Canada’s Trade Performance Is A Drag On The Economy

Image source: Pixabay

As one of the more open economies, Canadian national income is driven by its export performance. Roughly, one-third of Canada’s GDP comes from the external sector, and so when that sector stumbles, the rest of the economy will do the same.

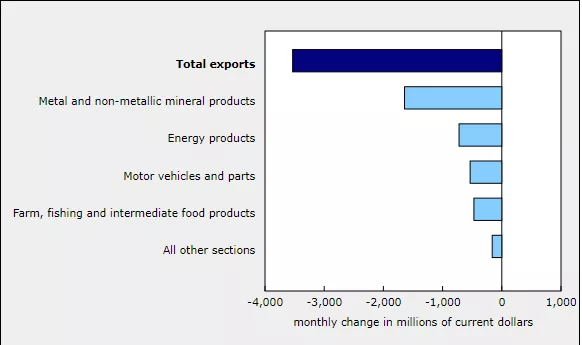

The trade deficit in March hit $2.3 billion, surprisingly, since the markets expected a surplus. Exports of every category shrunk, in total by 5.3%, a sign that world demand for Canadian products is weakening. The two most important sectors, natural resources, and automotive products were hit the hardest. Added to this unfavourable result is the fact that February’s trade surplus, initially estimated at $1.4 bn was virtually eliminated after revisions. The first quarter GDP results are not looking promising.

Contribution to Monthly Change in exports, March,2024

Growing economies are fuelled by a rise in imports, a reflection of a strong domestic market. From this perspective, import volumes barely grew in the first quarter, and combined with weak exports, spell trouble for the first quarter of 2024.

Going below the surface, despite higher oil and gas prices, energy exports dropped by 5%. Auto exports were down by 9% from last year’s. Economists point out some technical factors hitting these two vital sectors, (e.g. unplanned shutdowns in US oil refineries), but the bare fact remains that Canada’s external markets will be a drag on its economy.

There is a steady stream of evidence that Canada is, at best, treading water and, at worse, in an outright recession. Yet, the Bank of Canada remains frozen, unable to signal to investors that the rates are to be lowered in response to a deteriorating situation. The Bank’s fixation on a specific inflation target is a detriment to adopting a more accommodating monetary policy needed to turn around an economy that is clearly heading in the wrong direction.

More By This Author:

The Canadian Federal Budget And Its Impact On Debt Markets

Suppose We Never Get Back To 2% Inflation Rate

Canada Is Now Experiencing A Hard Landing