Elliott Wave Technical Analysis: Block, Inc.

ASX: BLOCK, INC – XYZ Elliott Wave Technical Analysis

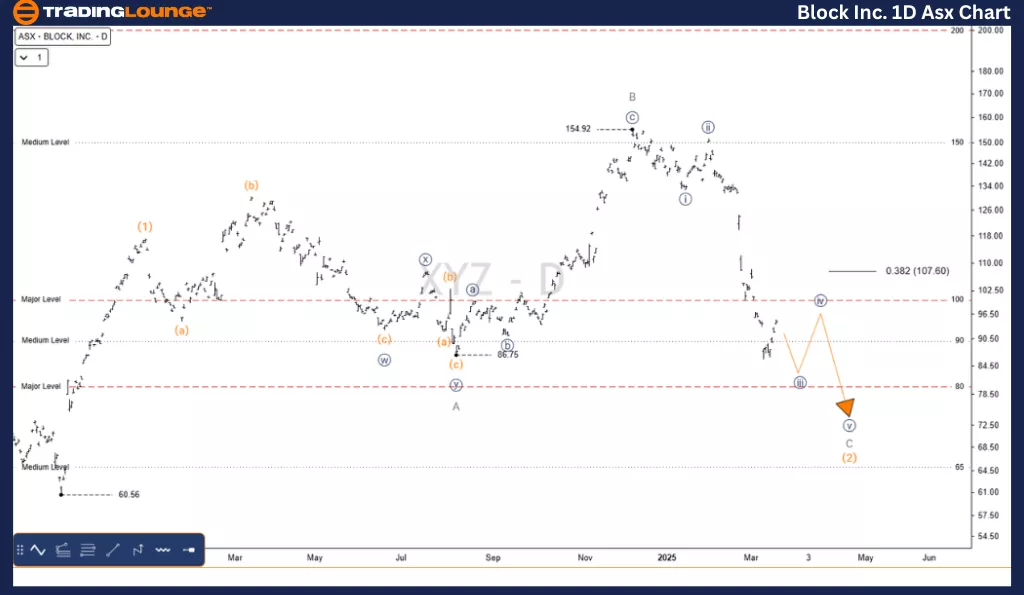

Our Elliott Wave analysis today provides an updated view of the Australian Stock Exchange (ASX), focusing on BLOCK, INC – XYZ.

We observe that ASX:XYZ is nearing the completion of an Expanded Flat corrective wave, indicating a potential upside opportunity for the stock.

ASX: BLOCK, INC – XYZ 1D Chart (Semilog Scale) Analysis

Function: Major trend (Intermediate degree, orange)

Mode: Motive

Structure: Impulse

Position: Wave C - grey of Wave (2) - orange

Details:

Wave (2) - orange is unfolding as a complex and extended Expanded Flat, now approaching completion.

Wave C - grey still requires one final push lower before Wave (3) - orange can initiate an upward move.

Invalidation Point: 60.56

ASX: BLOCK, INC – XYZ 4-Hour Chart Analysis

Function: Major trend (Minor degree, grey)

Mode: Motive

Structure: Impulse

Position: Wave ((iv)) - navy

Details:

A closer look reveals that Wave C - grey is unfolding as a five-wave structure.

Wave ((iv)) - navy is expected to make a slight upward move before continuing lower with Wave ((v)) - navy.

If price action breaks through the 0.382 level strongly and quickly, it could signal that Wave (3) - orange is unfolding sooner than expected.

Invalidation Point: 132.76

Key Level: 0.382

Conclusion

Our Elliott Wave analysis and forecast provide traders with valuable insights into ASX: BLOCK, INC - XYZ's market trends and potential price movements. We identify key validation and invalidation points, helping traders make informed decisions with increased confidence.

By combining technical expertise with objective market perspectives, we aim to offer the most professional and data-driven outlook.

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation)

More By This Author:

Elliott Wave Technical Analysis: Bitcoin Crypto Price - Wednesday, March 19

Elliott Wave Technical Analysis: ASX Limited - Tuesday, March 18

Elliott Wave Technical Analysis - Alibaba Group Holdings Ltd.

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more