Panic Signals Support As SPX And GDX Trends Stay Bullish

Image Source: Pexels

SPX Monitoring purposes; Long SPX on 10/31/25 at 6840.20.

Our gain 1/1/24 to 12/31/24 = 29.28%; SPX gain 23.67%

Our Gain 1/1/23 to 12/31/23 SPX= 28.12%; SPX gain 23.38%

Monitoring purposes GOLD: Long GDX at 75.76; 9/29/25

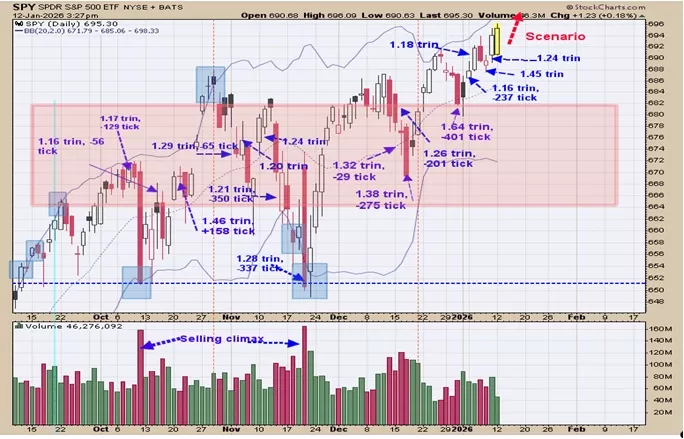

We have said many times in the past that panic is bullish for the market. We measure panic by trin closes above 1.20. Over the last five trading days, the TRIN reached near 1.20 and higher three of the five days; which shows that panic is present and suggests the current rally has further to go. We shaded in pink where panic form on price levels on the SPY with TRIN closes above 1.20. This pink price levels suggests support area which starts near 665 and runs to 682. Once panic forms at a price level, it produces panic trin readings again once that price level is tested which in turn suggests support. Staying long for now.

Above is the monthly 3 period moving average of the SPX/VIX ratio (bottom window). The 3 period moving average of the SPX/VIX ratio helps to identify possible pull backs in the SPX that exceed 10%. This chart goes back in mid 2019. We noted in shaded pink where the SPX made higher highs and the 3 period SPX/VIX ratio made lower highs and in each case this divergence showed up the market proceeded to a pull back that was near 10% or mover. Currently the 3 period monthly SPX/VIX ratio is making higher highs while the SPX is making higher highs, a bullish sign. Staying long the SPX for now.

Uptrend in GDX showing strength. Bottom window is the daily cumulative advance/decline for GDX, next higher window is the daily cumulative up down volume for GDX and top window is the GDX. We noted with a blue box where both indicators are hitting new highs showing that GDX is getting stronger. GDX is in an uptrend when both indicators are above there respected mid Bollinger band (noted with blue arrows). Until both indicators fall below their mid Bollinger bands the uptrend in GDX should continue. GDX is starting to get a little to exuberant and something to watch out for. Long GDX on 9/29/25 at 75.76.

More By This Author:

Panic Only Forms Near Lows

An Extended Market

Year-End Signals Hint At A Bullish SPX Setup While Gold Miners Enter A Critical Cycle

Signals are provided as general information only and are not investment recommendations. You are responsible for your own investment decisions. Past performance does not guarantee future performance. ...

more