The One-Minute Market Report - Saturday, March 15

Image Source: Pexels

In this brief market report, we will take a look at the various asset classes, sectors, equity categories, ETFs, and stocks that moved the market higher, as well as the market segments that defied the trend by moving lower. Identifying these pockets of strength and weakness can often allow us to see the direction of significant money flows, along with their origin.

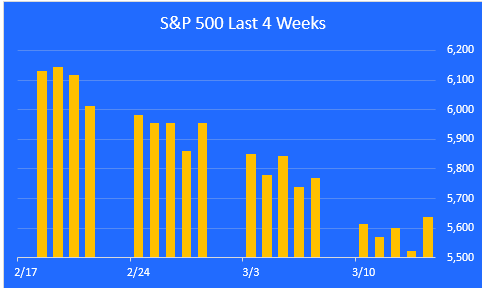

The Tariff Tantrum Continues

As tariffs - real or threatened - ratcheted up, and weakness in consumer spending, employment, and earnings estimates took hold, investors continued to pull back from equities and sought safety in cash, gold and Treasury bonds. The market was down 2.3% for the week and down 4% year-to-date. We are now below where we started on election day in November 2024.

Image Source: ZenInvestor.org

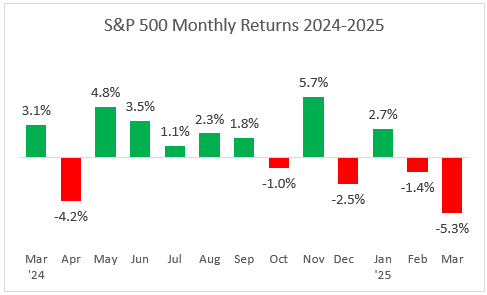

A Look at Monthly Returns

This next chart shows the monthly returns for the past year. After a weak showing in February, March has been off to an even weaker start.

Image Source: ZenInvestor.org

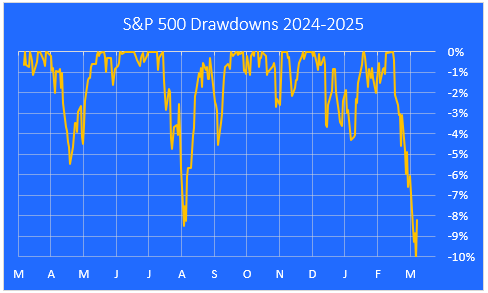

A Look at Drawdowns This Year

Here is a closer look at the pullbacks we've had over the last 12 months, using a drawdown chart. The current drawdown is -8.2%, after the market reached correction territory on Thursday and bounced back on Friday.

Image Source: ZenInvestor.org

A Look at the Bull Run Since it Began Last October

The following chart highlights the 57.6% gain in the S&P 500 from the October 2022 low through last Friday's close. It looks to be well below the trendline, and it seems like there may be further to go on the downside before the correction is over.

Image Source: ZenInvestor.org

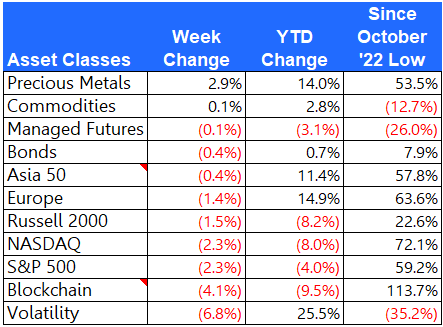

Major Asset Class Performance

Here is a look at the performance of the major asset classes, sorted by last week's returns. I also included the returns since the Oct. 12, 2022 low for additional context.

The best performer last week was the precious metals space, as both gold and silver benefited from the flight to safety trade. The worst performer was volatility, as the VIX index pulled back sharply with Friday's rally.

Image Source: ZenInvestor.org

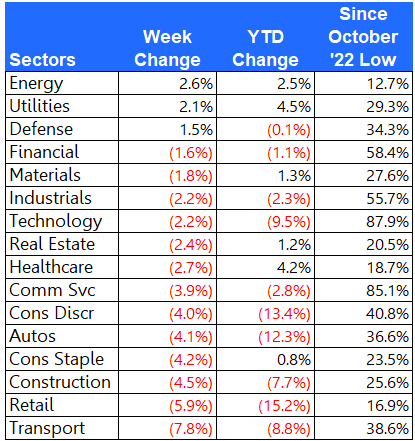

Equity Sector Performance

For this report, I use the expanded sectors as published by Zacks. They use 16 sectors rather than the standard 11. This gives us added granularity as we survey the winners and losers.

Investors were buying defensive sectors like utilities and defense contractors, while selling transportation and retail stocks.

Image Source: ZenInvestor.org

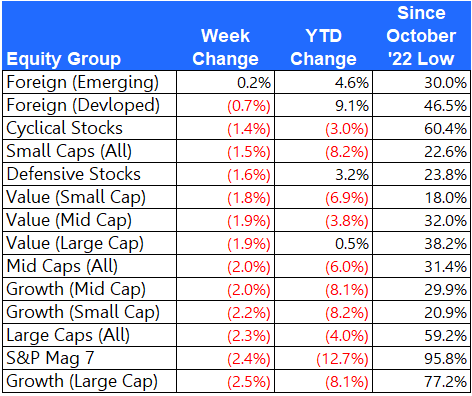

Equity Group Performance

For the groups, I separate the stocks in the S&P 1500 Composite Index by shared characteristics like growth, value, size, cyclical, defensive, and domestic vs. foreign.

