SPDR Select Sector Fund ETF – Elliott Wave Technical Analysis

SPDR Select Sector Fund ETF (XLF) – Elliott Wave Technical Analysis

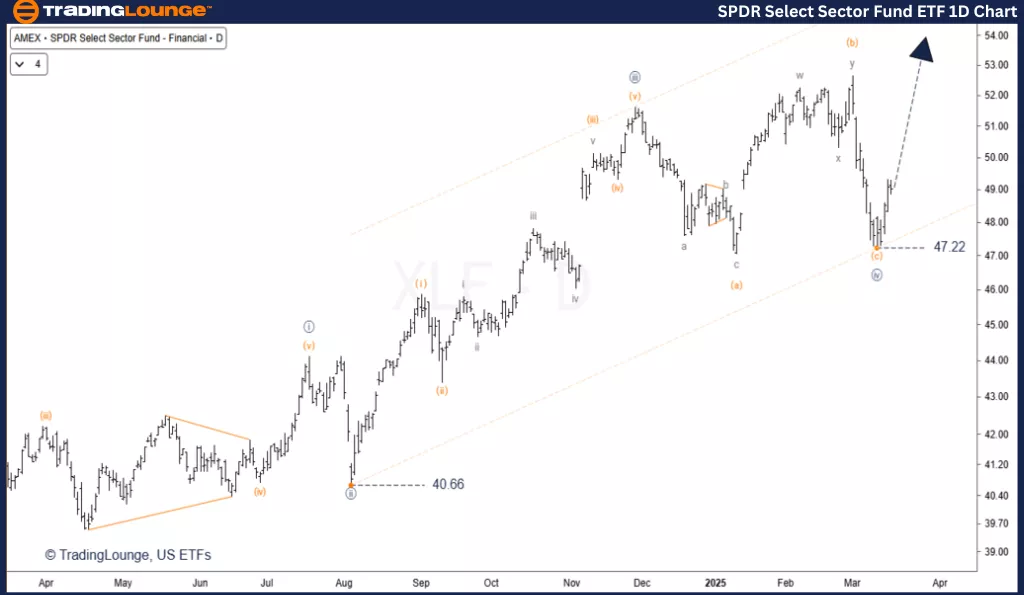

Daily Chart Analysis

Function: Major Trend

Mode: Motive

Structure: Impulse Wave

Position: Wave 5 Navy

Direction: Uptrend

Details:

The 4th wave bottomed at $47.22 in a flat pattern.

The current rally is still in its early stages and is expected to fully retrace Wave 4 in a five-wave upward structure.

Minimum target: $54.00, aligning with the upper boundary of Elliott’s final channel.

Invalidation Level: $47.22

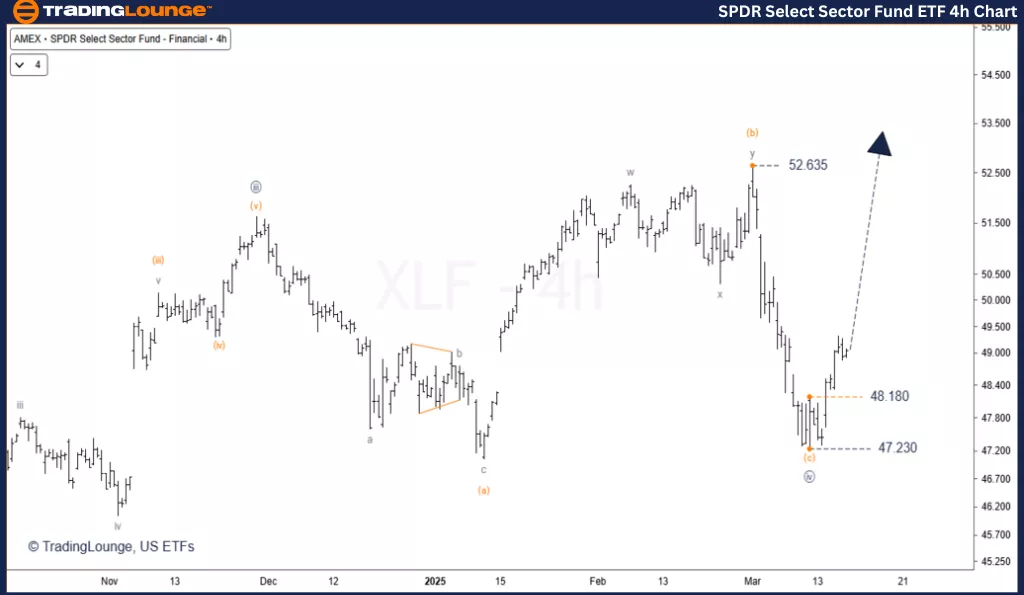

4-Hour Chart Analysis

Function: Major Trend

Mode: Motive

Structure: Impulse

Position: Wave 5 Navy

Direction: Uptrend

Details:

Wave 4 has ended within the expected KTL time range, confirming the wave count.

The ongoing rally indicates the early stages of Wave 5, suggesting a strong buying opportunity.

A throwback before continuation is expected, providing a better entry point.

The $52.635 high should be surpassed by the ongoing climb.

Key level: $48.18

Invalidation Level: $47.23

Conclusion

The 4th wave decline and correction in XLF is now complete.

The ongoing rally is a fifth-wave movement, signaling a strong upward trend.

After a potential throwback from a fifth-wave subwave, the market should rally significantly.

This setup presents a good opportunity for ETF traders to go long.

Adhering to Elliott Wave principles and monitoring invalidation levels is crucial to avoid unnecessary losses.

Technical Analyst: Siinom

More By This Author:

Elliott Wave Technical Analysis: Block, Inc.

Elliott Wave Technical Analysis: U.S. Dollar/Swiss Franc - Wednesday, March 19

Elliott Wave Technical Analysis: Bitcoin Crypto Price - Wednesday, March 19

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more