The Case Against China Invading Taiwan

Taiwan's tallest skyscraper, Taipei 101 (Li Angxuan/Pexels).

Why China Might Invade Taiwan

In a post last week (“What Comes Next In China“), I shared Sri Lankan geopolitical blogger Dhanuka Dickwella’s argument for why China might invade Taiwan as early as this winter. The heart of his argument was that China might take advantage of the Ukraine War depleting Western armaments and Western sanctions on Russia weakening Western economies:

But China might move on as early as the end of this year. While this is just a speculation, there are reasons to make such. In the European theater, Russians have started to win back the momentum. With the newly mobilized military groups, they could probably bring Odessa, Mykolaiv & Kharkov under their control. European weapons stocks have been depleted, eroded at an alarming rate. Production of the new system is going to be costlier, longer & difficult since Europe has to choose between eating & heating. The United Kingdom is in great chaos & the population has less appetite for any new conflict. Domestic issues seem far more urgent & important. Brits are in dire need of a leader to fix the domestic mess rather than the international chaos. America is vastly preoccupied in Ukraine. They have sacrificed a significant portion of their resources in supporting Kiev. Their military supplies & stocks are being used, destroyed in Ukraine faster than all the Middle Eastern wars. That makes it harder for Americans at this point to fight another multi-pronged war with a sophisticated, armed to the teeth enemy with enormous, untested capacities. Russia is not deterred & willing to fight NATO if it comes to that. This makes fighting against near peer enemies in two ends of the world a nightmare for the USA.

Since then, though, two commentators have offered compelling arguments for why China is unlikely to invade Taiwan. I have posted them below, followed by a comment about betting against Chinese stocks.

Why China Probably Won’t Invade Taiwan

British economist Philip Pilkington argued that China’s economic power is such that it can eventually peal Taiwan away from the U.S. and achieve unification without resorting to military force, and that America has little to offer Taiwan in response:

1/ A sensible thread in which @ElbridgeColby recognises that economic war against China is a non-starter. As with the Russian sanctions, they wouldn’t hurt the target that much but the blowback would be devastating and would destroy the United States. https://t.co/nZZ3JtfbHr

— Philip Pilkington (@philippilk) October 30, 2022

3/ China increases its global power through trade and economic dominance. This strategy has deep roots in Chinese history. Now check out what they’ve been doing with Taiwan. pic.twitter.com/xsKiKeLIkf

— Philip Pilkington (@philippilk) October 30, 2022

5/ When the deal was made there was still some memory lingering about the Chinese civil war too. That is now gone. Ancient history. Meanwhile, the US can no longer offer Taiwan prosperity. Rather it demands that they sanction their largest trade partner.

— Philip Pilkington (@philippilk) October 30, 2022

7/ Now, say you’re sitting in Beijing watching this. Are you thinking: “We need to launch a risky invasion”? Or are you thinking: “Let’s just let this stew for a while, applying pressure when needed; this is an alliance that is no longer in Taiwan’s interest”.

— Philip Pilkington (@philippilk) October 30, 2022

9/ When Americans get themselves riled up about an invasion they’re projecting their favourite strategy - gung ho General Patton military intervention - onto their rivals. But the truth is their rivals have watched this strategy in action and concluded it is self-defeating.

— Philip Pilkington (@philippilk) October 30, 2022

10/ The Americans will likely continue the invasion rhetoric. The arms manufacturers will appreciate it. But as the strategists wait for the Chinese invasion they’ll soon find they’re waiting for Godot.

— Philip Pilkington (@philippilk) October 30, 2022

No Asian Equivalent To NATO

It’s worth remembering, too, that unlike in Europe, where NATO expansion eventually helped provoke Russia’s invasion of Ukraine, there is no similar U.S.-led, explicitly anti-China alliance.* Arnaud Bertrand, a French expatriate entrepreneur who lives in China, made this point recently in relation to NATO Secretary General Jens Stoltenberg suggesting NATO should think about containing China:

NATO has no role to play on China, it's a military alliance for Europe!

— Arnaud Bertrand (@RnaudBertrand) October 29, 2022

The US didn't manage to form an anti-China coalition with local Asian countries (except maybe Japan) so it's trying to sucker the Europeans into it.

They're like the global village idiot at this stage... https://t.co/sl6mI973xJ

Bertrand also argues that China has the incentive to be patient regarding Taiwan reunification, since China is on the ascendance, while the U.S. is not.

Correction : it's the *US* that wants China to speed up.

— Arnaud Bertrand (@RnaudBertrand) October 26, 2022

Time is on China's side: its interest and strategy is to wait, the more it does, the more powerful it gets.

The US knows that, hence the urgency to provoke conflict now while it could still win.https://t.co/7BnX6fIpid

Asians Can Learn From Europe’s Mistakes

It’s hard to imagine America’s Major Non-NATO Allies in the Asia-Pacific region looking at the chaos in Europe now and imagining they’d be better off if America manages to turn Taiwan into Ukraine East. Our NATO allies appear to be significantly worse off in the wake of the Ukraine War, and our sanctions regime against Russia in response.

Betting Against Chinese Stocks

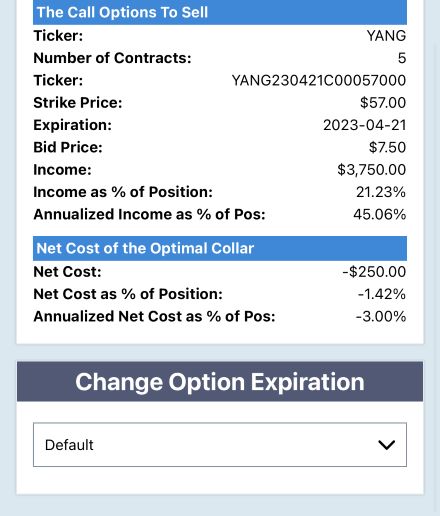

In our previous China post, I mentioned the Direxion Daily FTSE China Bear 3X Shares ETF (YANG). YANG was a top name of ours again on Friday. Leveraged ETFs can be extremely risky, but here’s a way you can use YANG to bet against Chinese stocks with 3x more possible upside than downside.

This was the optimal collar, as of Friday’s close, to hedge 500 shares of YANG against a >20% drop by late April while not capping your possible upside at less than 60% by then.

Screen captures via the Portfolio Armor iPhone app on 10/28/2022

As you can see, the hedging cost there was negative, meaning you would have collected a net credit of $250 when opening that hedge on Friday, assuming, to be conservative, you bought the puts at the ask and sold the calls at the bid, instead of placing both trades between the bid and ask.

Of course, you’d want to scan for an updated optimal collar if you make a hedged bet on YANG today.

*The U.S. currently designates several countries in the region including Japan, South Korea, and Australia as “Major non-NATO Allies”, and treats Taiwan as one as well, without the formal designation. Nevertheless, as Bertrand says, there’s no NATO-like bureaucracy wrapped around those countries, so no Stoltenberg-like figure in Asia to poke the dragon.

More By This Author:

Netflix Returns To Our Top Names

What Comes Next In China

What's Coming Next In The Ukraine War

Disclaimer: The Portfolio Armor system is a potentially useful tool but like all tools, it is not designed to replace the services of a licensed financial advisor or your own independent ...

more