The best-performing groups for two weeks in a row were non-US stocks, both developed and emerging. Investors raised cash by selling the Magnificent 7 and other growth stocks.

Image Source: ZenInvestor.org

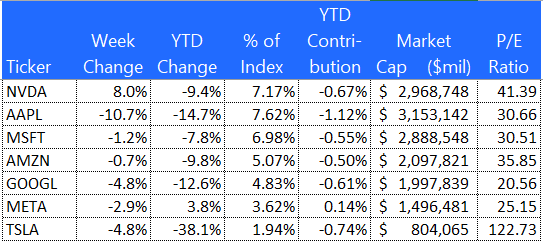

The S&P Mag 7

Here is a look at the 7 mega-cap stocks that have been leading the market over the past two years. These stocks have been off to a weak start year-to-date. Faith in the AI trade is being tested. Participation in the bull market has broadened on a year-to-date basis. Apple (AAPL) was the hardest-hit, while Nvidia (NVDA) rallied after being down nearly 30% peak-to-trough.

Image Source: ZenInvestor.org

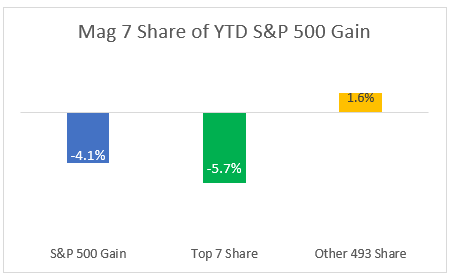

The Mag 7's Dominance Is a Drag On Performance

After leading the market higher for the last two years, the Magnificent 7 are now a drag on the S&P 500 index on a year-to-date basis. The other 493 stocks in the S&P 500 are up an average of 1.6% year-to-date.

Image Source: ZenInvestor.org

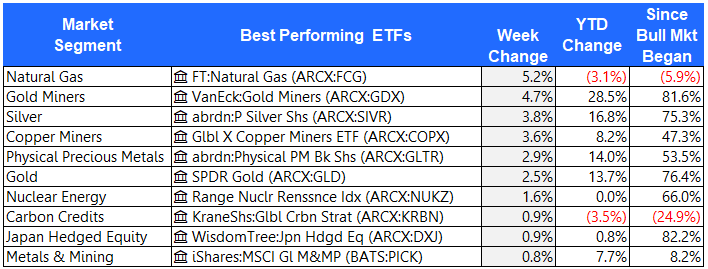

The 10 Best-Performing ETFs from Last Week

The two biggest winners this week, natural gas and gold miners, demonstrate how market leadership is changing in 2025. Energy stocks are holding up better than expected, and gold miners are benefiting from the flight to safety trade.

Image Source: ZenInvestor.org

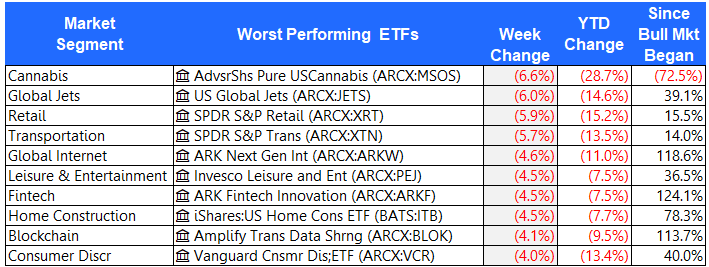

The 10 Worst-Performing ETFs from Last Week

Once again we find cannabis at the top of the list of the worst performers.

Image Source: ZenInvestor.org

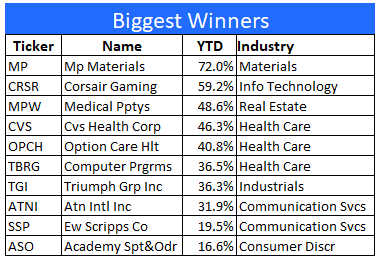

Best-Performing Stocks

MP Materials (MP) is a producer of rare earth materials. The company owns and operates the Mountain Pass Rare Earth Mine and Processing Facility, the only rare earth mining and processing site of scale in North America.

Image Source: ZenInvestor.org

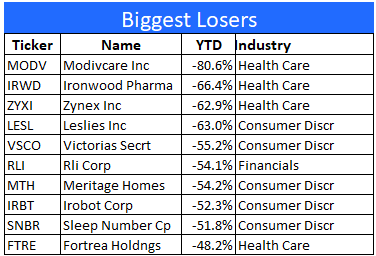

Worst-Performing Stocks

Modivcare (MODV) was recently seen exchanging hands at around $2.30 per share. In 2021, investors were paying $210 per share.

Image Source: ZenInvestor.org

Final Thoughts

To recap, in the week just past, investors were doing the following:

- Selling volatility, and buying gold

- Selling transportation stocks, and buying energy stocks

- Selling retailers, and buying utilities

- Selling growth stocks, and buying value stocks

- Selling US stocks, and buying foreign stocks

- Selling the Magnificent 7 (except Nvidia), and building cash positions

More By This Author:

The One-Minute Market Report - Saturday, March 8The One-Minute Market Report - Saturday, March 1

The One-Minute Market Report - Saturday, Feb. 22

Disclaimer: This content is for educational purposes only, and ZenInvestor.org is not an investment advisory service, nor an investment advisor, nor does ZenInvestor.org provide personalized ...

more