Financials And Small Caps Pushing Market The Last Mile To Overbought

AT40 = 61.9% of stocks are trading above their respective 40-day moving averages (DMAs) (near 5-month high)

AT200 = 23.2% of stocks are trading above their respective 200DMAs (1-month high)

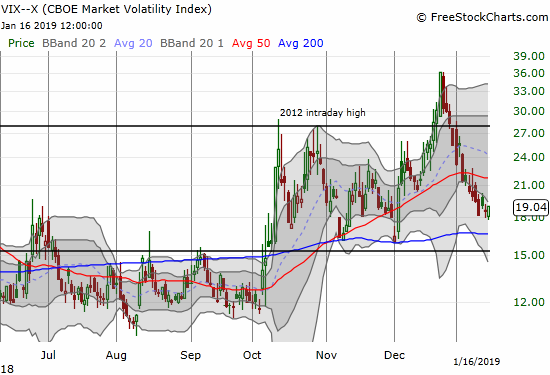

VIX = 19.0

Short-term Trading Call: cautiously bullish

Commentary

The signs of exhaustion in the major indices have given way to more and more breakouts. Most importantly, AT40 (T2108), the percentage of stocks trading above their 40-day moving averages (DMAs), sprang back to life after a small pause on Monday. AT40 closed at 61.9% and, incredibly, is within sight of hitting overbought trading conditions (above 70%). With so many stocks still below their 200DMAs – AT200 (T2107) – is only at 23.2%, I doubt the market will have enough energy to push through and maintain overbought levels.

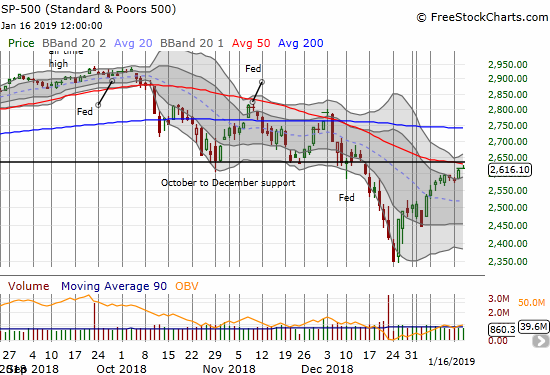

After a fresh breakout on Tuesday, the S&P 500 (SPY) challenged and faded away from its 50DMA. At 2616.10, the index closed right around the same level that served as support in October and November. This is “close enough” for me to lock in profits in my shares of ProShares Ultra S&P500 (SSO).

The S&P 500 (SPY) is knocking on the door of doubly-important resistance from its 50DMA and former support from the last three months of 2018.

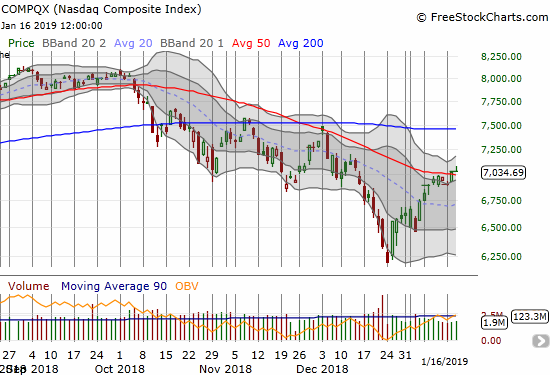

The NASDAQ and the Invesco QQQ Trust (QQQ) seemed to confirm exhaustion on Monday with a small gap down. I rushed in to buy puts on QQQ as planned. Both tech-laden indices turned right around on Tuesday for 50DMA breakouts. Wednesday’s positive open quickly flipped me into QQQ call options. I had profits by the high of the day, but I decided to keep holding. Those profits went poof after sellers faded QQQ back to a flat close on the day. The 50DMA breakout for QQQ looks more precarious than the NASDAQ’s.

The NASDAQ cleared 50DMA resistance but the fade from the intraday high put the move in question.

The Invesco QQQ Trust (QQQ) closed flat after racing higher to confirm its previous 50DMA breakout.

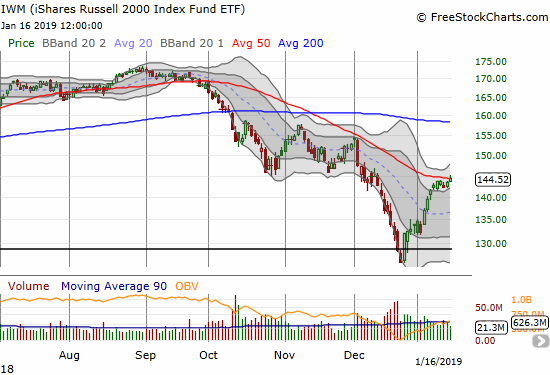

The iShares Russell 2000 ETF (IWM) fell behind the major indices as it churned a bit under 50DMA resistance. Today’s 0.8% gain put IWM above the hump.

The iShares Russell 2000 ETF (IWM) broke out above its 50DMA resistance.

