What Happens When $400 Billion Isn’t Enough?

Now is the time to be particularly careful in the markets.

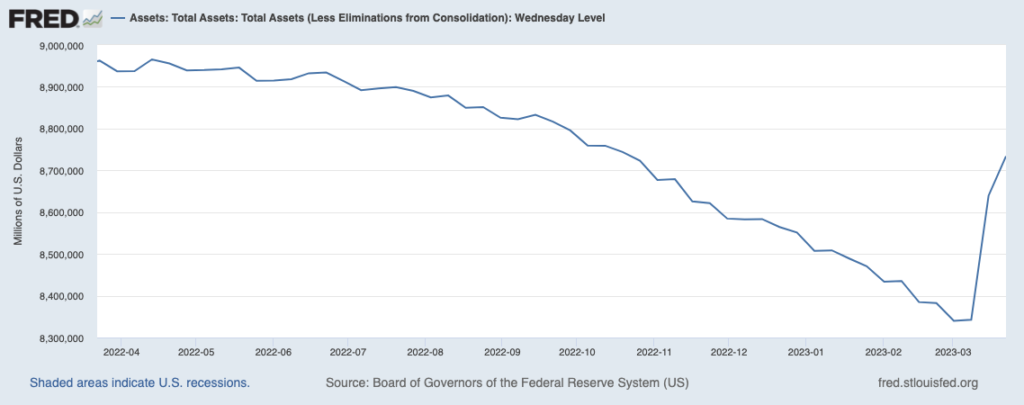

First and foremost, the banking crisis is not over. This is quite concerning because the Fed has pumped nearly $400 BILLION into the financial system in the last two weeks.

(Click on image to enlarge)

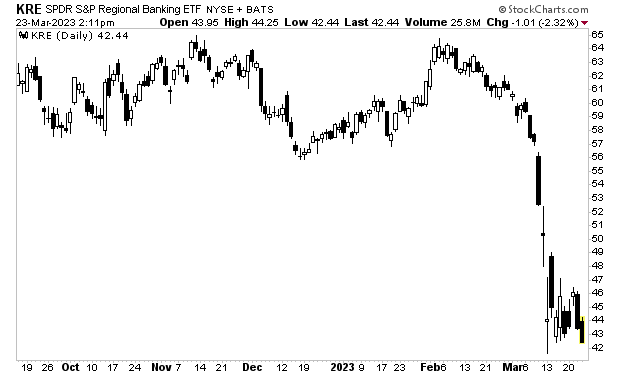

Despite these emergency loans/ access to credit, the regional banking ETF KRE is right back near its panic lows. What does it say about the issues in the financial system that $400 billion in additional liquidity combined with verbal backstops by the Fed/ Treasury isn’t enough to reverse the decline?

More By This Author:

Why The Credit Suisse Collapse Is A Big Deal For Banks Going Forward

The Fed Is Back To Printing Money… With Inflation At 6%

Three Charts Every Trader Needs to See Today