Blending Strategies For Japan Positioning

Japanese large caps have been a bright spot for value investors over the last three years—particularly when implemented with a currency hedge, as the yen weakened considerably.

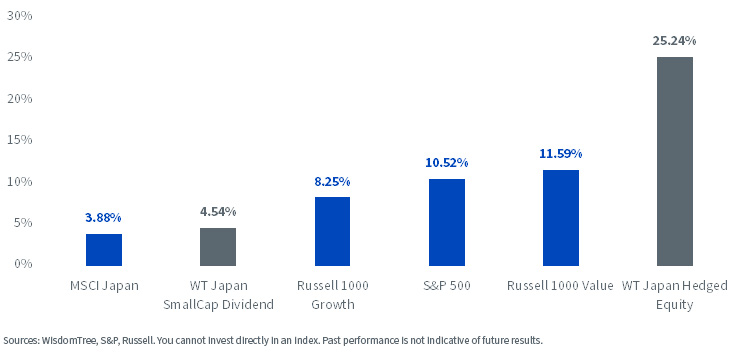

The WisdomTree Japan Hedged Equity Index outperformed the MSCI Japan Index by more than 20% per year for three years—a dramatic relative differential from a combination of better performance of the underlying equities and the currency hedge.

Index Annualized Total Returns: 8/31/20–8/31/23

I have long advocated that investors should default to being more hedged and taking less currency risk when investing abroad—the S&P 500 has a weak dollar bias inherent to multinational earnings (as I wrote about here). Thus, I see less diversification stemming from adding foreign currency bets on top of the long foreign stock exposure.

Better Diversifier: Rather, I see a strong U.S. dollar overlay on top of unhedged stocks as a better diversifier to U.S. large caps.

Carry Trade: You are also paid the relative interest rate differential between countries by hedging, and that number has approached 6% in Japan. The Bank of Japan has maintained a negative interest rate policy in the short end while the Fed hiked rates more than 500 basis points in about a year. This carry from hedging offers a nice added return on top of what local Japanese investors earn in their own market.

The time to add foreign currency is when you have a view that currency should appreciate.

The very large moves in the yen have some feeling the government and Bank of Japan will intervene to arrest the slide. With a 5%–6% carry, you need the yen to drop below the 138–140 level, from the current 147 level, to break even from the carry you receive from hedging.

WisdomTree offers a Japanese small-cap ETF, DFJ, that is unhedged to the yen and for those who do think the government or central bank interventions could alter the yen’s direction; a portfolio blend that is 50/50 hedged/unhedged with small caps is one thing to explore for those who agree with my longer-term hedged baseline but want some added yen exposure. Small caps are perhaps a more natural place to add the yen, as they’re more sensitive to local economic dynamics than large caps, which often are more competitive with a weak currency.

The below analysis compares a Japan portfolio (50/50 Blend of DXJ/DFJ) to standalone investors in Japan and the global markets.

It has been difficult to beat the U.S. markets over the last five years. The MSCI EAFE compounded at 4.1% a year, while the S&P 500 delivered 11.1% per year.

Yet note that DXJ outperformed the S&P 500 over the last five years, with more than double the gains over the last three years.

Over the long run (last 13 years), DFJ has outperformed the MSCI Japan Index, but over the last five years, large caps have benefited more from a weak currency.

One of the reasons Japan performed so well over recent years: an increased focus on returning cash to shareholders in the form of dividends and buybacks.

Warren Buffett’s investment in five Japanese trading companies was an added catalyst in the last three years as those companies dramatically grew payouts.

But over the last decade, one can see the dividend growth in the WisdomTree Japanese Hedged Equity Index has been almost 10 times the dividend growth in the MSCI EAFE Index and double that of the S&P 500 Index.

Even Japanese small caps delivered higher dividend growth than the S&P 500 over the last decade!

Fundamental Driver of Return: Dividend Growth

Valuations Supportive:

We started this piece with the comment that Japan has been a bright spot for value investors from a performance perspective—but also still carries attractive valuations when compared to other global value alternatives.

The S&P 500 is selling at more than 20 times trailing earnings and a considerable 10 P/E point premium to international markets with the MSCI EAFE Index.

Japan Discount: Both WisdomTree large and small caps trade at a good discount to the MSCI EAFE Index of international stocks.

Japan was not known as a high-dividend country in the past.

But one can see even the MSCI Japan Index has a higher dividend yield than the S&P 500, and both WisdomTree Japan strategies have competitive dividend levels compared to the MSCI EAFE Index.

Further Catalysts

Japanese exchanges are taking action to catalyze corporate governance change, bring refreshed sentiment, and revitalize valuations in companies with price-to-book values below 1.0.

DFJ has an aggregate valuation below this critical 1.0 threshold, meaning there is still room for valuation improvement as companies take action.

The most common response from Japanese management has been to increase dividends and buybacks in a renewed spirit of shareholder-friendly corporate governance. Performance has also improved for those with high dividend yields.

If one wants to add yen exposure because they think Japanese authorities think the yen weakened too much, this portfolio blend of 50/50 DXJ and DFJ represents a solid value-based option to do so.

More By This Author:

U.S. Economy: Receding Recession ExpectationsU.S. Labor Market Activity: Slowing, Not Weakening

Post-Nvidia’s Q2 2023 Earnings — Will the ‘AI Hype’ Keep Driving Equity Performance?