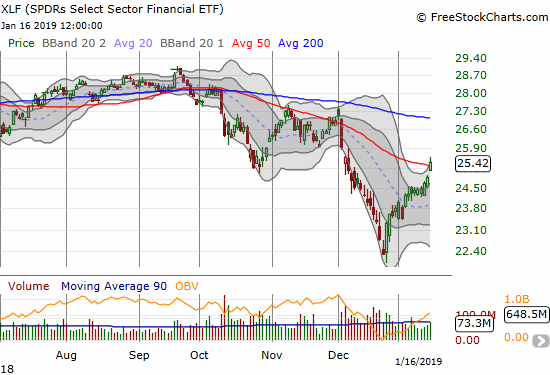

Financials have quickly transformed from anchor to rocket ship. The Financial Select Sector SPDR ETF (XLF) out-performed with a 2.1% gain and closed above its 50DMA for the first time since December 3rd. I loaded up on weekly calls in XLF on Monday as soon as I saw the bullish reaction to Citigroup’s earnings (more below). Given the single-stock reaction and the potential for more this week, I was surprised at the relatively low price of the call options. The calls even declined a bit on Tuesday. Today was the big validation. I took profits a bit early, but I will not complain about a double.

The Financial Select Sector SPDR ETF (XLF) broke out from 50DMA resistance with a 2.1% gain. Follow-through buying puts 200DMA resistance in play.

Despite the good cheer, the volatility index, the VIX, managed to gain 2.4%. The move looks like a blip given the on-going downtrend from the last highs. Still, this contrary move caught my attention.

The volatility index, the VIX, is still stuck in a downtrend despite today’s upside.

The stock market swept away my skepticism about punching through 50DMA resistances on the major indices (the S&P 500 is the final proofpoint!). Now, my skepticism sets its sights on the overbought threshold. I am quite surprised the stock market reached these heights so soon.

CHART REVIEWS

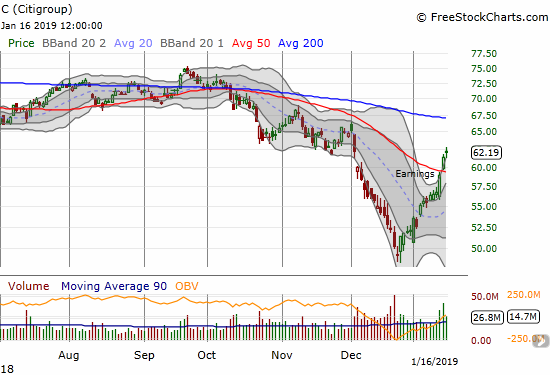

Citigroup (C)

Citigroup is the earnings hero of the week. The bank stock jumped 4.0% in reaction to earnings. The buying picked right up the next day and delivered a 50DMA breakout along with bullish follow-through. At least for now, the financials are breathing fresh life into this rally from historic oversold conditions.

Citigroup (C) broke through 50DMA resistance thanks to on-going post-earnings momentum. The stock has even closed two days in a row above its upper Bollinger Band.

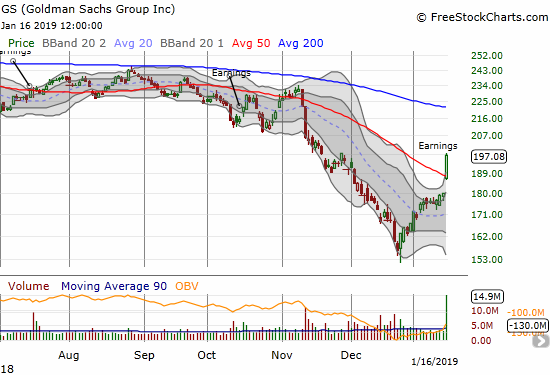

Goldman Sachs (GS)

I fortuitously dropped GS from my shrinking list of stocks to use as hedges against bullishness. I did not flip bullish on the stock as previous bearishness was hard to suppress. Now, GS is in its most bullish position in a very long time. The stock soared 9.5% on an earnings-inspired 50DMA breakout. GS is now a buy on the dips with a strict stop below 50DMA support.

Goldman Sachs (GS) roared to life with a 9.% post-earnings 50DMA breakout. GS now trades at a 1 1/2 month high.

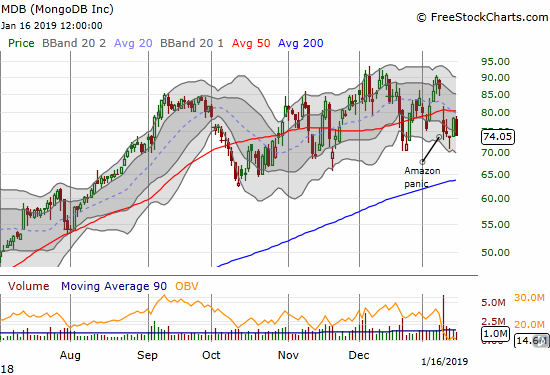

MongoDB (MDB)

Last week, MDB became the latest victim to an Amazon.com (AMZN) panic. The stock broke down below its 50DMA and is still struggling to recover. On today’s 5.6% loss I decided to try out a calendar call spread as a play on panic abatement. This is my first test of this trade since the stock market plunged into bear market trading style. MDB is particularly interesting given its relative resilience through the last three months of bearish trading action in the stock market.

