may be losing control of inflation. Stocks have already given up half of their gains this year, leaving investors to wonder what will happen next. The market’s direction depends on five key factors:

Retail Investors Rush

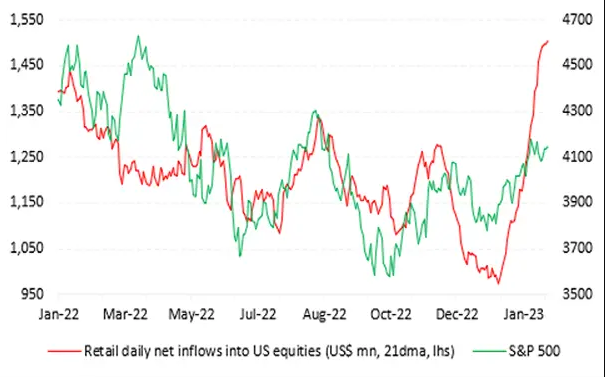

Retail investors have been buying $1.51 billion in U.S. stocks per day on average recently, setting a new record. However, these high volumes will be hard to maintain and may decline, removing a major support for stock prices.

JPMorgan research shows retail investor interest, measured by social media posts, has started falling along with flows into stocks. Retail call option volume, indicating retail investor risk appetite, has also declined from its peak.

Algorithmic Trading

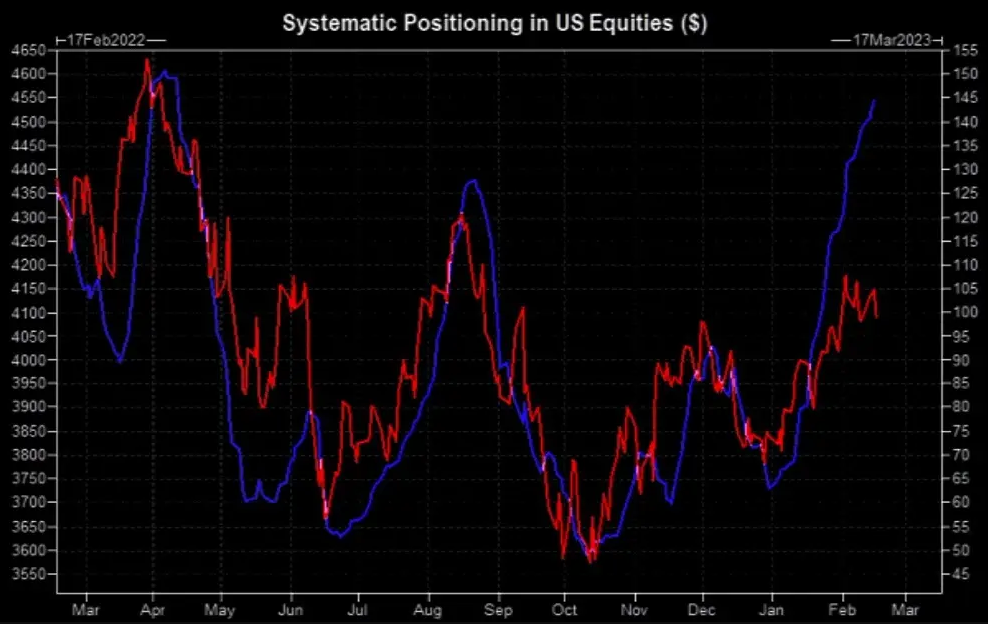

Systematic investors like commodity trading advisors (CTAs) and volatility-targeting funds have caused sharp swings in stock indexes. CTAs buy and sell based on price changes and momentum, while volatility funds buy more when volatility falls and sell when it rises.

CTAs bought heavily in January, and volatility funds also bought as volatility declined. If these flows reverse, stock prices could fall significantly. Goldman Sachs estimates $46 billion of S&P 500 stocks could be sold over the next month, with $14 billion likely sold last week.

