UK Jobs Market Stays Solid Despite Big Tax Hikes

Image source: Pixabay

The UK jobs market is showing little sign of damage following this month's hike in employers' National Insurance.

Away from the tariffs, perhaps the biggest unanswered question in the UK economy is what the recent employer tax hikes mean for the jobs market. Earlier this year, the mood music looked grim. Survey after survey painted a negative picture about hiring intentions and layoffs.

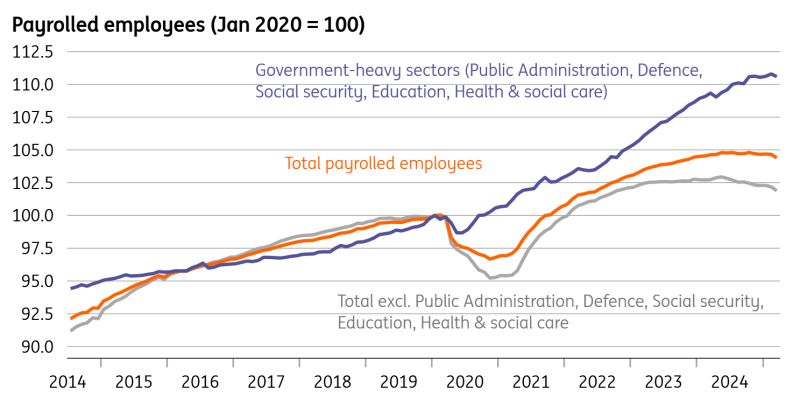

So far, at least, that’s not really played out in the official numbers. The unemployment rate stayed at 4.4% in today’s data, though admittedly that should be completely disregarded, given its well-publicised quality issues. Instead, we should look at the more reliable payroll-based employment data, and this did fall more steeply than expected by 78,000 in March, led by the private sector. The caveat is that this data is often revised up, and even if it isn’t, the latest data is more consistent with the slow, modest fall in private employment we saw through 2024. The pace of decline doesn’t look particularly worrisome at this stage.

UK redundancies didn't rise ahead of the tax hike

Source: Macrobond, ING

More importantly, separate weekly data on redundancies from the government haven’t increased at all. That could change, though we would have expected to see some pressure emerge ahead of the employer national insurance hike earlier in April.

Our working assumption, for now, is that the jobs market continues to cool this year, but that we don’t see a material spike in joblessness. And for the Bank of England, that keeps all the focus on wage growth. The news here was a tad better than expected in February’s numbers – the year-on-year rate of regular pay growth stayed at 5.9%, versus expectations of a pick-up.

In theory, though, we’d have expected that to have come much lower over recent months, not just because the jobs market has cooled a lot, but also because various surveys point to more muted pay rises. The Bank of England’s Decision Maker Panel has, for some time, suggested firms expect pay rises of more like 4% over the next year.

But for now, that isn’t showing through. The latest one-month and three-month changes in private-sector pay show that the pressure isn’t really abating. The latest rise in the National Living Wage will also keep pay growth supported through the spring.

Given what those surveys show, we suspect wage growth will come lower through this year, but only very gradually. It’ll perhaps end the year in the 4.5-5% area.

That doesn’t mean the Bank of England can’t keep cutting rates, however. Services inflation, the Bank’s other major focus right now, should come lower in the coming months; we'll get fresh data on that tomorrow. Coupled with heightened concerns about the global economy, it should keep the BoE on its current rhythm of gradual rate cuts once per quarter.

We expect a cut in May and two more in the second half of the year.

More By This Author:

The Commodities Feed: Oil Edges Higher Despite Demand CutsChina’s March Exports Shrugged Off Early Tariffs, But Headwinds Are Intensifying

Bank Of Canada Preview: A Hold Is Slightly More Likely

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more