MongoDB (MDB) lost 5.6% as it continues to struggle around its 50DMA pivot.

Nordstrom (JWN)

I was very tempted to pile back into JWN on the heels of its post-earnings disappointment. The stock is once again below its price where privatization talks were active, but the stock is also trading at 13-14 month lows. The double peaks from September and November look like the confirmed tops of a stock slowly breaking down.

Nordstrom (JWN) lost 4.8% post-earnings. Buyers rushed into the gap down and bought from the open to the close.

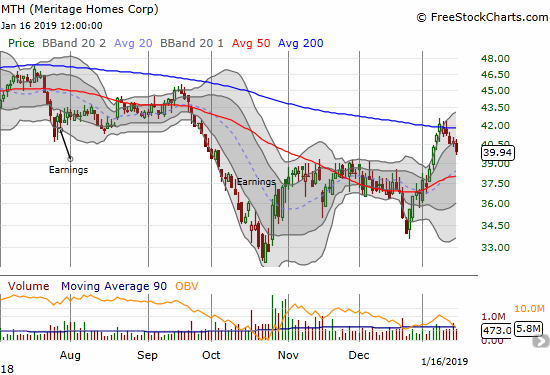

Meritage Homes (MTH)

MTH started this week by confirming its failure to break through 200DMA resistance. That raised a flag to me on my home builder seasonal trades. I will be taking profits on all these stocks and leave just my (residual) call options on iShares US Home Construction ETF (ITB) (which lost 1.0% on the day).

Meritage Homes (MTH) lost 1.5% as selling volume picks up in the wake of a failure at 200DMA resistance.

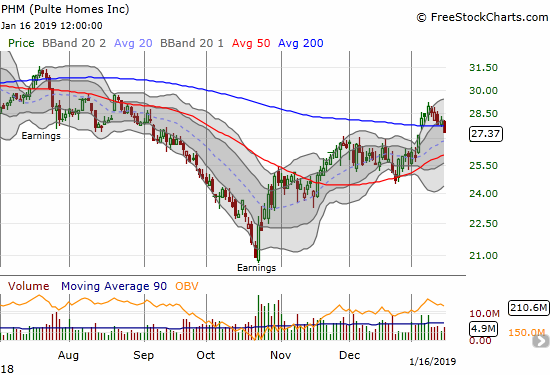

Pulte Homes (PHM)

PHM confirmed for me it is time to take profits on my seasonal home builder trades. The stock lost 2.5% after breaking down below its 200DMA. The next question is whether home builders are once again a leading indicator for a coming pullback in the stock market. A successful test of 50DMA support would be a bullish refresher.

Pulte Homes (PHM) suffered a fresh 200DMA breakdown with a 2.5% loss.

— – —

“Above the 40” uses the percentage of stocks trading above their respective 40-day moving averages (DMAs) to assess the technical health of the stock market and to identify extremes in market sentiment that are likely to reverse. Abbreviated as AT40, Above the 40 is an alternative label for “T2108” which was created by Worden. Learn more about T2108 on my T2108 Resource Page. AT200, or T2107, measures the percentage of stocks trading above their respective 200DMAs.

Active AT40 (T2108) periods: Day #9 over 20%, Day #7 over 30%, Day #6 over 40%, Day #5 over 50%, Day #1 over 60% (overperiod ending 94 days under 60%), Day #150 under 70%

Daily AT40 (T2108)

Black line: AT40 (T2108) (% measured on the right)

Red line: Overbought threshold (70%); Blue line: Oversold threshold (20%)

Weekly AT40 (T2108)

*All charts created using freestockcharts.com unless otherwise stated

The T2108 charts above are my LATEST updates independent of the date of this given AT40 post. For my latest AT40 post click here.

Related links:

The AT40 (T2108) Resource Page

You can follow real-time T2108 commentary on twitter using the #T2108 or #AT40 hashtags. T2108-related trades and other trades are occasionally posted on twitter using the #120trade hashtag.

Disclosure: Long SSO, long MDB calendar call spread, long PHM, long QQQ calls and puts.

Follow Dr. Duru’s commentary on financial markets via more

Haven't seen you around in a while Dr. Duru...

Thanks for noticing! :) Yes. I recently decided to stop syndicating the content of my blog. You can check me out there and subscribe for free to get an email when I post. I will also occasionally post specific content here, but it will be infrequent.

How do you think the #shutdown and the #tradewar will factor into all of this?

It is hard to say. Both of those events are now long-standing and on-going. The market has likely incorporated the negative effects already. But again, hard to tell. For the short-term trades, I just try to stay tuned to the price action. So, for example, the price action has remained strong and means the market is not really paying much attention to the shutdown right now. The trade war drama has gone on so long you can argue the market would be a lot higher without it, or you could argue the market has already discounted all the effects and/or is largely ignoring it now.

Regardless, the price action helps reduce the need for guessing about outcomes of catalysts....