The One-Minute Market Report - Saturday, March 1

Image Source: Pixabay

In this brief market report, we will take a look at the various asset classes, sectors, equity categories, ETFs, and stocks that moved the market higher, as well as the market segments that defied the trend by moving lower. Identifying these pockets of strength and weakness can often allow us to see the direction of significant money flows, along with their origin.

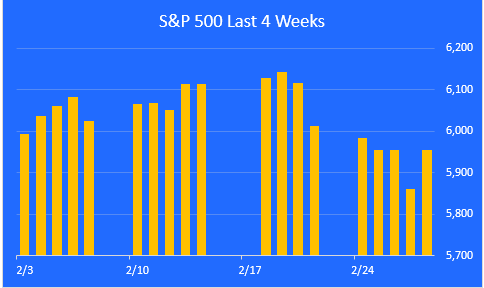

After Making a New High on Feb. 19, the Market Stumbled

As tariffs - real or threatened - ratchet up, and weakness in Consumer Spending hits the tape, investors pulled back from equities and sought safety in Treasury bonds. The market was down 1% for the week and up 1.2% year-to-date.

Image Source: ZenInvestor.org

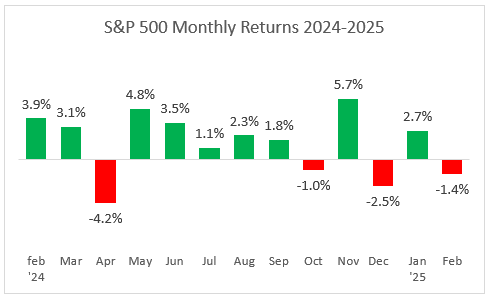

A Look at Monthly Returns

This next chart shows the monthly returns for the past year. A look at the last four months on the chart reveals the volatility in the equity market.

Image Source: ZenInvestor.org

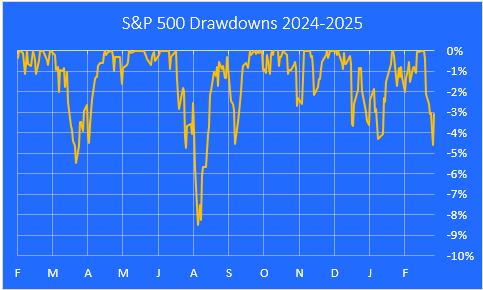

A Look at Drawdowns This Year

Here is a closer look at the pullbacks we've had over the last 12 months, using a drawdown chart. The current drawdown is 3.1% after making a new high on Feb. 19. We haven't witnessed a 10% correction since October 2021. I think we're due for one this year.

Image Source: ZenInvestor.org

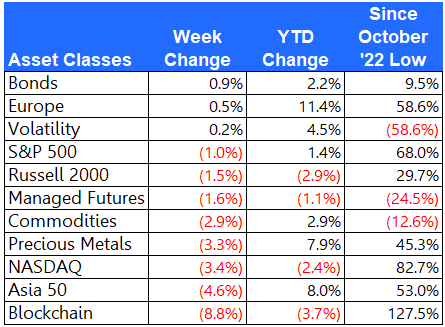

A Look at the Bull Run since it Began Last October

This next chart highlights the 66.5% gain in the S&P 500 from the October 2022 low through last Friday's close. It came to rest below the trendline, and it looks like there may be further to go on the downside before this pullback is over.

Image Source: ZenInvestor.org

Major Asset Class Performance

Here is a look at the performance of the major asset classes, sorted by last week's returns. I also included the returns since the Oct. 12, 2022 low for additional context.

The best performer last week was Bonds, especially the 10-year Treasury. The worst performer was Blockchain, as Bitcoin ended the week at around $84,373. That's down from the recent high of $108,100. This 22% decline puts Bitcoin in a bear market.

Image Source: ZenInvestor.org

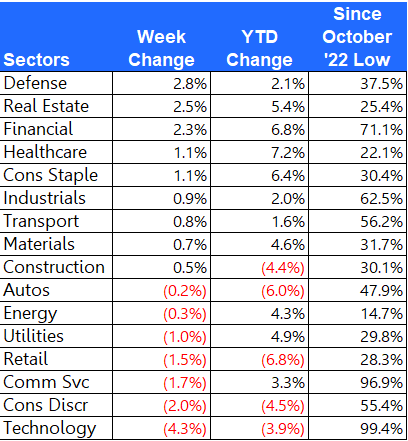

Equity Sector Performance

For this report, I use the expanded sectors as published by Zacks. They use 16 sectors rather than the standard 11. This gives us added granularity as we survey the winners and losers.

Investors were buying defensive sectors like Defense Contractors and Consumer Staples, while selling Technology and Consumer Discretionary stocks.

Image Source: ZenInvestor.org

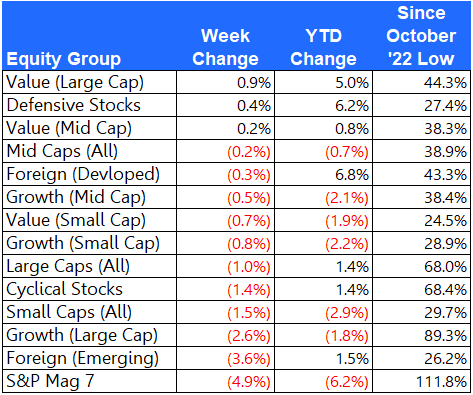

Equity Group Performance

For the groups, I separate the stocks in the S&P 1500 Composite Index by shared characteristics like growth, value, size, cyclical, defensive, and domestic vs. foreign.

The best-performing groups last week were Large-Cap Value stocks and US Defensive stocks. Investors raised cash by selling Magnificent 7 and Emerging Market stocks.

