April ECB Cheat Sheet: Confused About Tariffs? Don’t Count On ECB Guidance

Image Source: Pexels

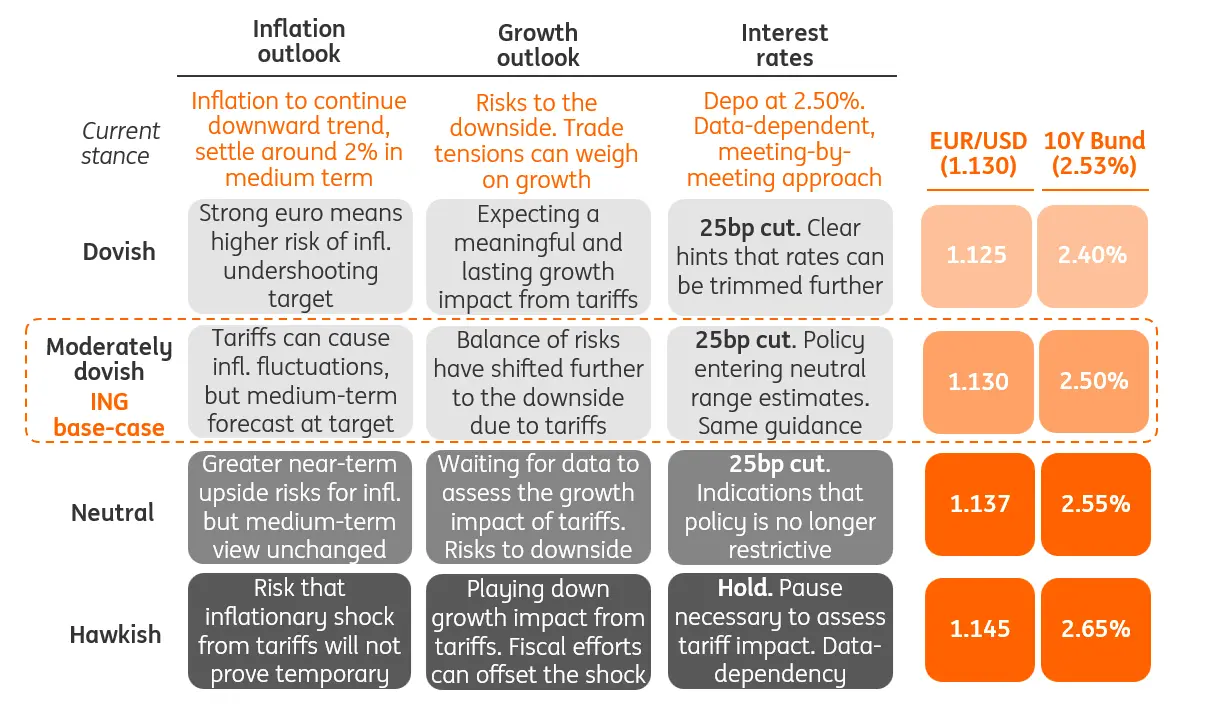

The ECB is widely expected to cut rates by another 25bp on 17 April, as growth risks have intensified on the back of US tariffs. The Governing Council may highlight rates are now close to neutral, but that doesn’t rule out further tariff-led cuts. We think the ECB will keep its options open, and markets should continue to lean on the dovish side of pricing.

Rates: Trade headlines more important than ECB communication

EUR money markets are close to fully discounting a 25bp rate cut this Thursday after Trump’s “liberation day” sealed the case for further European Central Bank easing in the eyes of investors. Prospects of increased fiscal spending out of Germany and the EU are just too far in the distance.

As so often, the focus turns to the ECB’s guidance on what it might hold in store for the coming months. The market is leaning heavily into the idea that ECB will bring the deposit facility down to 1.75% in the fourth quarter with even a small chance of further moves into more accommodative territory.

While the ECB could tweak its language to indicate that it is now moving further into neutral ranges, we do not think that the very uncertain backdrop would justify taking a stronger stance. Rather the ECB should aim to keep all options on the table. While the growth impact of tariffs appears well understood, the impact on inflation is far from certain. This is also reflected in Bloomberg’s survey of economists ahead of the meeting where 26% of respondents expected higher inflation in the near term. Obviously, much will depend on the evolution of the trade spat and whether we will see more meaningful retaliation. As such, also the pricing of the ECB beyond this meeting will depend more on such headlines than what the ECB will tell us on Thursday.

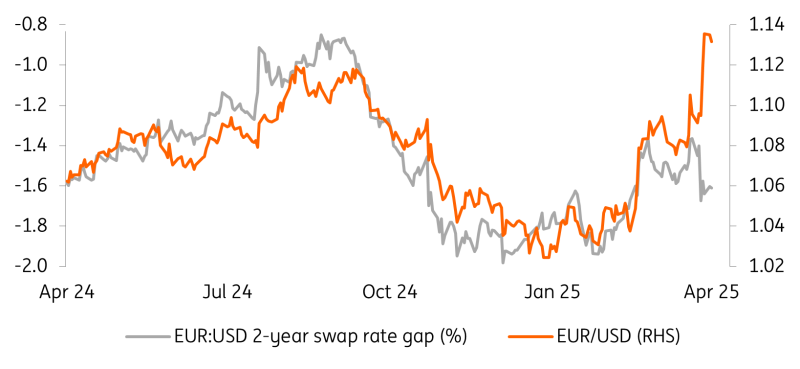

EUR/USD has dislocated from short-term rate differentials

Source: ING, Refinitiv

FX: Rate cut shouldn’t hurt EUR momentum

The correlation between short-term rate differential and EUR/USD has vanished since “liberation day”. As shown in the chart above, the EUR:USD 2-year swap rate gap has actually widened in favour of the dollar while EUR/USD spiked. This means that there is now a substantial risk premium embedded into the dollar.

That is observable across different G10 USD crosses, but we estimate that EUR/USD is one of the most overvalued, which reinforces the view that the euro is the preferred channel for loss of confidence in the dollar.

Our view is that the rotation from US to European assets and the lack of safe-haven appeal of the dollar can continue to justify that EUR/USD overvaluation, and we expect the pair to keep finding support at 1.130 for now. The ECB is a secondary variable in all this. We cannot fully exclude that rate cuts in the ECB may actually help the euro on the margin as long as markets trade more on growth concerns than rate differentials.

More By This Author:

FX Daily: EUR/USD Can Return To 1.15Eurozone Industrial Production Jumped In February, But That Doesn’t Mean Much

UK Jobs Market Stays Solid Despite Big Tax Hikes

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more