Short Squeezes

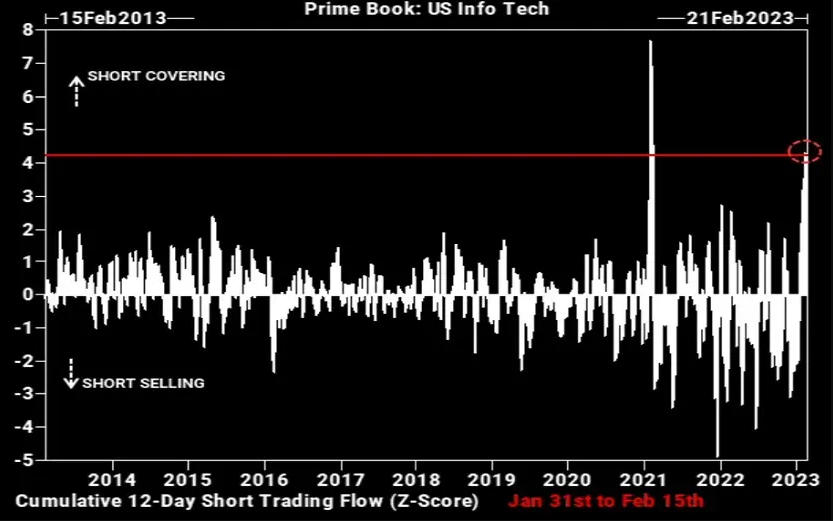

Much of the stock rally since the start of the year resulted from short covering, when investors close out short positions by buying the underlying stock. The strongest performance came from the lowest-quality, most heavily shorted stocks.

Speculative traders’ net short positions declined from $119 billion to $14 billion net long, indicating no more fuel from short covering but room for new shorts to pressure stocks lower. Hedge funds had the second-highest level of short covering in U.S. tech stocks from January 31 to February 15 in the past decade. However, short covering spikes are short-lived, leaving stocks vulnerable without it.

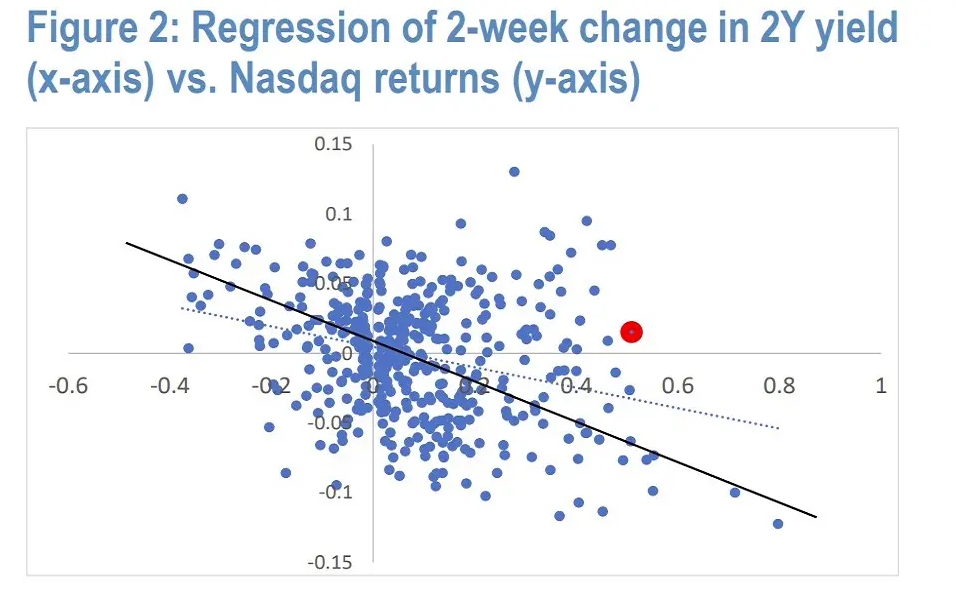

The Relationship Between Bond Yields and Equities

Typically, rising two-year Treasury yields hurt stocks as future earnings are discounted, lowering stock prices today. Recently, this relationship broke down, with stocks rising along with yields.