Image Source: ZenInvestor.org

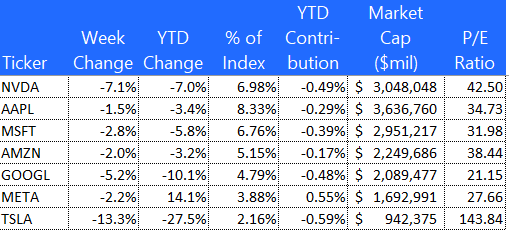

The S&P Mag 7

Here is a look at the 7 mega-cap stocks that have been leading the market over the past two years. These 7 stocks are off to a weak start year-to-date. Faith in the AI trade is being tested. Participation in the bull market has broadened on a year-to-date basis. Tesla (TSLA) was the hardest-hit, while Apple (AAPL) was the best house in a crummy neighborhood.

Image Source: ZenInvestor.org

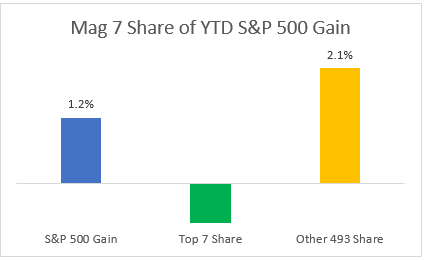

The Mag 7's Dominance Is Now a Drag on Performance

After leading the market higher for the last two years, the Magnificent 7 group of stocks are now a drag on the S&P 500 index on a year-to-date basis. You can't see it on the chart below, but the Magnificent 7 have contributed -0.9% to the 1.2% gain in the S&P 500 year-to-date.

Image Source: ZenInvestor.org

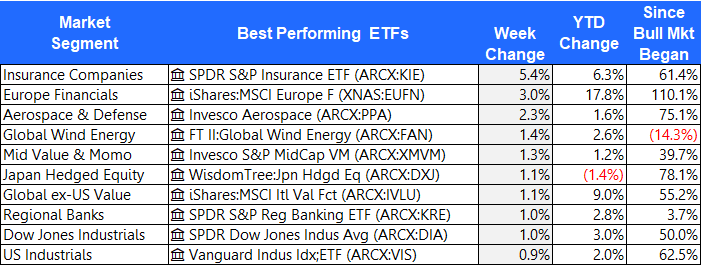

The 10 Best-Performing ETFs from Last Week

The two biggest winners this past week, Insurance Companies and Europe Financials, demonstrate how market leadership is changing in 2025.

Image Source: ZenInvestor.org

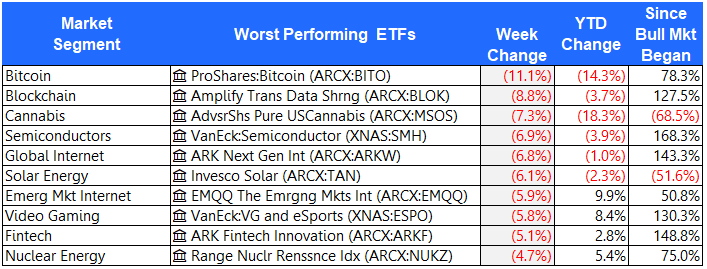

The 10 Worst-Performing ETFs from Last Week

With Bitcoin now in a bear market, the ETFs that track it are getting hit hard. Blockchain companies are also getting hit pretty hard. And Cannabis just can't seem to catch a bid.

Image Source: ZenInvestor.org

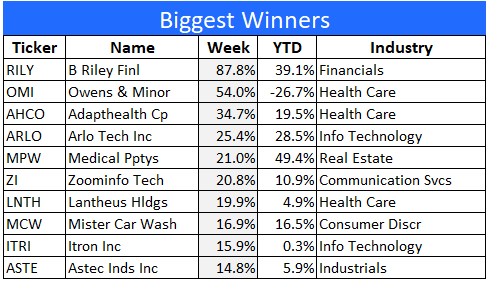

The Best-Performing Stocks

B. Riley Financial (RILY) spiked higher after securing $180 million in financing from Oaktree. Proceeds were used to retire debt owed to Nomura.

Image Source: ZenInvestor.org

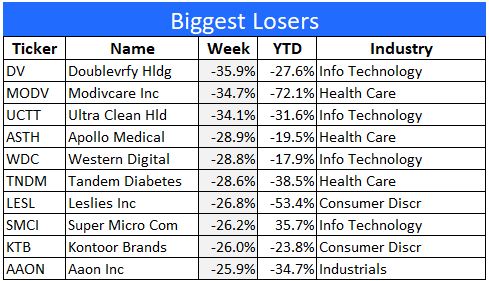

The Worst-Performing Stocks

DoubleVerify's (DV) growth rate slowed in 2024 more than expected, and management believes it will slow again in the coming year. Some large customers are cutting back on their spending on the platform, which worries investors.

Image Source: ZenInvestor.org

Final Thoughts

To recap, in the week just past, investors were doing the following:

- Selling stocks and buying bonds

- Selling Bitcoin and raising cash

- Selling Semiconductors and buying Insurance companies

- Selling Tech and buying Defense Contractors

- Selling US stocks and buying Foreign stocks

- Selling the Magnificent 7 group of stocks and buying other large-caps

More By This Author:

The One-Minute Market Report - Saturday, Feb. 22The One-Minute Market Report - Sunday, Nov. 2

The One-Minute Market Report - Sunday, Oct. 20

Disclaimer: This content is for educational purposes only, and ZenInvestor.org is not an investment advisory service, nor an investment advisor, nor does ZenInvestor.org provide personalized ...

more