Technology And Communication Services Diverge

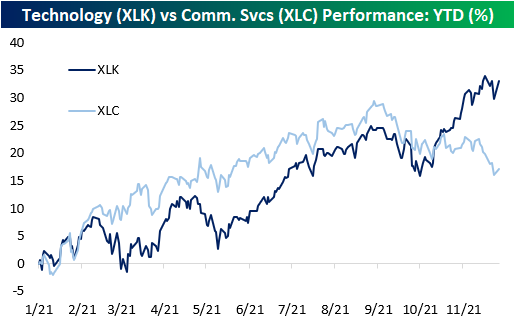

Typically, the Technology and Communication Services sectors tend to have high levels of correlation. However, beginning in mid-October, that relationship started to change course. While there have been other performance divergences between the two sectors this year, the current disparity is particularly noteworthy. Since mid-October, the Technology Select Sector SPDR Fund (XLK) and the Communications Services Select Sector SPDR (XLC) have been moving in opposite directions causing the YTD performance spread between the two sectors to widen out to the most extreme level of the year with Technology outperforming by 15.9 percentage points.

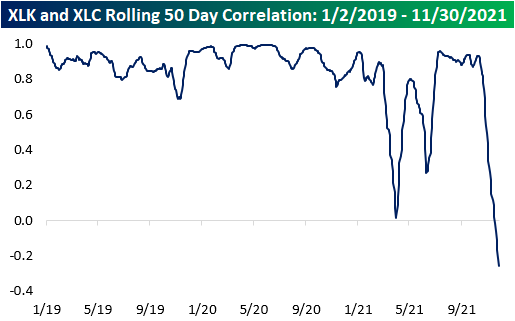

Since the start of 2019, just after Standard and Poors switched major stocks like Facebook (FB) and Alphabet (GOOGL) out of the Technology sector and into Communication Services the two ETFs tracking these sectors have had a median 50-day rolling correlation coefficient of +0.89, which implies a strong relationship between the two. For the years 2019 and 2020, the minimum correlation coefficient was +0.68, which still signifies a strong relationship. In 2021, though, the relationship has reversed and actually inverted this month, meaning that over the last 50 days, the two sectors are moving in opposite directions.