The rise in two-year yields since January 31 should have caused a 5-10% drop in the Nasdaq but instead coincided with a 3% increase. JPMorgan expects this relationship to return to normal, with bonds looking more attractive than stocks based on yields. Pension funds may also sell stocks at month- and quarter-end to rebalance their portfolios.

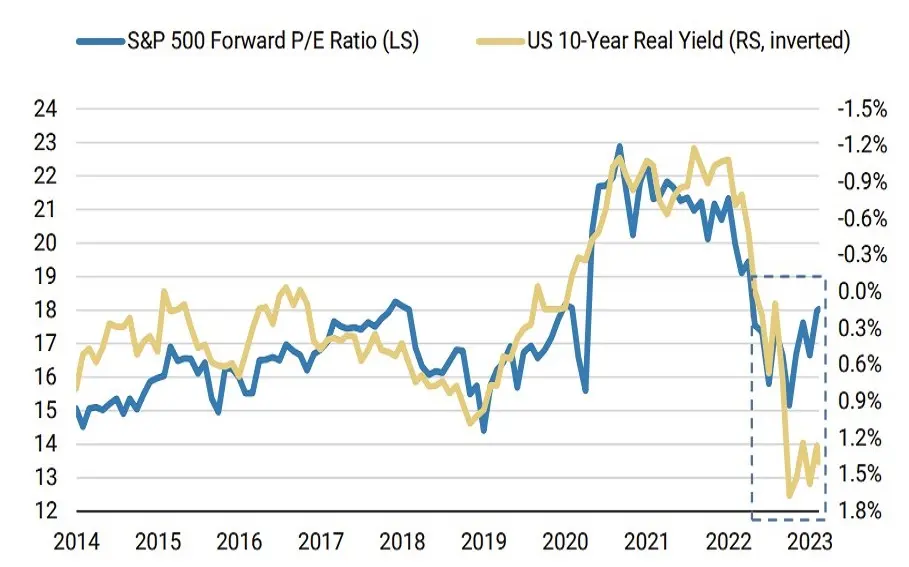

High Stock Valuations

With stocks trading at 18 times expected earnings, valuations are not cheap. This is above the 80th percentile historically, indicating optimism and good news are priced in with little room for error. Higher rates and interest in keeping rates elevated will make it difficult for valuations to rise further.

The gap between real yields on 10-year Treasuries and the S&P 500 forward P/E ratio is very wide, suggesting one will need to adjust. The equity risk premium, the extra return investors expect from stocks over bonds, is in the “death zone” at 1.55%, indicating high risks for stock investors with little margin of safety. If earnings expectations are too high, as Morgan Stanley’s chief equity strategist believes, the equity risk premium could fall further.

Investors should be cautious in this environment. Remember, stock prices typically do not bottom until the Fed stops hiking rates, and more hikes are likely on the horizon…

However, the Fed may pause if economic data weakens or market volatility increases substantially. While no immediate crash seems likely given strong economic and earnings growth, risks are rising. It is a good time for investors to review their portfolios and ensure proper diversification, rebalance as needed, and have some cash on hand in case of a downturn.

What Are the Opportunities Here?

While stocks have seen strong gains recently, significant risks are emerging that could threaten the bull market and lead to a decline. Investors should not ignore these risks but rather prepare for more volatile and potentially negative market conditions.

Traders can look into short trades for individual stocks that has seen a lot of momentum recently, usually the more volatile assets are good candidates to bet with if you are expecting more volatility or positive/negative momentum.

By rebalancing portfolios or taking different directions trades on the same asset, diversifying, and keeping some cash or other safe haven assets on hand, investors and traders can weather a market downturn without panicking.

Although a crash does not seem imminent, the time to prepare is before risks materialize, not once the market has already declined substantially.

With the economic expansion aging and the Fed tightening policy, now is a good time for investors to review their strategy and ensure they are prepared for whatever the market may bring over the coming months and years.

More By This Author:

Nvidia Spikes On The Back Of Earnings Report, What’s Next?Deciphering February CPI Data

Can Chat GPT Perform Valid Technical, Fundamental Or Wave Analysis?

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. On average around 80% of retail investor accounts loose money when trading with high ...

more