The Week Before Memorial Day

SPX Monitoring purposes; Long SPX 4/12/24 at 5123.41.

Our Gain 1/1/23 to 12/31/23 SPX= 28.12%; SPX gain 23.38%

Monitoring purposes GOLD: Long GDX on 10/9/20 at 40.78.

This is the week before a three day weekend (Memorial Day is next Monday, market is closed) which in general volume declines and consolidation are likely. Our view right now for this week is that the SPY may consolidate down to the gap that formed on May 15 near the 522 SPY. If the gap is tested on lighter volume (which is most likely) than the gap should hold has support and than continue higher. The bottom window is the VIX which is below its previous low and staying low, both of which are bullish.

Last week the SPY traded at a new high and the SPY/VIX ratio traded at a new high suggesting the larger trend is up. It's common near highs for the SPY to made a new high and the SPY/VIX ratio make a lower high, this negative divergence sets the tone for a high in the SPY; and we don’t have that here. Though there can be a pullback this week it may find support at the gap level near 522 SPY. The short-term trend may be sideways this week and the bigger trend remains up.

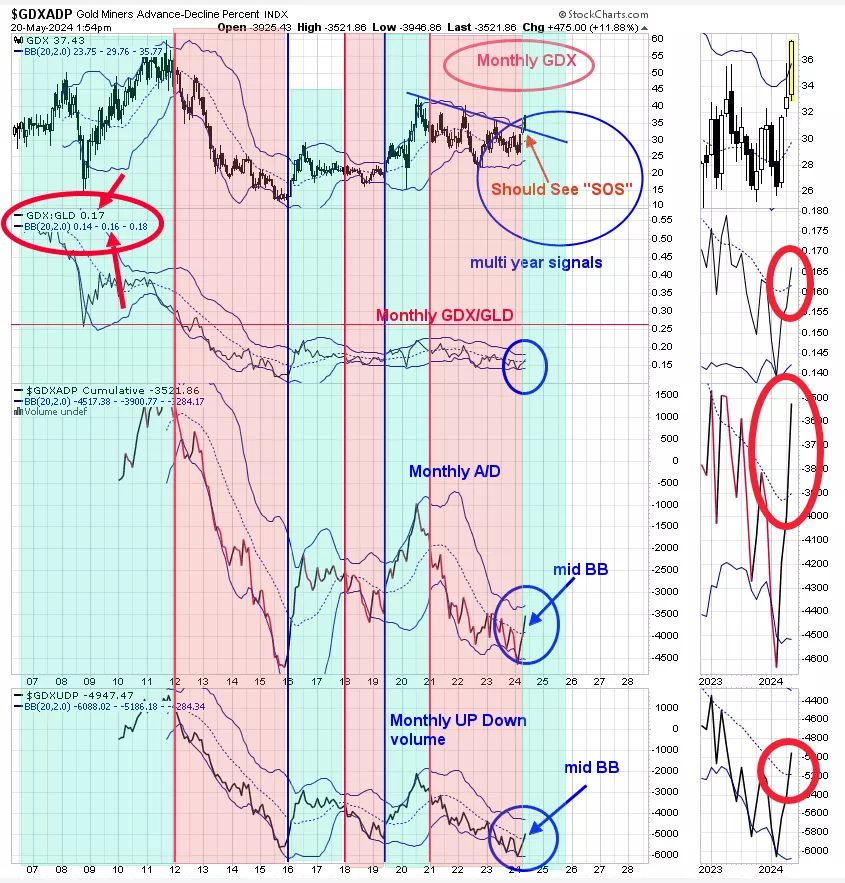

We updated the chart to the current data. Last Thursday’s commentary still applies, we said, “The bottom window is the monthly cumulative GDX up down volume with it’s Bollinger band; next higher window is the monthly cumulative GDX Advance/Decline with its Bollinger band and next higher window is the monthly GDX/GLD ratio with its Bollinger band. A monthly close (about two weeks to go on the current signal) on all three indicators above their mid Bollinger bands will trigger a bullish signal that in the past lasted at least 1 ½ years. The shaded pink areas are when all three indicators closed below their mid Bollinger bands and the shaded green areas are times when all three closed above their mid Bollinger bands. Looking at last nights report, the short term trend remains bullish suggesting the above monthly indicators may be triggered. The far right window shows where all three indicators lie right now; which are above their mid Bollinger bands.” Baring a crash in GDX in the next two weeks and month closes here or higher, a multi month if not a multi year bullish signal is being triggered.

More By This Author:

A New Uptrend Has Started

Positive Divergence Going Forward

New Highs Are Likely

Signals are provided as general information only and are not investment recommendations. You are responsible for your own investment decisions. Past performance does not guarantee future performance. ...

more

Thanks for sharing.