So Far, So Good For The Bulls

Image Source: Pexels

Since my minimum downside target was met on Monday, the response by the bulls appeared to be solid across the major stock market indices, as all of them rallied rather smartly.

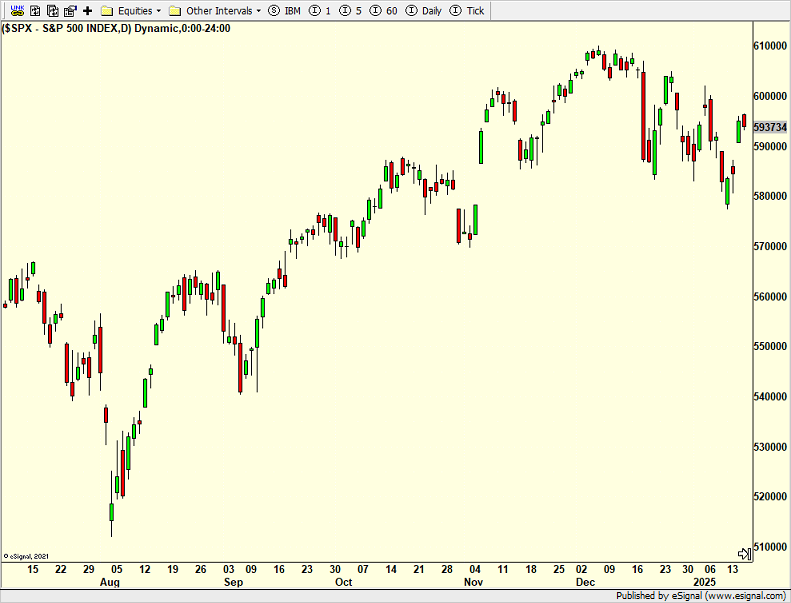

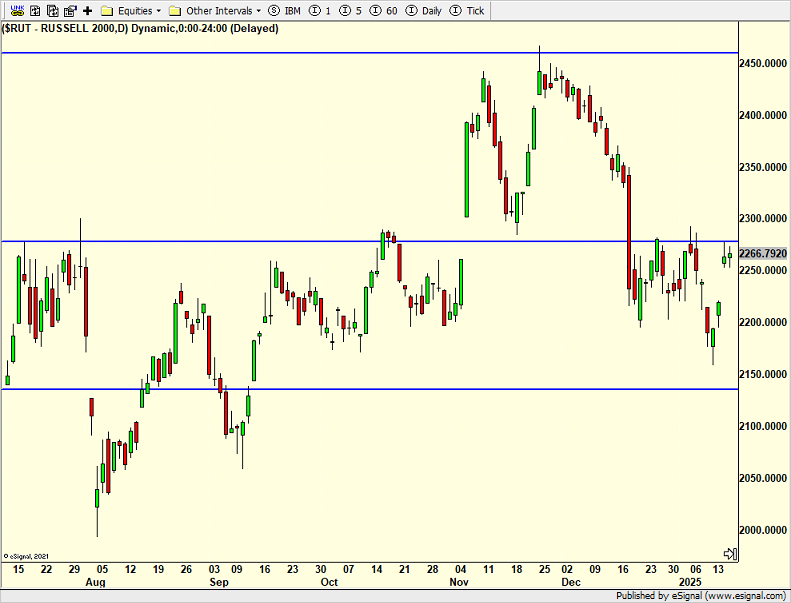

Provided below is a look at the S&P 500 and the Russell 2000. While the former looked to be in better shape than the latter, the Russell maintained more upside potential simply because it sold off the most.

(Click on image to enlarge)

(Click on image to enlarge)

Several things have continued to bother me, though. Sentiment never fully cycled to bearish, although market internals did. I don’t love the leadership set up in the market from the four horsemen -- banks, semis, discretionary, and transportation -- although we do own three out of the four.

Finally, our big picture market models have been all over the place, with some heavily long, some mostly neutral, and some heavily short. I would feel much better if they were more in line with each other.

Meanwhile, on Wednesday we bought First Trust Value Line Dividend Index Fund (FVD), XPO, Inc. (XPO), Invesco Emerging Markets Sovereign Debt ETF (PCY), and iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB). We then sold some Tradr 2X Long Triple Q Monthly ETF (MQQQ).

On Thursday, we bought ProShares UltraShort QQQ (QLD), more iShares iBoxx $ High Yield Corporate Bond ETF (HYG), more SPDR S&P Retail ETF (XRT), and more PCY. We then sold MQQQ, QLD, ProShares Ultra Russell 2000 (UWM), some Tradr 2X Long SPY Weekly ETF (SPYB), and some Tetra Technologies, Inc. (TTI).

More By This Author:

Stocks Break Down – Plenty Of Reasons To Support Bull Market

New Jobs Soar – Markets May Not Like That

Bears Thwart Bulls To Own The Edge

Please see HC's full disclosure here.