Bank Of Canada Surprises With A Hike And Hints At More To Come

The Bank of Canada has resumed interest rate increases after a five-month hiatus. Demand is proving to be more resilient and inflation could be more persistent. Another hike looks likely in July, but we are wary about pushing for more aggressive action. The attractive risk-adjusted carry can keep CAD in investors' favour for longer.

Bank of Canada building in Ottawa

BoC tightening is back

We have had a surprise 25bp interest rate increase from the Bank of Canada, which takes the target for the overnight rate to 4.75% having been on hold at 4.5% since last hiking at the January meeting. Only around 10bp was priced beforehand with one-third of economists looking for an increase, but odds had certainly risen in the wake of Australia's own 25bp non-consensus rate rise earlier this week.

The accompanying statement talks of activity being stronger than expected, the housing market picking up and labour conditions remaining tight, which combined means "excess demand in the economy looks to be more persistent than anticipated". Meanwhile, there was an acknowledgement that the annual rate of Consumer Price Inflation picked up for the first time in 10 months and there are concerns that "inflation could get stuck materially above the 2% target". The Bank therefore decided to hike "reflecting our view that monetary policy was not sufficiently restrictive to bring supply and demand back into balance and return inflation sustainably to the 2% target".

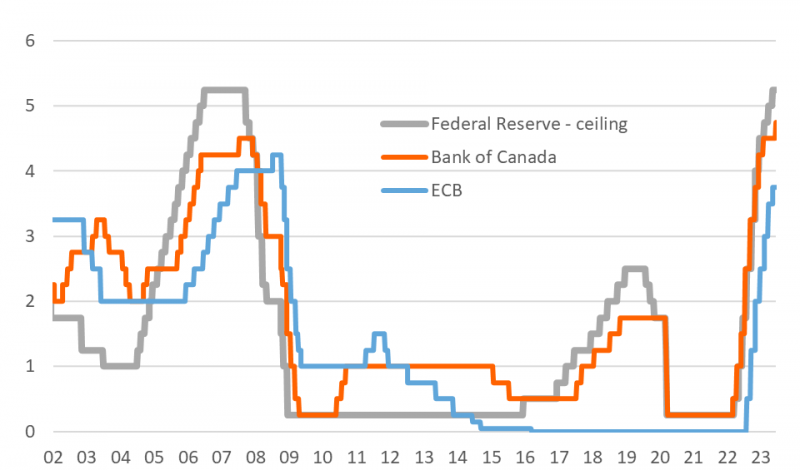

Tightening cycles in Canada, the US and the eurozone

There was little in the way of forward guidance other than to say it will continue to evaluate inflation, wage and demand dynamics. Nonetheless, having restarted hiking after a five-month period the odds certainly favour at least one additional move. Markets are fully discounting a further 25bp hike at the July policy meeting with a decent chance of another in September with rates staying 50bp higher through to year end. We would agree that a 25bp hike in July looks very likely, but are less convinced on a September move at this stage. The BoC themselves acknowledged inflation is likely to slow to “3% in the summer” and that “financial conditions have tightened back to those seen before the bank failures in the United States and Switzerland”. Given that monetary policy tends to take effect with long lags we are wary about pushing too aggressively ahead with more rate hikes.

Loonie’s momentum getting even stronger

The BoC hike today sent USD/CAD lower and the pair is now aiming at testing the November 2022 lows at 1.32/1.33. Below that, we’d be looking at 1.30 as the next key resistance level for the pair.

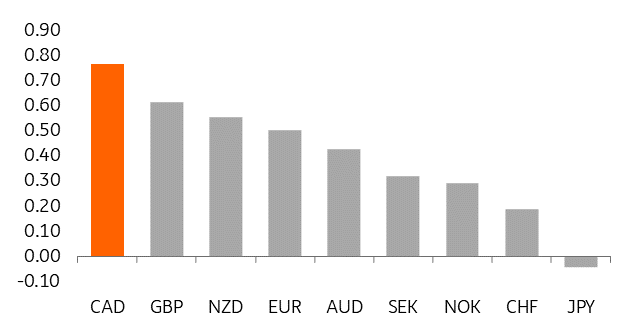

As discussed above, we don’t see reasons to push back against market expectations for another 25bp hike in July at this stage. Since this is fully priced in, there is arguably limited direct implications for CAD in terms of further hawkish repricing, especially considering we are not convinced another hike in September will be delivered. However, the resumption of the tightening cycle is keeping loonie’s risk-adjusted carry very attractive – as shown below.

Volatility-adjusted 3-month carry in G10

Our pre-BoC forecast for USD/CAD had 1.30 as an end-3Q target. We now think the chances of 1.30 being hit earlier this summer are quite elevated. Later in the year, a negative re-rating in US growth expectations and prospective Fed cuts late in 2023 can impact CAD negatively and we expect it to lag other procyclicals later in the year. But fresh BoC tightening means that USD/CAD may trade closer to 1.25 than 1.30 by year-end.

More By This Author:

Australia: GDP Slows Further

Rates Spark: Enough Out There To Nudge Market Rates Higher

The Commodities Feed: China’s Imports Recover

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more