The Fed Is Back To Printing Money… With Inflation At 6%

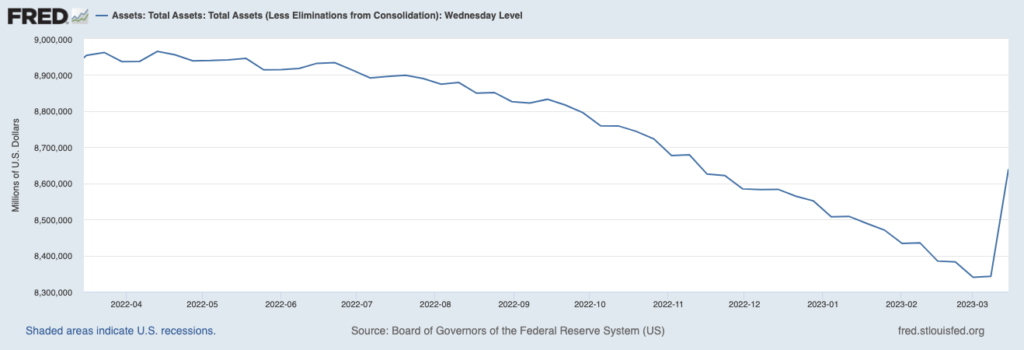

The Fed just gave out over $300 BILLION in a single week.

See for yourself: the Fed’s balance sheet has erupted higher, erasing over HALF of its Quantitative Tightening (QT) efforts. Again, we are talking about $300+ BILLION in a single week.

(Click on image to enlarge)

Now, technically much of this ($164 billion to be exact) came in the form of loans to banks. The banks will have to pay this back, so it’s not quite the same as Quantitative Easing (QE). Regardless, the key point is that the Fed is NO LONGER shrinking its balance sheet… instead, it is printing money. And not a little bit, but $300+ billion in a single week.

To put that into perspective, it’s the equivalent of more than TWO MONTHS’ worth the Fed’s emergency QE program that it ran in response to the pandemic. And again, the Fed did this in just FIVE DAYS.

What does this mean?

First and foremost, that something VERY BAD is going on behind the scenes in the U.S. banking system. But more importantly for us as investors, that the next round of bailouts/ easing/ reflating the financial system is here.

This won’t end well.

The Silicon Valley Bank bailout is the Bear Stearns moment for this bubble. Lehman is coming… as is AIG… and this entire mess won’t end until the stock market hits levels most cannot even imagine today… to the downside

More By This Author:

Three Charts Every Trader Needs to See TodayIs The Great Debt Crisis Of Our Lifetimes Finally Going To Arrive?

The Next Major Downdraft Is Approaching