Canada Is Now Experiencing A Hard Landing

Photo by Jp Valery on Unsplash

Evidence is piling up that the Bank of Canada is not able to engineer the vaulted soft landing after a brutal series of rate hikes. Economists were so sure that this rate cycle would be managed in a way that inflation would moderate sufficiently to meet the target of 2% without any harm to the labor market. In other words, we would have the best of both worlds--- an acceptable inflation environment and relatively full employment.

The release today of the job numbers and the unemployment rate in Canada signifies that the landing is far from smooth and soft. The March unemployment rate was up 100 bps on a year-over-year basis, registering 6.1%. The total number of unemployed people in the country stands at 1.3 million, an increase of nearly 250,000 compared with a year ago. With no net increase in jobs created, the jump in the unemployment rates reflects a surge in those looking for work. The labor market is weakening as the employment rate--- the proportion of the population aged 15 and up who are employed—declined for the sixth consecutive month.

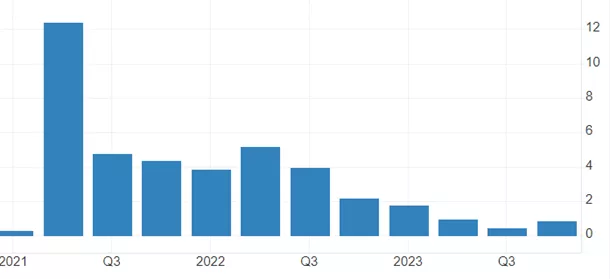

Quarterly Change in Canada's GDP

This continued weakness in the job market comes as no surprise given the steady drumbeat of an economy whose growth rates continue to slow dramatically, now barely above zero.

So, where does the Bank of Canada stand in relation to a slowing economy and rising unemployment? The Bank, stubbornly insists that the fight to bring down the inflation rate is not over. Acknowledging that the economy remains weak and that GDP is barely expanding, certainly not enough to accommodate population growth, the Bank does not hold any timetable for rate cuts. Economists speculate that rate cuts are due this summer, but the Bank officials do not provide any insight that would support that position.

A variety of inflation measures clearly suggest that the Bank’s work is done and these measures, collectively, argue that inflation targets have been reached, and in some cases, exceeded. Time to take its foot off the brakes. Slow to apply the brakes in 2021-22, the Bank of Canada is now behind the curve, and its policy rate needs to be cut, starting now.

More By This Author:

The Great Canadian Debate Is Underway Why Productivity Is So PoorThe Choice Of Inflation Measure Depends On The Eye Of The Beholder

It Is The End Of An Era For Negative Interest Rates