Why Inflation Is About To Get A Whole Lot Worse

Yesterday I outlined how real rates suggest gold will be moving MUCH higher in the coming months.

By quick way of review:

- Because we are in a fiat-based monetary regime, gold trades like any other asset.

- Specifically, gold typically tracks “real rates” or the actual cost of money as illustrated by the difference between yields on Inflation Treasury Inflation-Protected Securities or TIPS and regular Treasuries).

- Real rates typically lead gold at major turns. We saw this at the bottom in March 2020 and more recently in June 2021.

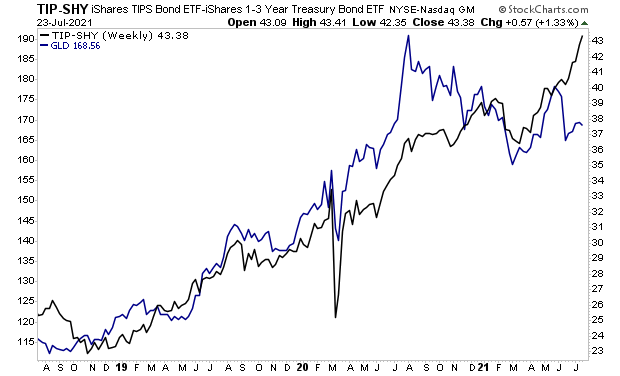

Recently a massive divergence has developed between real rates and gold with real rates rising and gold lagging (see the chart below).

This would suggest gold will be going MUCH higher in the coming months.

What would trigger this?

Inflation.

Remember, real rates represent the difference between the yields on Treasury Inflation-Protected Securities (TIPS) and regular Treasuries. So, when TIPs outperform regular Treasuries, this line rises, and when regular Treasuries outperform TIPs, this line falls.

So, the fact real rates are rising so aggressively means that TIPS which focus on inflation are dramatically outperforming Treasuries right now. This means the bond market is predicting greater inflation is coming.

What would trigger this?

Two things:

- The $2-$4 trillion infrastructure program the Biden Administration is hoping to sign into law in the near future.

- Jerome Powell’s continued tenure as Fed Chair in 2022.

Regarding #1, policymakers have already made it clear from their response to the 2020 shutdowns that their entire blueprint for dealing with crises, boils down to just two words.

PRINT MONEY.

Shutting down the economy triggers a depression?

Print money.

Stock market experiences fastest 30% crash in history?

Print money.

Municipal bonds collapse because the bond markets don’t believe cities and states will be able to meet their debt obligations?

Print money.

The economy still hasn’t come back because state officials continue to keep their economies on partial or complete lock downs?

Print money.

The economy isn’t coming back fast enough despite vaccines and states reopening?

Print money.

Indeed, policymakers printed so much money to combat the impact of the COVID-189 lockdowns that if you add up all of the money the U.S. has ever printed… over 40% of it was printed in 2020.

And the Biden administration doesn’t intend to stop anytime soon. It has already implemented a $1.9 trillion stimulus. It’s now attempting to get a $2-$4 trillion infrastructure program signed into law. And after that it hopes to implement a $1.7 trillion climate change program.

Inflation is already roaring. What do you think another $2-$4 trillion in money printing will unleash?

And bear in mind, that’s just the Federal Government. We’re not even accounting for the Fed here.

I’ll dive into that tomorrow.

For more market insights and investment ideas, swing by our FREE daily e-letter at www.gainspainscapital.com.