New Jobs Soar – Markets May Not Like That

Image Source: Unsplash

The government released the December employment report this morning. Surprisingly, the economy created 100,000 more new jobs than economists forecast. This is great news on the surface that the economy continues to hum along. It also speaks volumes to the lack of forecasting ability by economists with this very volatile monthly number.

Here’s the problem. The current market regime is that good news is bad news because the Fed will provide less accommodation through lower rates. So while the economy isn’t showing the cracks that lead to imminent recession and inflation still a bit sticky, long-term interest rates are rising and somewhat quickly.

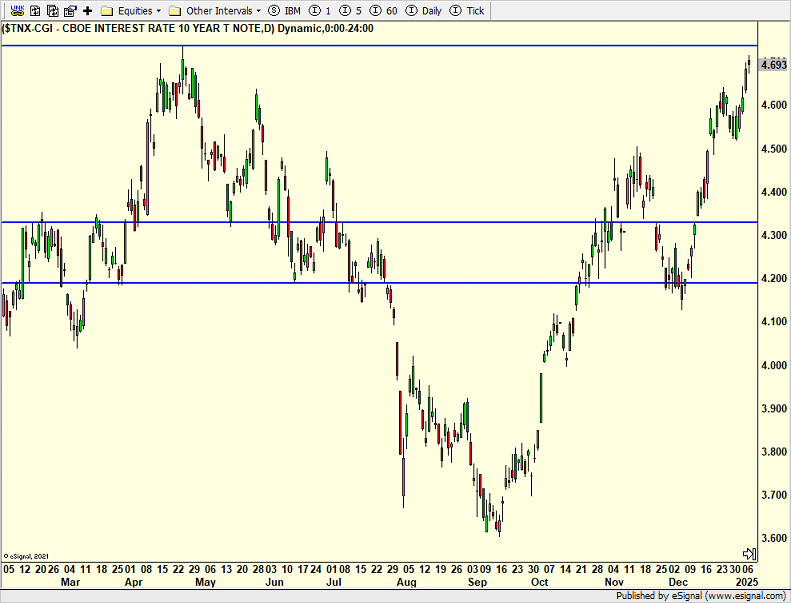

Look at the 10-Year chart below. From a low of 3.65% in the fall, yields have soared to 4.70%. That is a huge move for market to digest. It certainly looks like 5% is a magnet. It was last seen in 2023. Before that you have to go back to early 2007.

(Click on image to enlarge)

On Wednesday we bought more IYT and MQQQ.

More By This Author:

Bears Thwart Bulls To Own The EdgeWho Sucked $330 Billion Out Of The Markets?

Looks Like The Grinch Won

Please see HC's full disclosure here.